By Robb Engen, Boomer & Echo

By Robb Engen, Boomer & Echo

Special to the Financial Independence Hub

One of the strongest arguments made by investment industry groups against banning embedded commissions – or the trailer fees paid to advisors when you purchase mutual funds – is that investors don’t want to pay up-front for financial advice.

Advocis, which represents financial advisors across Canada, as well as the Mutual Fund Dealers Association, believe things are fine just the way they are, claiming, “investors prefer to pay for financial advice through fees that are part of their mutual funds.”

Advocis, which represents financial advisors across Canada, as well as the Mutual Fund Dealers Association, believe things are fine just the way they are, claiming, “investors prefer to pay for financial advice through fees that are part of their mutual funds.”

These arguments are used to convince regulators that a ban on trailer fees would only hurt investors, with potentially “devastating consequences” for those who are just starting out and don’t have the means to pay directly for advice.

I’ve tried to debunk this argument in a recent post, stating that it’s up to the investment industry to adapt and deliver new service (and cost) models to meet the needs of consumers.

But a recent study by Morningstar India shed further light on the gap between investor expectations and what advisors perceived to be investors’ expectations.

A third of investors don’t seek professional advice

The study found that over one-third of investors do not seek out professional advice when it comes to their finances, instead relying on their own knowledge or help from family, friends or colleagues.

Advisors were convinced that this was because investors simply did not want to pay for financial advice, or had a bad experience with financial advice in the past.

What was surprising was that investors were not averse to paying for advice. In fact, 42 percent of the investors surveyed stated that they were willing to pay for advice while another 42 per cent were open to it.

If investors are willing to pay for advice, what is it they really want? Our survey tells us that they want quality advice (41%) from a financial adviser they trust (34%).

Trust trumps cost

A similar survey conducted by Morningstar UK revealed trust was the most important factor when choosing an advisor, and that cost was only the third consideration after past investment returns.

It’s nice of the mutual fund industry to tout the benefits of their products – and while it’s true that the funds are accessible to anyone, that’s only because the fees are embedded inside the mutual fund, so you don’t even notice them. It doesn’t feel like a lot of money because you’re not writing a cheque to your advisor every year.

And that says nothing about the inherent conflict of interest when your advisor is selling you products and collecting a commission on that sale.

Final thoughts

One of the challenges we thought we might face after starting our fee-only financial planning business this year was this reluctance to pay up-front for advice. Consumers just weren’t used to it and so we thought it would be a major hurdle.

Guess what? Like the Morningstar study indicated, most of our clients were looking for quality advice from someone they could trust. Cost has rarely been an issue.

I haven’t seen any evidence of the so-called advice gap that the industry feels will widen if regulators ban trailer fees. Half of my clients are what the industry would consider to be “small investors” and the fact that they are willing to pay up-front for independent financial advice means the tide may indeed be turning.

By showing clients what they’re currently paying in real dollar terms they usually end up grasping the value of paying directly for objective advice.

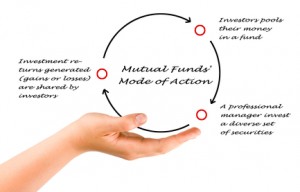

In addition to running the Boomer & Echo website, Robb Engen is a fee-only financial planner. This article originally ran on his site and is republished here with his permission. The graphic on how mutual funds work did not appear in the original blog but was added by the Hub for the benefit of younger investors new to the concept.