(Sponsor Content)

“Can you believe it, honey? Friday’s my last day at work! Time sure flies. I can’t wait to start spending all of our free time together!”

Did this thought warm your heart, or get your pulse racing in panic? That probably depends on whether you’ve given some good thought to what you’re doing after retirement.

But what do you actually want to do after you stop working? Your retirement income goals will depend much on your answer to that question, as your financial adviser is apt to tell you.

We’re living longer — and that’s a good thing, if you plan for it

‘Retirement’ wasn’t really a thing, until recently. You lived, you worked, you died … and the world kept turning as youth picked up the baton of life’s track meet. That’s partly the reason pension age was set at 65: few were expected to live long enough to claim it! When the USA passed their Social Security Act in 1935, American men were expected to live to about 58.

But with our longer life spans, you could still be shuffling around decades after you’ve stopped working. According to Statistics Canada and the 2016 Census, “there were 5.9 million seniors in Canada, which accounted for 16.9% of the total population. In comparison, there were 2.4 million seniors in 1981, or 10% of the population.”

There are more retirees than ever! So, our question is a practical one: how do you retire and still fill 40 hours a week?

What Canadian retirees are already doing with their time

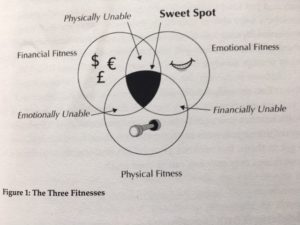

Does this all seem inspiring … or overwhelming? Is the room spinning at the prospect of playing shuffleboard and doing yard work for the next two or three decades? Fortunately, we’ve picked up an important idea from doing retirement income planning with countless clients. Continue Reading…