So don’t ask me no questions

And I won’t tell you no lies

So don’t ask me about my business

And I won’t tell you goodbye

- Lynyrd Skynyrd

By Noah Solomon

Special to Financial Independence Hub

I know virtually nothing about investing in private companies. However, I do know a thing or two about the theoretical and practical aspects of asset allocation and portfolio construction. In this vein, I will discuss the value of private equity (PE) investments within a portfolio context. Importantly, I will explain why PE investments may contribute less to one’s portfolio than is widely perceived.

Before I get into it, I am compelled to state one important caveat. Generalized statements about PE are less meaningful than is the case with public equities. The dispersion of returns across public equity funds is far lower than across PE managers. Whereas most long stock funds fall within +/- 5% of the average over a several year period, there is a far wider dispersion among underperformers and outperformers in the PE space. As such, it is important to note that the following analysis does not apply to any specific PE investment but rather to PE as an asset class in general.

The Perfect Asset Class?

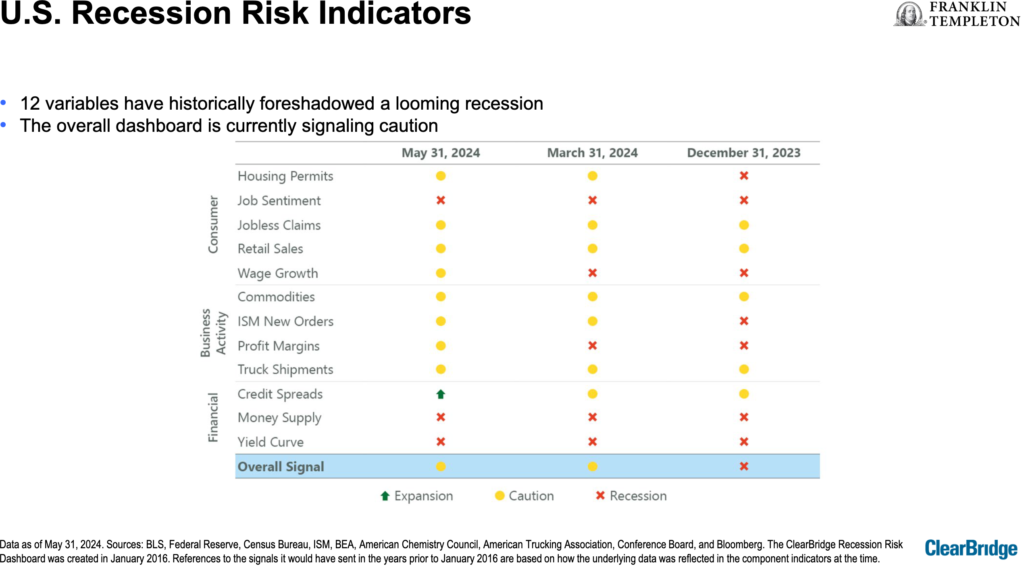

PE allocations are broadly perceived as offering higher returns than their publicly traded counterparts. In addition, they are regarded as having lower volatility than and lower correlation to stocks. Given these perceived attributes, PE investments can be regarded as the “magic sauce” for increasing portfolio returns while lowering portfolio volatility. In combination, these attributes can significantly enhance portfolios’ risk-adjusted returns. However, the assumptions underlying these features are highly questionable.

Saturation, Lower Returns, & Echoes of Charlie Munger

It is reasonable to expect that average returns within the PE industry will be lower than in decades past. The number of active PE firms has increased more than fivefold, from just under two thousand in 2000 to over 9000 today. This impressive increase pales in comparison to growth in assets under management, which went from roughly $600 billion in 2000 to $7.6 trillion as of the end of 2022. It seems unlikely if not impossible that the number of attractive investment opportunities can keep pace with the dramatic increase in the amount of money chasing them.

Another reason to suspect that PE managers’ returns will be lower going forward is that their incentives and objectives have changed. The smaller PE industry of yesteryear was incentivized to deliver strong returns to maximize performance fees. In contrast, today’s behemoth managers are motivated to maximize assets under management and management fees. The name of the game is to raise as much money as possible, invest it as quickly as possible, and begin raising money for the next fund. The objective is no longer to produce the best returns, but rather to deliver acceptable returns on the largest asset base possible. As the great Charlie Munger stated, “Show me the incentive and I’ll show you the outcome.”

There are no Bear Markets in Private Equity!

It is also likely that PE investments on average have both higher volatility and greater correlation to stocks than may appear. The values of public equities are determined by exchange-quoted prices every single day. In contrast, private assets are not marked to market daily. Not only do PE managers value their holdings infrequently, but they also must employ a significant degree of subjectivity in determining the value of their holdings. Importantly, there is an inherent bias for not adjusting private valuations when public equities suffer losses. Continue Reading…