Special to the Financial Independence Hub

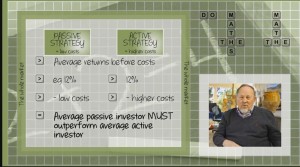

Perhaps the most conspicuous disconnect in the financial services industry today revolves around cost. It should be noted at the outset that the cost paid by a client comes in two forms: the cost of advice and the cost of products used to construct portfolios. Both matter a great deal.

The adage that many in the financial services industry use is: “price is what you pay; value is what you get.” I’ll leave it to you to do your own due diligence about both the cost of advice and the value provided. Today, I want to talk about the confluence of those two factors as it pertains to product cost. The combination of quality advice with low-cost products can be a powerful one. Unfortunately, my experience has been that some otherwise excellent advisors remain dogged in their determination to use high cost products: or at least to be indifferent to cost as a primary determinant when making product recommendations.

After over a quarter century in the business, my sense is that many advisors who work at brokerage firms with a “traditional” mindset (i.e., a firm that has historically recommended individual securities as building blocks) are more cost conscious if only because the individual securities that they sometimes recommend don’t have MERs. Of course, individual securities can add to portfolio risk due to their reduced diversification, so there’s a trade-off to be considered.

Big price difference between Mutual Funds, ETFs and Seg Funds

For those advisors like myself that want their clients to have broadly-diversified baskets to get access to specific asset classes and strategies, the options generally boil down to segregated funds, mutual funds and exchange traded funds. All of these options cost money, but the difference in price is often substantial. Does your advisor care?

In a ground-breaking paper entitled “The Misguided Beliefs of Financial Advisors” released in late 2016, some American academics show that many advisors are essentially indifferent to product cost. The paper also shows that advisors tend to chase past performance and recommend unduly concentrated portfolios, but those very real problems are beyond the scope of what we’re looking at here. Continue Reading…