By Kevin Flanagan, Senior Fixed Income Strategist, WisdomTree

Special to the Financial Independence Hub

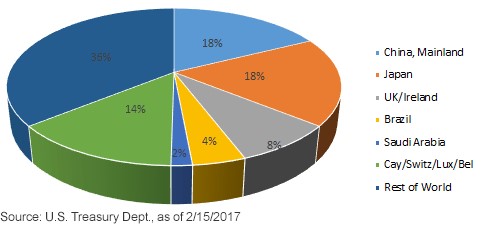

One of the linchpins supporting the U.S. Treasury (UST) market in recent years has been the relative yield advantage against the rates that have existed among the sovereign debt of other G7 nations. In the post-U.S. presidential election landscape, fixed-income investors have witnessed a back-up in G7 government bond yields on a global basis, and questions have arisen as to whether said advantage would remain a key contributor to the UST market outlook in 2017, now that the “zero rate club” has shrunk. The best way to answer this query is to examine just who exactly has been buying and who’s been selling, with the first data point looking at developments from the foreign perspective.

Each month, the Treasury Department releases statistics on this front, but it should be noted that the actual data are provided with a one-month lag. Thus, the latest report did not provide any fresh details on how 2017 got started, but it does offer interesting information for calendar year 2016. The report itself is called Treasury International Capital data, or TIC, as it is known in fixed income trading circles, and includes the figures for “Major Foreign Holders of Treasury Securities.” Continue Reading…