A successful retirement begins with a successful retirement income strategy.

A successful retirement begins with a successful retirement income strategy.

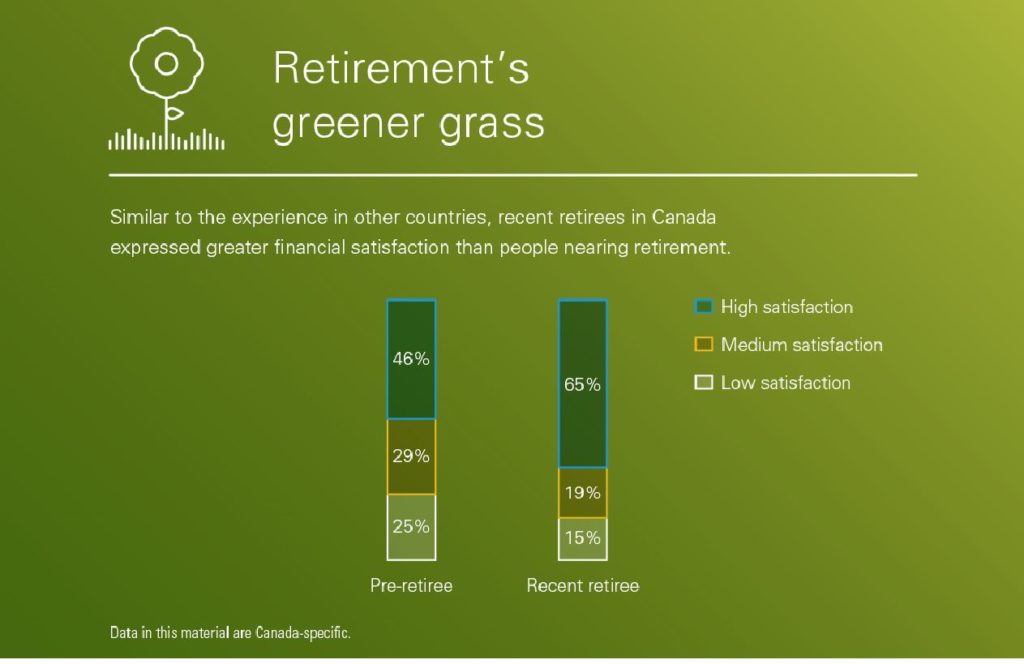

One of the things that investors of all ages fear is that they won’t have a good financial plan in place so that they have enough retirement income to live on once they’ve stopped working.

Here are some ways to ease that anxiety:

In retirement, try to even out (equalize) your income with your spouse’s income, to lower overall taxes. Here’s how:

1.) Have the higher income spouse pay the household bills

The easiest way to even out income between two spouses is to have the higher-income spouse pay the mortgage, grocery bills, medical costs, insurance and other non-deductible costs of family life.

2.) Set up a spousal RRSP

Registered retirement savings plans, or RRSPs, are a form of tax-deferred savings plan designed to help investors save for retirement. RRSP contributions are tax deductible, and the investments grow tax-free.

3.) Pay interest on your spouse’s investment loans

If the lower-income spouse takes out an investment loan from a third party, such as a bank, the higher-income spouse can pay the interest on that loan.

RRIFs are a great long-term retirement income strategy