By Ambrose O’Callaghan, Harvest ETFs

(Sponsor Blog)

Canadians in retirement, or those nearing retirement, are faced with unique challenges in the present-day market. Interest rates have moved up from their historic lows since 2022. The benchmark rate for the Bank of Canada (BoC) reached its zenith of 5.00% in July 2023. Economic headwinds forced the hand of the BoC in 2024 and 2025. The benchmark rate now stands at 2.75%, with more rate cuts expected before the end of the year. (The BOC stood pat on April 16th).

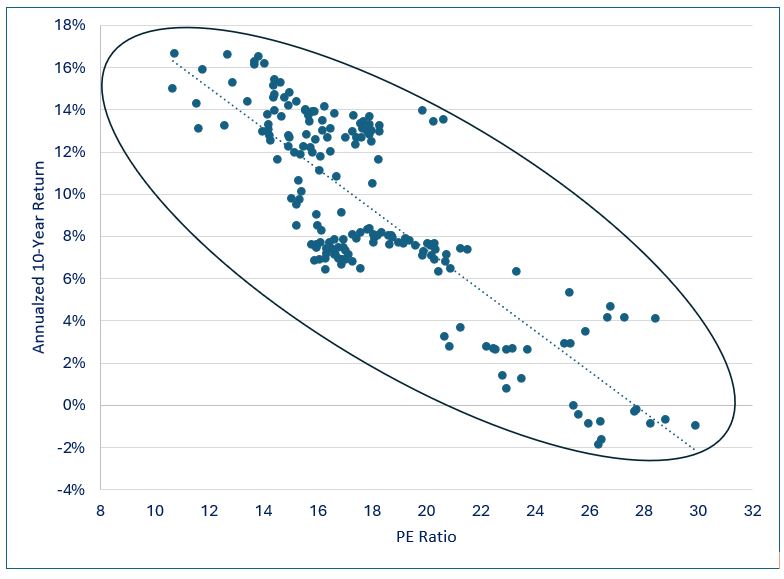

This downward trend for interest rates means that investors who want a secure investment while outpacing inflation may have to look beyond GICs and other fixed-income products in this changing climate. Market volatility is another headwind investors are now contending with, spurred on by a new and aggressive U.S. administration.

There was enthusiasm surrounding the broader economy and the stock market coming into 2025. The previous GOP administration cultivated a reputation as a market-friendly one in the late 2010s. That momentum ground to a halt due to the COVID-19 pandemic, but the perception of a market-friendly GOP largely remained.

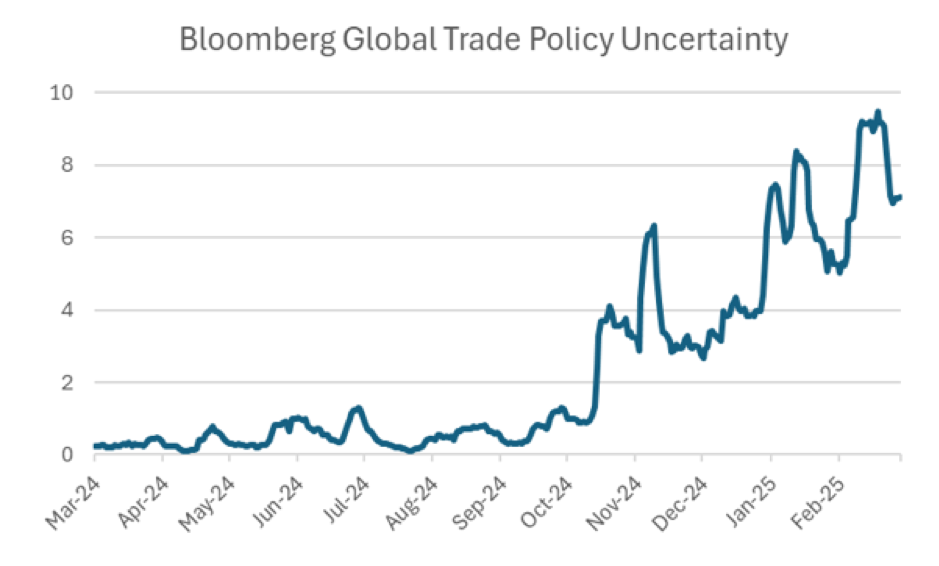

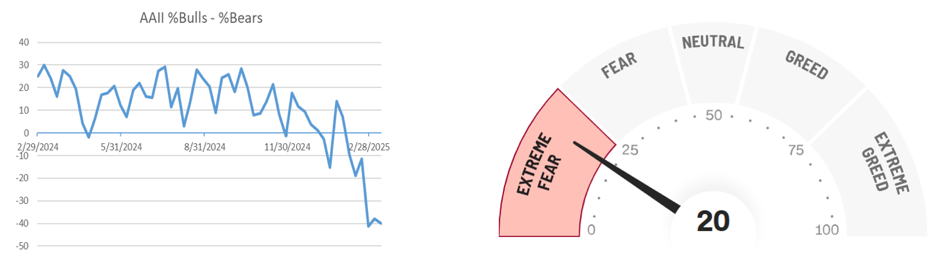

Investor outlook has soured in the late winter and early spring, in large part due to the uncertainty surrounding U.S. government policy, particularly when it comes to tariffs.

Source: American Association of Individual Investors, Bloomberg, Harvest ETFs. As of March 21, 2025.

This uncertainty has resulted in elevated levels of market volatility. Some names have suffered retracements of 50% or more over the past two months. This market is unique in that the sell-off was not triggered by one significant catalyst. Indeed, it is lingering trade policy uncertainty that is fuelling negative sentiment.

Source: American Association of Individual Investors, CNN (Fear and Greed Index). As of March 20, 2025.

The S&P 500 has dropped 8% in the year-to-date period as of close on Friday, April 10, 2025. A research note from Vanguard recently speculated that volatility was likely to remain due to factors like policy uncertainty, disruptive currents in the economy like artificial intelligence development, and the shifting policy of the Federal Reserve.

Demand for Low Volatility products has increased in this environment. These ETFs offer Canadian retirees a pure low volatility play with exposure to 100% Canadian equities. Moreover, we have introduced Harvest’s trusted option writing strategy to the second Low Volatility ETF. It aims to lower portfolio volatility while generating high monthly cash distributions.

Harvest Low Volatility ETFs: A smoother Investment Experience

Harvest’s new Low Volatility ETF suite could be appealing to defensive and long-term investors. This approach to equity investing is factor-based, disciplined, outcome-oriented, is designed to mitigate risk, as well as provide long-term growth. Moreover, the suite includes a high-income solution that generates monthly cash distributions through an active covered call writing strategy. Continue Reading…