By Mathieu Litalien

Special to the Financial Independence Hub

The interest in Blockchain has surged in recent months as Bitcoin goes on a record run. Naturally, the two are inherently linked but one common mistake investors make is to assume one equals the other.

Unfortunately, it is a mistake made by many and one that could not be further from the truth. Blockchain is not Bitcoin, and Bitcoin is not Blockchain.

Without going into great technical detail, Blockchain is the technology that underpins the Bitcoin cryptocurrency. Blockchain powers Bitcoin and while it was initially created for Bitcoin, they are not one and the same.

Decentralization

Blockchain is a decentralized database or a ledger that is distributed across many computers. Hence, why it is referred to as decentralized. Arguably, it is what makes Blockchain’s technology so revolutionary and why the use cases expand far beyond that of cryptocurrencies.

Many believe that Blockchain’s decentralization will revolutionize the way companies do business. For one, it is largely considered to be safe as there is no single point of attack for which to target. Secondly, Bitcoin has made the use case for making digital transactions much easier (and secure). Finally, given its nature blockchain leads to greater transparency, increased accuracy and ultimately, can lead to significant cost reductions.

The potential use cases for Blockchain are too many to list but include things such as executing contracts, maintain records and auditing. Today, organizations worldwide are investigating how they can utilize and adopt Blockchain technology.

How can investors benefit?

Exchange Traded Fund (ETF) investing, is one of the simplest ways of gaining exposure to a broad base of assets. Canadian ETFs cover markets, sectors, industries and in some cases, get down to specific niche industries. Blockchain is one such niche industry and in Canada, there are two solid options for investors.

Harvest’s Blockchain Technologies ETF (TSX:HBLK)

It is worth noting that there have been a few failed attempts at Blockchain ETFs in the past and today, Harvest’s Blockchain Technologies ETF is one of the only one’s left standing. The fund aims to track the performance of the Harvest Blockchain Technologies Index. HBLK (TSX:HBLK) invests in equity securities of issuers exposed, directly or indirectly, to the development and implementation of blockchain and distributed ledger technologies.

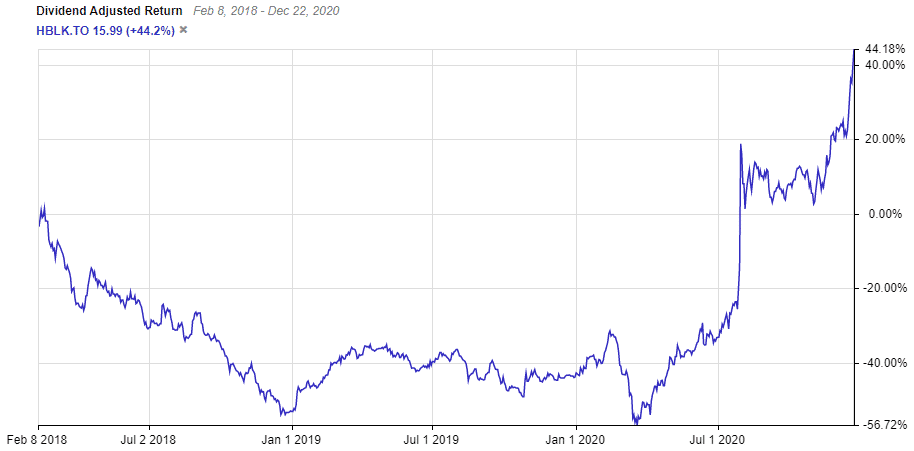

he fund is now two years old having first launched in December of 2018. A $10,000 investment in HBLK would be worth $13,699 as of end of November. Worth noting that the fund was underwater until it made a big comeback this past June.

TSX:HBLK Dividend Adjusted Return

This chart provided by StockRover. Check out Stockrover Here!

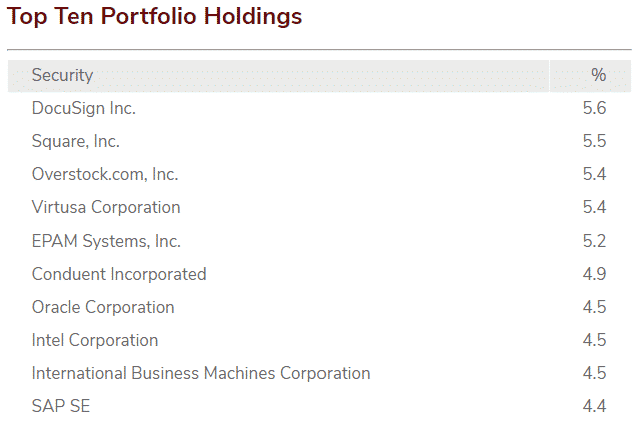

Holdings include a mix of well-established large caps and stand-alone emerging blockchain companies. As of end of November, emerging and large cap companies accounted for 55% and 44% of the fund. It carries a high 0.65% Management Expense Ratio (MER) fee and is eligible for most account types.

As of writing, the company is trading at $15.00 per share, a 9.4% premium to its net asset value (NAV) of $13.70 per share. It is a smaller ETF, with holdings of approximately $10.5 million and as such, is prone to greater volatility.

The ETF appears to be well diversified with no holding accounting for more than 6% of the fund. Combined, the Top 10 account for approximately 50% of assets. Among the notable names, there are upstarts and hypergrowth stocks such as DocuSign and Square which are complemented by large players such as Intel and Oracle.

Horizon’s Big Data and Hardware ETF (TSX:HBGD)

Although it is not explicitly stated in its name, Horizon’s Big Data and Hardware ETF (TSX:HBGD) is a blockchain focused fund. The fund seeks to replicate the performance of the Solactive Blockchain Technology & Hardware Index which tracks companies focusing on blockchain innovation and development, and companies providing hardware and hardware-related services used in blockchain applications.

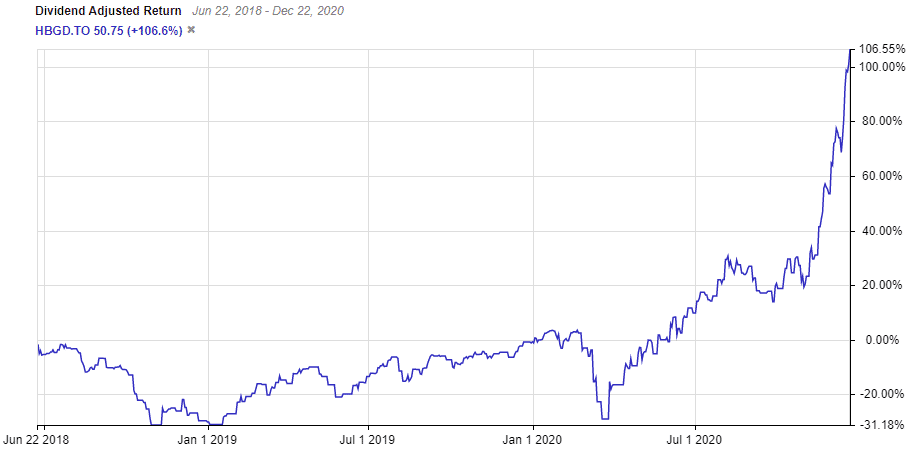

Horizon’s ETF has a reasonable MER of 0.55% and at today’s price of $48.70 trades at a steep 20.15% premium to its NAV of $40.53. The fund was launched in June of 2018 and a $10,000 investment in HBGD at the time of inception would be worth $17,487 as of end of November. Much like HBLK, most of those gains have come over the past six months.

TSX:HBGD Dividend Adjusted Return

Somewhat surprisingly, the fund also pays a modest annual distribution of $0.3701 per share (0.76% yield). Distributions are rare for ETFs that track technology and growth stocks. Horizon’s ETF is made up of approximately 50% mid-to-large cap stocks, while 23% of holdings are microcap stocks. Once again, this is a small fund with only $7.1M in assets and is a higher-risk investment.

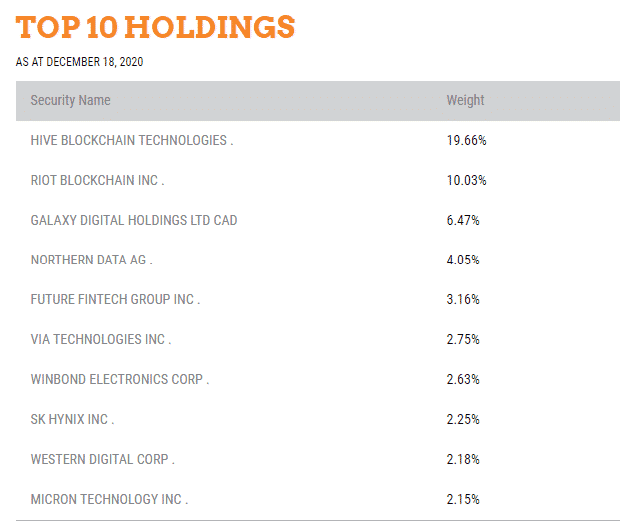

This is accentuated by the makeup of the company’s holdings.

The company’s Top 10 holdings are vastly different than that of HBLK. For starters, none of the Top 10 overlap. Although the Top 10 also account for approximately 50% of fund holdings, two companies – Hive Blockchain (TSX:HIVE) and Riot Blockchain (NASDAQ: RIOT) – account for ~30% of holdings. This means that the fund is more reliant on those two companies to drive performance.

Furthermore, half of the top 10 holdings trade on exchanges outside of North America and approximately 31% of total holdings operate in Asia. This makes it the more globally diversified fund of the two.

HBLK vs HBGD

Interestingly, both ETFs offer something different and can be held together without worry of much overlap. Harvest’s fund is likely to be less volatile given its exposure to some of the larger and more traditional tech companies.

Horizon’s appears to be the purest play of the two, however comes with additional risk given the makeup of its holdings. Although greater risk comes with greater reward, should one of HIVE or RIOT falter, the fund could take a significant hit.

As of writing, HBLK is also trading at a higher valuation. This is not surprising as the blockchain industry is in a bull run. (Also see how Canadian covered-call ETFs are affected by market trends). In such a scenario, I’d expect the fund with the higher risk profile to trade at more expensive valuations. Worth noting, the reverse is also true. In a blockchain bear market, I’d expect it to underperform.

Overall, both look like solid options. The only caveat being that HBLK’s 1.59% MER is very high which is a pretty big negative. Although actively managed, this is a high MER to pay for a fund that includes stocks like Intel, Oracle, and IBM. It is something investors must consider.

With over 20 years of self directed experience, Mathieu Litalien has the experience and knowledge to navigate the Canadian markets. He has spent years writing for some of the most respected names in the industry such as Seeking Alpha, Motley Fool and Stocktrades. Mat is also a founding partner of Stocktrades Premium, one of Canada’s fastest growing investment resources.

With over 20 years of self directed experience, Mathieu Litalien has the experience and knowledge to navigate the Canadian markets. He has spent years writing for some of the most respected names in the industry such as Seeking Alpha, Motley Fool and Stocktrades. Mat is also a founding partner of Stocktrades Premium, one of Canada’s fastest growing investment resources.

Mat has an MBA, is a Certified Health Executive (CHE) and is a certified Professional Director (Pro. Dir), one of only three recognized board director certifications by the Canadian Securities Commission. Mat currently sits on the Board of Directors of Greater Sudbury Hydro (GSHi) as an independent director. At GSHi, he sits on the Audit Committee which is responsible for setting the direction, implementing controls and approving the budget of this multi-million dollar corporation.

This blog originally appeared at Stockhouse.ca on April 4th and is republished here with permission of the publisher.