By Mark Seed, myownadvisor

Special to Financial Independence Hub

There’s a lot to think about when it comes to achieving your retirement goals.

I know. 🙂

I think about it a lot. I write about it a lot.

Better still, I’m planning for our retirement income needs just around the corner.

As we all know by now, personal finance is forever personal.

You need to develop a strategy and retirement income plan that works for you. Nobody else will do.

Read on to learn about the key steps I’m taking and what key steps might apply to you as well. I hope you enjoy this free playbook to retirement income planning.

No course fee required. 🙂

Your Free Playbook to Retirement Income Planning

“Drawing down one’s savings in retirement is something very few retirees do well, even with the help of professional advisors.” – Fred Vettese, Retirement Income for Life.

A general retirement preparation rule suggests that retirement income should be about 70%-80% of your annual earnings.

Well, rules are made to be broken.

In some cases, these expert rules of thumb won’t apply to you at all!

Forecasting your future financial needs can be complicated – a puzzle that needs to be deconstructed and put back together.

That said, I believe there are two-major steps involved in retirement income planning and then a third for good measure:

Step 1: What are your spending goals?

Step 2: What are your investment savings and income sources to meet those needs?

Beyond that, you’ll want to consider a third step in my opinion:

Step 3: What is the bare minimum lifestyle that you’re ready to live?

With those key questions/steps to answer, here are our answers to these key steps I’m working through as part of my retirement income planning this year, for next year in 2025.

Step 1: What are our spending goals?

Step 1 is always first.

Some Canadians can live off a little.

Some Canadians want to live off a lot.

Your income needs and wants in semi-retirement or full retirement or whatever you want to call the next phase of your life will forever be personal and up to you.

A past headline that got a lot of retirement planning attention was this BMO study and its findings.

“BMO’s 13th annual Retirement Study reveals Canadians are prioritizing retirement savings as both contributions and account holdings have increased from the previous year. The study found that Canadians believe they will need $1.7 million to retire, up 20 per cent from 2020 ($1.4 million). However, fewer than half (44 per cent) of Canadians are confident they will have enough money to retire as planned, a 10 per cent decrease from 2020.”

Do you need $1.7 million to retire?

You might.

It is my conclusion most won’t need that much.

Here are the questions we’ve answered on this subject, to figure out what we need and want related to our spending goals:

- How much do we wish to spend, annually, on average in retirement and starting when?

- Do we see us working part-time or not at all?

- Do we wish to have any “go-go” spending years/higher spending years in early retirement years vs. later retirement years?

- How might inflation or other factors impact our savings?

- Do we have any capital expenses in retirement – like newer cars every 10 years?

- Do we care to leave any estate? If so, how much?

- Are we prepared to change our lifestyle if needed?

I’ll link to all our answers to these questions later in today’s post with some articles for reference. 🙂

Step 2: What are our retirement income sources to meet those needs?

Just like planning a trip, once you figure out where you want to go you’ll need to figure out how to get there: what components are part of your trip.

As a starter for our retirement income planning considerations, I looked at these components: Canada’s retirement income pillars and what income might be available from each pillar and when:

- Pillar 1 is the Old Age Security (OAS) pension and its companion program, Guaranteed Income Supplement (GIS) – age 65.

- Pillar 2 is the Canada Pension Plan (CPP) – starting age 65 or ideally later.

- Pillar 3 includes your mix of tax-assisted vehicles such as Registered Retirement Savings Plans (RRSPs), Tax Free Savings Accounts (TFSAs) and other accounts – starting in our 50s.

- Pillar 4 includes other assets accumulated over your lifetime such as your primary residence, vacation property (if you are lucky to have one), or stocks held with your brokerage firm in a taxable account – starting in our 50s.

In Step 2, we basically listed all our available income sources and the potential timing of those income sources along with other considerations you might wish to review as well:

- Maximize your Registered Retirement Savings Plan (RRSP). If you have unused RRSP contribution room from previous years, take advantage of the ability to “catch up” your contributions.

- Eliminate debt. I believe servicing debt eats into your available income when you’re retired – we won’t have this problem since we intend to enter semi-retirement remaining debt-free.

- Consolidate your investments. Consolidating your assets under one financial roof should make it easier to manage and diversify your portfolio and it could reduce your overall investment costs too.

- Make your portfolio as tax-efficient as possible. Are you paying more to the government than you have to? Different types of income are taxed in different ways. Too much interest income, which is fully taxable in a taxable accont should be avoided beyond an emergency fund while capital gains and Canadian dividends receive preferential tax treatment when held in a taxable account. You should also strongly consider maxing out your TFSA with equities as well = tax-free growth. 🙂

- Company pension(s). We have been fortunate enough to have x1 defined contribution (DC) and x1 defined benefit (DB) pension plan in our household – so we use those account values and income estimates in our retirement income planning at certain ages. For us, the DC will come online at age 55. The DB is likely to come online at age 65.

- Inheritance/family estate. Is that in your financial future at all? “Bonus money” if so?

- Part-time or hobby work. We have also considered the option to work part-time here and there not only for hobby income for travel but also to keep your minds busy and remain socially active too.

You might want to consider creating a retirement income map that breaks down your income sources every 5-years or so. Here is mine:

I’ll highlight our three (3) key early retirement income sources later in the post as well.

Step 3: What is our bare mininum lifestyle – could we scale back?

Through basic budgeting, I know our base – what our day-to-day living costs are with some buffer built-in.

Using this information, I know what we need to earn at age 65 to enjoy retirement with.

Our retirement income plan has that covered with a few income sources listed above including government benefits such as CPP and OAS in our future at age 65.

My problem and opportunity is, I don’t want to wait that long until age 65. 🙂

Maybe the same applies to you.

Life is short. Time is precious. Work on your own terms is better than needing to work.

I’ve recently heard from one blogger that it’s quite easy to spend less in retirement – just assume you will. You will take off-peak vacations as an example. I think that’s flawed thinking. You don’t always want to spend less in retirement. There could be bucket-like trips or other purchases you’ve waited your entire life to take.

A good solution is to figure out your Coast FIRE number.

With Coast FIRE:

- While you expect your retirement assets to grow as you reach a final retirement date, the good news is,

- Based on the assets you have, you don’t really need to save any more money for retirement = you are financially coasting to your retirement date. This is because existing income (full-time, part-time, hobby income, occasional work) or whatever work that is covers your key expenses until you reach your final retirement date.

Another option is Barista FIRE.

I would advise just like looking at your spending goals related to what you want to spend, you should also look at your bare bones budget and determine what you must spend. That’s your floor. That’s your starting point. Coast FIRE or Barista FIRE could be add-on solutions.

I’ve linked to this fun Coast FIRE calculator here and I’ve also listed this calculator amongst other FREE stuff on my Helpful Sites page.

Your Free Playbook to Retirement Income Planning

Before my answers I promised above here are a few other factors to consider:

- Time – Do you have a lot of time to save for retirement? i.e., are you saving later in life?

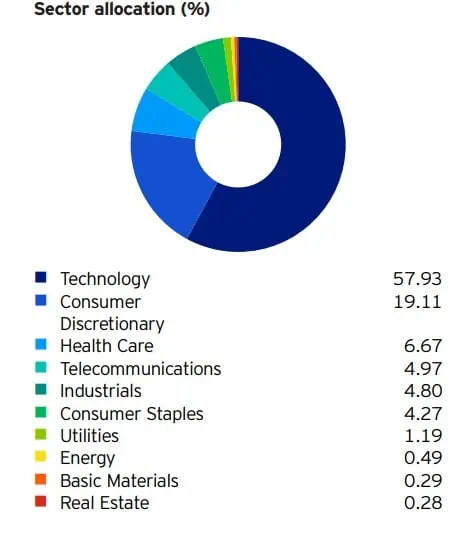

- Diversification and risk and liquidity – As good as any one stock performs in my portfolio, some are up over 40% this year (!!) it’s probably never a good idea to put all your retirement eggs in the same basket. What goes up could go down… I’ve always believed that any near-term spending within the next 1-2 years should likely be in safe cash or cash equivalents and not equities. Again, your mileage may vary.

- Inflation – To help ensure that your spending power is retained, you need to factor in the rising costs of goods and services. Ensure you include higher spending / inflation factors as you age. I’ll tell you mine below.

Our Playbook to Retirement Income Planning

Inspired by readers that wanted to know more, here are our answers to the questions above:

1. How much do we wish to spend, annually, on average in retirement?

Our desired spending for our first year of semi-retirement is in the range of $70,000 – $75,000 per year (that means after-tax).

As part of our retirement income assumptions we use the following that might be helpful to you as well:

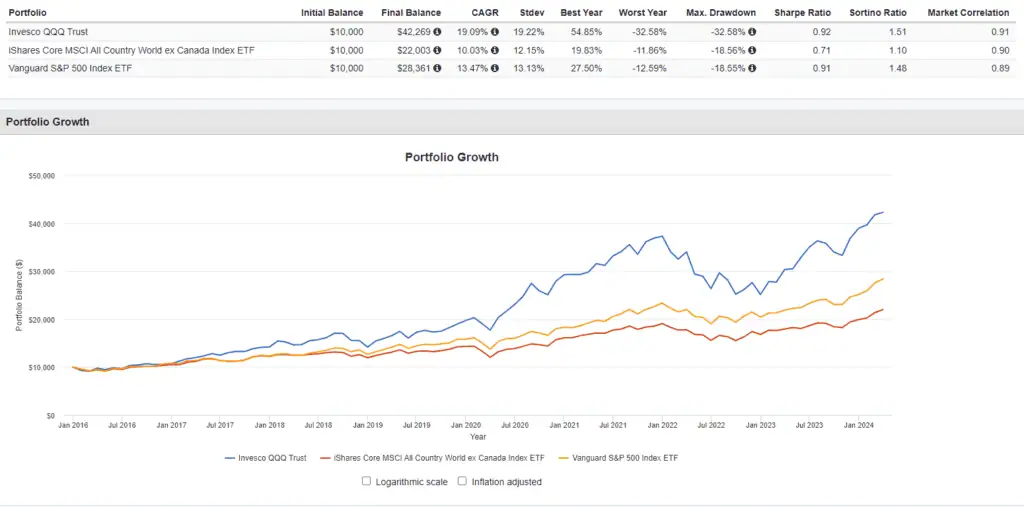

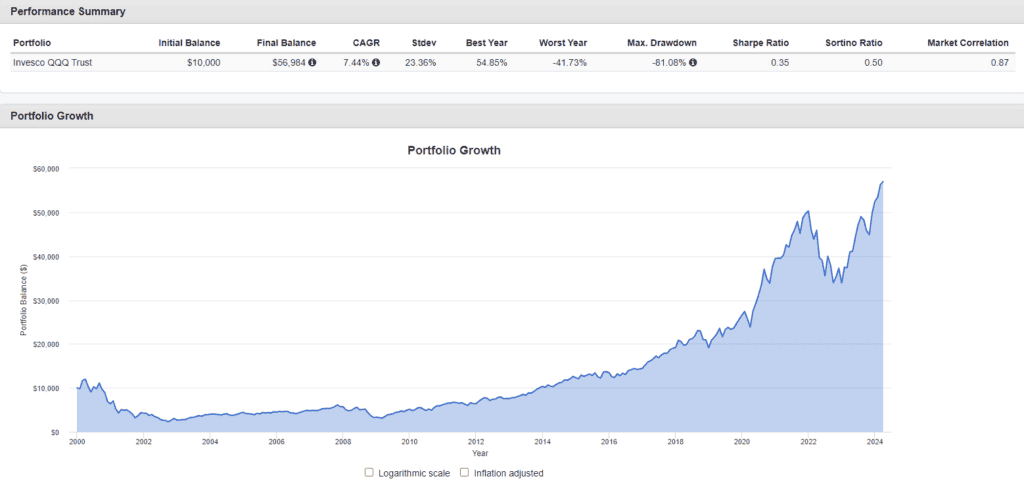

- 5% annualized rate of return i.e., over the coming decades from RRSPs/RRIFs, TFSAs and Non-Registered Accounts. Historically, we’ve earned much more than that but I like to be cautious.

- 3% sustained inflation. I personally wouldn’t go any lower than 2.5%.

2. Do we see us working part-time or not at all?

Yes, part-time for sure.

I have personally anticipated I will continue working at something here and there after full-time work is done but the need to work however to meet our desired spending is now optional and therefore no longer required as of this year. Continue Reading…