By Paul Philip, CLU, CFP Financial Wealth Builders Securities

Special to the Financial Independence Hub

If you’ve ever dabbled in graphic design, you’re familiar with the concept of white space. When viewing an illustration, we typically pay the most attention to the visible ink on the page, such as a paragraph of text, a bar chart or an entertaining illustration. White space is the essential empty areas in between that are hidden in plain sight. We barely notice them … until they’re not there:

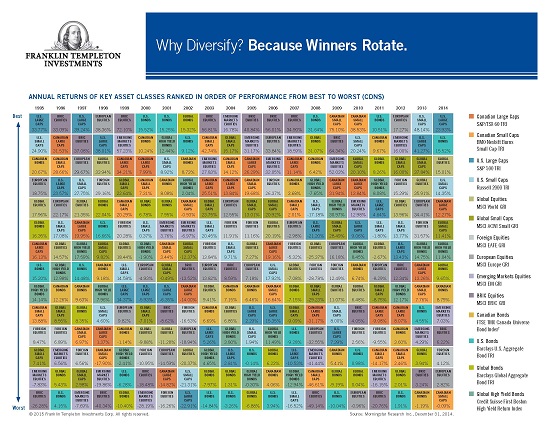

When making investment decisions, most people likewise assume that the most eye-catching ink matters the most: an alarming economic forecast, an exciting Initial Public Offering, hot trading tips. But there’s a catch. This evident assumption does not hold up under evidence-based scrutiny. In reality, you have little or no control over how the most obvious news impacts your investments. The most exciting action has already been priced into any trade you might make well before you decide to make it.

Stop fixating on headlines

Instead of fixating on the headline news, consider that liberating financial white space. There, hidden in plain sight, you’ll find a number of powerful investment strategies that are freely available and far more within our control. In this series, we’ll introduce three of our favorite “plain sight” investment strategies:

- Being there

- Managing for market risks

- Controlling costs