By Aman Raina, SageInvestors

Special to the Financial Independence Hub

Four years ago, Obama was President of the United States and Stephen Harper was Prime Minister of Canada. A Liberal was running America and a Conservative was running Canada. The New England Patriots were still making it to the Super Bowl, even winning a few…

…and I had opened my Robo Advisor account.

Yes it been a full 4 years since I opened up my Robo Advisor account. For those new to investing, a Robo Advisor is a new wave of wealth management companies that invest on behalf of others using an online platform and a combination of algorithms and computer coding to buy and sell specific investments and manage portfolios. Four years ago these firms were just stepping into the investing conciousness, but since then they have mushroomed and even traditional investment companies are now offering some flavor of online investment management services. It all seemed quite appealing however there was one thing that many marketing materials, blogs, and mainstream media was avoiding (and still are I might add)…do these types of services make money for investors?

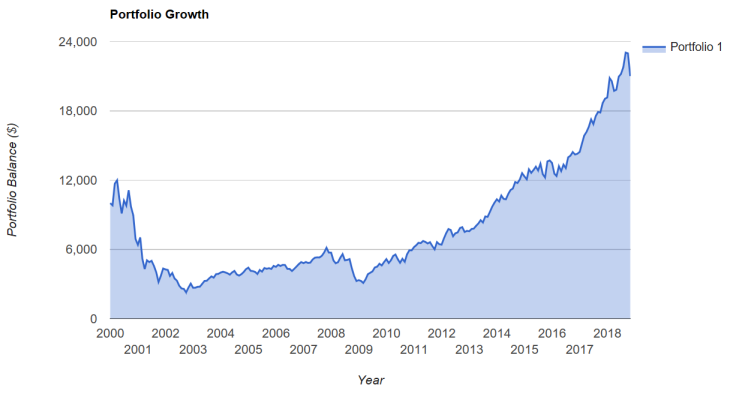

Since no robo advisor company back then was interested in disclosing their performance (they still avoid it) other than citing research that their strategy is superior, I decided four years ago to try an experiment and find out for myself. I setup an account with one of the big Robo Adviser firms. My goal was to go through the process and blog about my experience and more importantly, the results. I’ve always said that we need a good five years to really get a handle on how effective these services are compared to traditional wealth management services. Well, we’re at the 80% mark of my ROBO journey, so let’s check back in and take a look at how it’s doing now and see if we can squeeze any conclusions about the service.

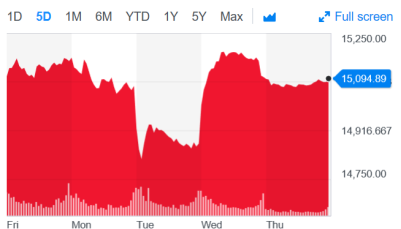

In previous years, I have stated that for us to get a real handle on their effectiveness, we need to see these robo-portfolios experience some stress. Up until 2018, the markets have been quite tame. We’ve seen how these portfolios operate in a period of rising stock prices. In 2018 we finally hit some periods where there were major swings in stock prices around the world. In February we saw the Dow Jones on several days drop more than 1000 points and in December we had the Christmas Eve Massacre where stock prices fell off a cliff creating a lot of hand wringing over the Christmas break. Finally meaningful, although short-term stress points for the ROBO portfolio.

Performance

Below is the current status of my ROBO portfolio as of January 30, 2019 and below that is the chart of annual returns over the past four years.

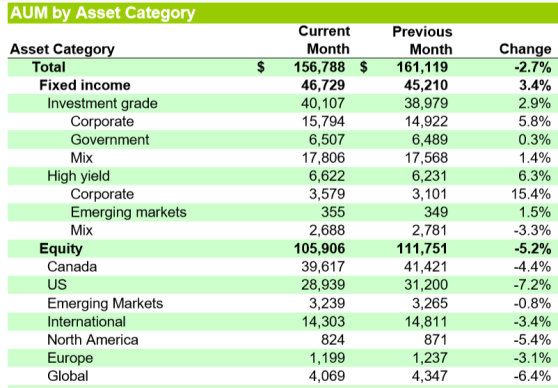

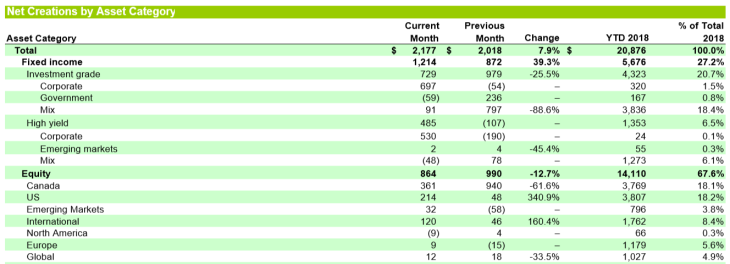

My ROBO Advisor portfolio as of January 30, 2019

(annual returns)

The first year was a rough one for ROBO as it had lost 2.15 per cent. In the second year and third year, ROBO picked up its game. The portfolio generated a 13.2 per cent return in Year 2 and in Year 3 it posted another solid year with a 14.2 per cent return. In 2018, the portfolio pulled back going down a total of 2.1 per cent. The loss was tempered by dividends, where the portfolio generated $142.91 in dividend income. The ROBO was also saved a bit by a strong rebound in stock prices in January coming off the correction in December. The losses could have been much worse. Considering the largest component of the ROBO portfolio was concentrated in US and Canadian stocks and where the S&P500 and TSX/S&P Composite were down 6.3 and 11.7 per cent respectively in 2018, a 2.1 per cent drop is very reasonable. I lost money but not as much. Since January 2015, the portfolio is up 22 per cent over the last 4 years.

Asset Allocation

When I set up the account I answered a series of questions about my financial literacy and risk tolerance. ROBO took my responses and crafted a portfolio that it felt was compatible with my profile. As I am pretty experienced with investing and have a long-term investment horizon, ROBO determined that a portfolio mix of 85 per cent stocks and 15 per cent bonds would work for me. It has since then retained the same stocks/bonds ratio. Continue Reading…