Special to the Findependence Hub

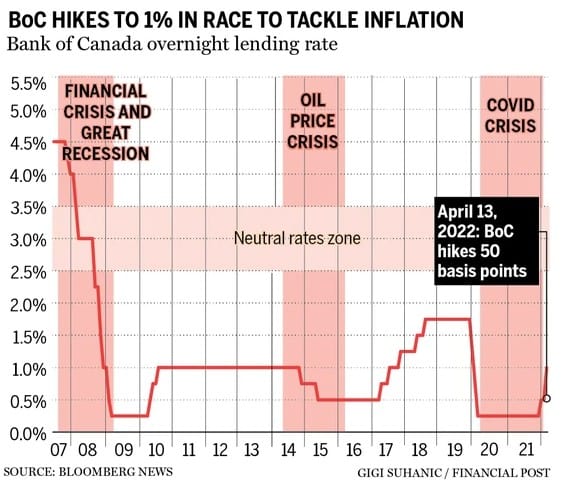

Lately, the talk of the town seems to be rising interest rates. In April, the Bank of Canada raised the benchmark interest rate by a whopping 0.5% to 1%, making it the biggest rate hike since 2000. Given the high inflation rate, it is almost a given that these rate hikes will continue throughout 2022 and beyond. [On July 13, 2022, the BOC hiked a further 1%: editor.]

But before you freak out, let’s step back and look at the big picture. At 1%, the benchmark interest rate is still relatively low compared to the past interest rates.

I still remember years ago before the financial crisis, being able to get GIC rates at around 5%. And some people may remember +10% interest rates in the 80s or early 90s. Back then, interest rates were much much higher than measly below 1% rates we’ve been seeing the last decade.