We’re halfway through 2022 and the year has not been kind to investors, to say the least. Global stock markets are suffering their worst prolonged losses in recent memory. The S&P 500 is down about 18.5%, international stocks are down about 17%, and emerging market stocks are down about 15%. Domestic stocks have fared better, but the broad Canadian market is still down about 4% this year.

We’re halfway through 2022 and the year has not been kind to investors, to say the least. Global stock markets are suffering their worst prolonged losses in recent memory. The S&P 500 is down about 18.5%, international stocks are down about 17%, and emerging market stocks are down about 15%. Domestic stocks have fared better, but the broad Canadian market is still down about 4% this year.

Meanwhile, bonds have not been a safe haven as rising interest rates pushed bond prices down. A broad Canadian bond index is down almost 13% this year, while short-term bonds are also down about 5.5%.

What’s an investor to do?

For starters, stop checking your portfolio so often. Investors who focus too much on short-term performance tend to react too negatively to recent losses, at the expense of long-term benefits. This phenomenon is known as myopic loss aversion:

“A large-scale field experiment has shown that individuals who receive information about investment performance too frequently tend to underinvest in riskier assets, losing out on the potential for better long-term gains (Larson et al., 2016).”

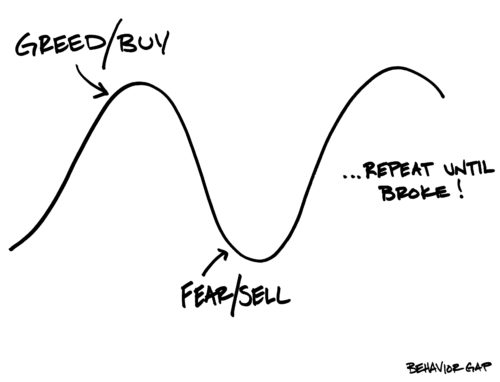

Loss aversion is a cognitive bias – the idea that a loss is psychologically more painful than the pleasure of an equivalent gain.

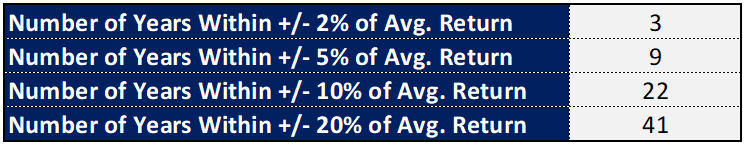

Think of the your portfolio returns over the past three years (2019-2021). It felt good to see your investments increase by double-digits. Here are the returns for Vanguard’s Balanced ETF (VBAL) during that time:

- 2019 – 14.91%

- 2020 – 10.24%

- 2021 – 10.27%

Fast forward to 2022 and VBAL is down 10% on the year. Loss aversion tells us the pain of these losses is felt twice as powerfully as the pleasure of the previous years’ gains.

Myopic loss aversion fails to consider the bigger picture

With myopic loss aversion, we focus too narrowly on specific investments without taking into account the bigger picture. You’ve experienced this if you’ve ever checked your portfolio a short time after a recent purchase and cursed your luck if the investment is down.

Professor John List was a recent guest on the Rational Reminder podcast and he co-authored a paper on myopic loss aversion. The paper found that, “professional traders who receive infrequent price information invest 33% more in risky assets, yielding profits that are 53% higher, compared to traders who receive frequent price information.”

When asked how often investors should check their portfolio, List said, “as rarely as possible”:

“I would say once every three, six months is fine. But the reason why I don’t want you to look at your portfolio is, because when you do and you see losses, even though they’re paper losses. You say, “My gosh, that hurts.” And you’re more likely to move your portfolio out of risky assets and into less risky assets. And as we all know, just look at the data. The data over long periods of time, that’s the equity premium puzzle, is that you get much higher returns, if you’re willing to bear some of that risk. Now, if you look at your account a lot and you have myopic loss of version, you’ll be much less likely to bear that risk. So, you’ll move out and you’ll be in inferior investments.”

This applies to both novice and experience investors. I coach clients regularly on the benefits of sticking to their investment strategy and ignoring short-term market fluctuations. But it’s hard when the daily news headlines are screaming in your face about how bad the market is doing and why it’s only going to get worse.

My worst moment was during the March 2020 crash. I had just quit my job three months before, and my investments were down 34% in a short period of time. It was a rough time when even I was questioning what to do. It didn’t help that I had no RRSP or TFSA contribution room – so I couldn’t even “buy the dip” to make myself feel better.

Related: Exactly How I Invest My Own Money

What did I do? I stopped checking my portfolio. I had no reason to log-in anyway, since I wasn’t making regular contributions. I reminded myself that my investments were long-term in nature, and that markets go up most of the time. Periodic declines are the price of admission for risky assets like stocks. Continue Reading…