By Jonathan Chevreau

Over the holiday break I’ve been reading about Russia and its president, Vladimir Putin, who came to power at the turn of the millennium. As one of the three books flagged below points out, Russia is the only power that has the capacity to destroy the United States in a nuclear strike. Those who assumed the west “won” the Cold War when the Soviet Union collapsed in 1991 should keep reading. From Ukraine to the War in Syria and the battles over gas pipelines and the plummeting price of oil, Russia is very much in the news as we enter 2015. It’s a fascinating story in itself but investors will find it of particular relevance.

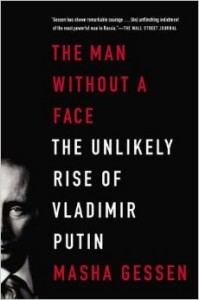

Before his surprise appointment by Boris Yeltsin, little was known about the former KGB (now FSB) operative, which is why Masha Gessen titled her 2012 book about him The Man Without a Face. Subtitled The Unlikely Rise of Vladimir Putin, the gutsy Moscow-based veteran journalist pulls no punches about the true nature of Putin’s Russia.

She traces Putin’s formative years in a chapter entitled “Autobiography of a Thug.” Continue Reading…