Special to the Financial Independence Hub

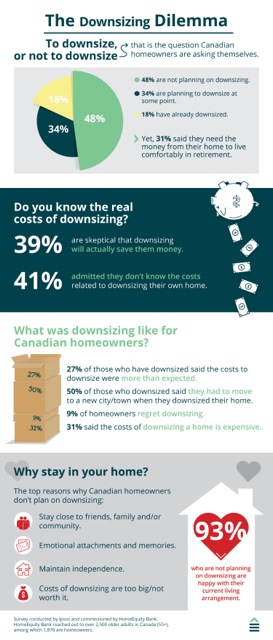

For older Canadians considering selling a home to retire to a smaller living space or a more affordable community, downsizing might sound like a financial bargain, but in a recent Ipsos survey commissioned by HomeEquity Bank, 39 per cent of current homeowners are skeptical that downsizing will actually save them money.

More than a decade ago, I faced the downsizing dilemma and I now wish I’d been as skeptical as these savvy consumers. I put a considerable down payment on a condo in downtown Toronto, purchasing it from builder’s plans. At the time, I wished to retire from my long-time position as a college professor to launch a new career as a writer. Selling my home, cashing in on the equity I’d accumulated, while moving to smaller digs, made sense to me.

Yet as 27 per cent of downsizers shared with the Ipsos survey, the costs were more than expected. Expenses from downsizing can add up quickly.

Originally I was attracted by the lure of improving my cash flow to support a new career, but downsizing didn’t net out that way after factoring in all the closing costs and moving expenses along with the disruption to my lifestyle.

Moving away felt like starting all over again: this time in my sixties. The weight of condo living took its toll.

After living in my condo for two years, facing unexpected changes to the original building plan, loud nocturnal noise from other condo dwellers, endless fire drills and my terrace furniture burning up with cigarette butts dropped on my balcony from above, I put the unit on the market. Once again I was faced with real estate and closing costs. When I purchased a home in my former neighbourhood, I was forced to negotiate a mortgage.

According to an earlier Ipsos survey commissioned by HomeEquity Bank in July 2018, half (51 per cent) of those aged 75+ say it’s important to stay in their current home because they want to keep close to family, friends or their community, while four in ten (40 per cent) say emotional attachment and memories are what’s behind the importance of staying put in their current home during retirement.

What I’d do differently if considering downsizing:

1.) Calculate the real costs of pulling up stakes. Don’t forget legal and moving expenses as well as real estate costs.

2.) Figure out what you’ll be leaving behind. It’s not only about selling or donating your furniture, but clearing out memorabilia and other prized possessions.

3.) Think about how much you rely on your family and friends in your community and the professionals you employ.

4.) Ensure you are re-locating to a new city or neighbourhood that is age friendly and that there are public transportation options if driving becomes problematic.

5.) Explore all your financial options before assuming that downsizing will enhance your cash flow or provide cash for your children to purchase their own home.

6.) Speak to a financial advisor who is open to solutions other than downsizing. Reverse mortgages are one such solution. As the leading provider of reverse mortgages in Canada HomeEquity Bank aims to encourage older homeowners to more clearly define their plan to retire at home and explore the benefits of a reverse mortgage.

Joyce Wayne has worked in media in Canada for more than 35 years. Joyce was the head of the journalism program at Sheridan College and the Director of the Sheridan Centre for Internationally Trained Individuals, a graduate program she launched for new immigrant and refugee journalists who were persecuted in their home countries. In 2013, Joyce took early retirement from the college, and chose to downsize her home to finance the launch of her “retirement reframe” of her career as a writer. She prefers to call this her “unretirement” since now she is busier than ever writing and promoting her two novels. She writes RetirementMatters.ca, a blog about retirement for HomEquity Bank. She also runs writing workshops at the Public Library. Joyce lives in Oakville with her husband.

Joyce Wayne has worked in media in Canada for more than 35 years. Joyce was the head of the journalism program at Sheridan College and the Director of the Sheridan Centre for Internationally Trained Individuals, a graduate program she launched for new immigrant and refugee journalists who were persecuted in their home countries. In 2013, Joyce took early retirement from the college, and chose to downsize her home to finance the launch of her “retirement reframe” of her career as a writer. She prefers to call this her “unretirement” since now she is busier than ever writing and promoting her two novels. She writes RetirementMatters.ca, a blog about retirement for HomEquity Bank. She also runs writing workshops at the Public Library. Joyce lives in Oakville with her husband.