By Nick Gétaz and Matt Quinlan

Franklin Equity Group (Sponsor Content)

As fund managers with the Franklin U.S. Rising Dividends team, we believe that a company increasing its dividends is evidence of three key characteristics: growth, strong capital allocation, and resilience.

Firms that show substantial and sustainable dividend growth also tend to experience greater long-term stock price appreciation. Being able to consistently increase dividend payouts, even during periods of wider economic malaise (the past year being a perfect example) points to a company that is well managed and with a resilient business model. Investors can therefore participate in market growth, while still protecting their capital against downside risk.

Dividend-paying companies can be found across all sectors, and diversification is an important element of the Rising Dividends portfolio. Currently, Industrials, Information Technology and Health Care have the largest allocations in the fund, while there is no exposure to Communication Services, Utilities and Real Estate: the latter two sectors’ growth prospects make them generally less attractive at the moment.

In Health Care, current holding Medtronic PLC is a good example of the type of company we seek out for the portfolio. With consistent dividend increases for 43 years, the world’s largest medical device manufacturer has a diversified and resilient product shelf. Medtronic is a leading provider of cardiovascular and surgical products, and the development of surgical robots and a suite of cardiac rhythm products position it for potential sales growth and efficiency gains in the coming years.

The largest position in the fund is Microsoft, which has accounted for 8–9% of the portfolio over the past year. In our view, Microsoft has a number of different growth drivers among its cloud, enterprise productivity and gaming offerings. Microsoft Teams has also become a vital tool for many companies that had employees switch to working from home over the past year, which is further evidence of Microsoft’s resilience and ability to thrive through different market cycles.

Dividend cuts were less severe than expected during the pandemic

Resilience, on a variety of fronts, has certainly been required over the past year as the COVID-19 pandemic has hammered the global economy. At the outset of the crisis, dividend reductions were widely predicted, but these cuts weren’t as far reaching as expected: in our portfolio, approximately 3% of holdings reduced dividends in 2020.

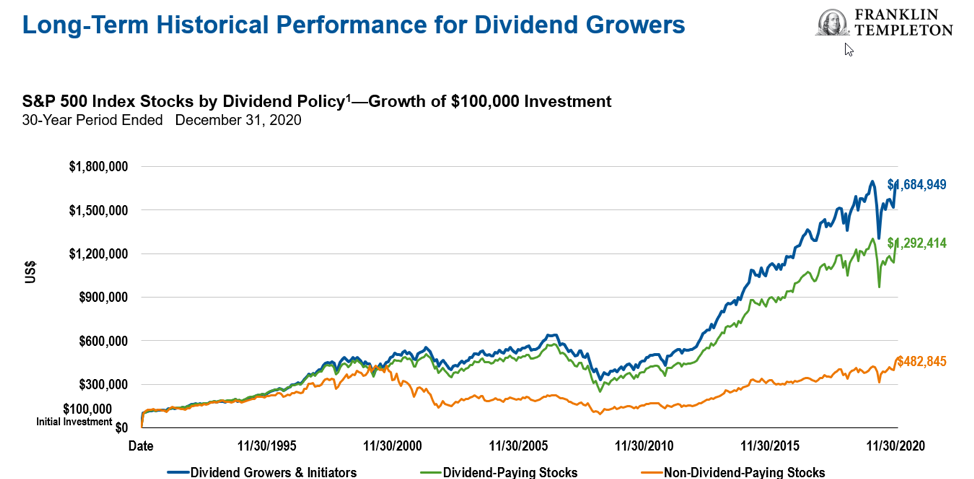

Historically, the evidence shows that dividend-growing stocks have tended to perform better than stocks that don’t provide dividends, and they have done so with less risk. The chart below shows dividend growers against the S&P 500 Index over the 30-year period ending December 31, 2020. This time frame includes multiple market cycles and downturns, including the Dot-Com collapse; the Global Financial Crisis; “The Lost Decade”, the 10-year period up to 2009 when U.S. equities (represented by the S&P 500 Index) had a near-zero return; as well as the correction of last February/March.

Taking a long-term view, corrections and drawdowns are inevitable, so it’s crucial to build portfolios of high-quality companies that can navigate different economic cycles.

Optimistic outlook for IT

Looking ahead, we are optimistic about the outlook for both the global economy and equity markets, particularly in sectors such as Health Care and Industrials. Another sector to keep an eye on is IT: we have high expectations for various technology firms aside from the outperforming FAANG names, given the somewhat muted stock reactions to 2020’s fourth quarter results, which were very strong.

There are various risks to consider too, including inflation; certain sectors being left behind in the recovery; and the impact of QE tapering by central banks. Of course, these risks are contingent upon what progress is made in containing COVID-19 and whether public vaccination programs can drive infection and hospitalization rates down to levels where lockdowns are no longer necessary in the second half of 2021.

Nick Gétaz and Matt Quinlan are portfolio managers with Franklin Equity Group. Franklin Equity Group brings together more than six decades of investment experience offering in-depth expertise in managing growth, value and hybrid/balanced equity strategies that cover global, regional and sector specialties. Franklin U.S. Rising Dividends Fund seeks to achieve long-term capital appreciation by investing primarily in American equities, with at least 80% of net assets in companies that have paid consistently rising dividends. Management Expense Ratio—Series F:1.30%; Management Fee—Series F: 1.00%

- Source: © 2021 Ned Davis Research Group, Inc. The chart represents the dividend growers and initiators, dividend and non-dividend-paying stocks of the S&P 500 Index, based on a rolling 12-month dividend policy.

This commentary is for informational purposes only and reflects the analysis and opinions of Franklin Templeton as of February 10, 2021. Because market and economic conditions are subject to rapid change, the analysis and opinions provided may change without notice. The commentary does not provide a complete analysis of every material fact regarding any country, market, industry or security. An assessment of a particular country, market, security, investment or strategy is not intended as an investment recommendation nor does it constitute investment advice. Statements of fact are from sources considered reliable, but no representation or warranty is made as to their completeness or accuracy. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus or fund facts document before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus or fund facts document before investing. The indicated rates of return are historical annual compounded total returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges, or income taxes payable by any securityholder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. Franklin Templeton Canada, part of Franklin Templeton Investments Corp.