By Jeff Weniger, CFA, WisdomTree Investments

Special to the Financial Independence Hub

Is the footing getting shaky in Ontario housing? The Teranet–National Bank National Composite House Price Index for Toronto rose 272.8% from its inception in July 1998 to the peak last summer. Everyone knows nothing of the sort happened to wages. The average Canadian earned $579 a week back then and $988 today, a 69% change.1 Something is amiss, and maybe the bell was rung in July 2017.

The Toronto housing market appears to have turned on a dime, and the home price index is off 7.3% through 2/28/2018 (figure 1). Aside from the index’s 10.9% fall during the global financial crisis, this is the sharpest decline in Toronto residential real estate since the index’s inception in 1998.

Figure 1: Teranet–National Bank National Composite House Price Index, Toronto

When home prices quadruple in the span of one generation, with much of the appreciation in recent years taking on a “just buy before getting priced out forever” mentality, the natural concern is that the 7% drawdown might be just a taste of what is yet to come.

When home prices quadruple in the span of one generation, with much of the appreciation in recent years taking on a “just buy before getting priced out forever” mentality, the natural concern is that the 7% drawdown might be just a taste of what is yet to come.

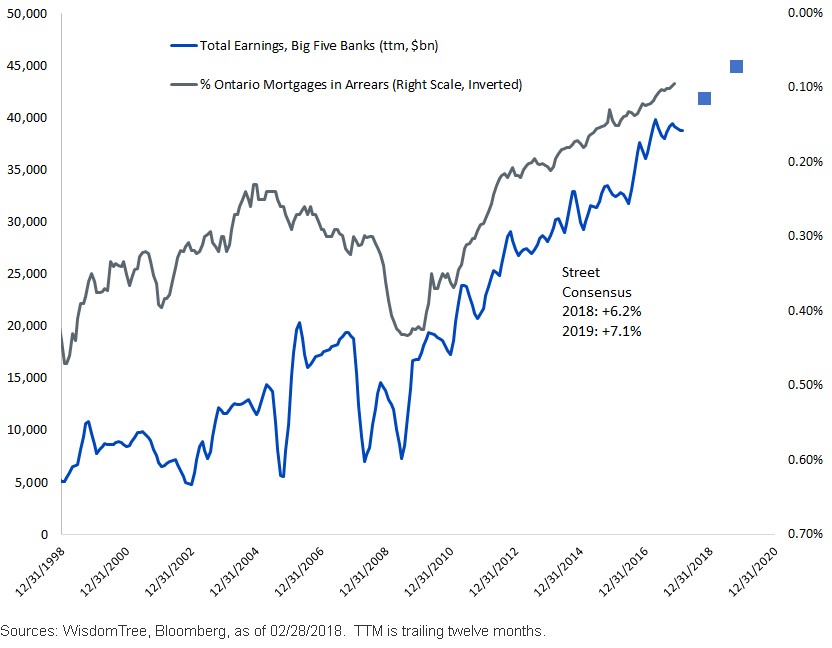

This is where we are reminded that MSCI Canada has 43% of its weight in financials,2 and almost all of that is in the big banks. Canada is unique in that its banking system, for better or worse, is concentrated in the five national champions.3 The U.S. has 4,888 commercial banks,4 so major indexes like the S&P 500 do not have the same domination of Bank of America or Wells Fargo as the big players do on the TSX. In fact, in the developed world, Canada’s degree of sector concentration is akin to only Hong Kong, with hardly any other industrialized economies as reliant on so few key sectors.

Figure 2: Ontario Mortgage Arrears

If we do see continued trouble in Ontario housing, being under-weight in financials may be rewarding.

If we do see continued trouble in Ontario housing, being under-weight in financials may be rewarding.

How bank stocks behave in a tough housing market has only one precedent from the last generation, and that was when U.S. housing fell apart. The S&P CoreLogic Case-Shiller 10-City Composite Index of U.S. home prices peaked in June 2006, falling 33.5% by April 2009. To witness a similar fall from the July 2017 peaks — by more than a third — all that needs to happen is for the Teranet–National Bank National Composite House Price Index for Toronto to revert to 2015 levels.6

Then again, this is not to say that the Canadian banks will collapse. In a pinch, they can seize automobiles and furniture from nonpayers; American banks can’t do that. Also, whereas many economists believe Americans’ mortgage tax deductibility fuels speculation, Canada doesn’t have to worry about this issue. And, of course, it is Canada’s pride that its banking system proved among the most resilient in the world when Lehman buckled.

Nevertheless, as was seen in the U.S. when the housing market unwound, sometimes regularly honest, good-natured people find themselves up against a wall when their million-dollar condo falls to $600,000. They put the keys in the mail, not because they’re bad people, but because the clock runs out on them, and they are out of choices. One thing the Canadian banks don’t have going for them is that, unlike in the U.S., the regulatory system has them keeping the mortgages on their own books. The good news is that this forces strict underwriting standards; the bad news is that the gilt-edged borrower in a housing boom has a different credit profile when their condo is a couple hundred thousand in the red.

Because financials have been outperforming broader Canadian equities, by and large, for nearly nine years, we have to go back to the experience of the S&P/TSX Composite Financials Index during the global crisis. It underperformed the broad S&P/TSX Composite by 3,312 basis points from its September 29, 2006, monthly relative performance peak to the June 30, 2008, relative trough.

If Toronto home prices keep misbehaving, some investors may wish to find an exchange-traded fund [ETF] that covers broad Canadian equities without heavy exposure to financials.

1Source: Statistics Canada. Data as of 2/28/18.

2Sources: WisdomTree, MSCI, as of 2/28/2018.

3RBC Royal Bank, Bank of Montreal, TD, Bank of Nova Scotia and CIBC

4Source: St. Louis Fed, as of the fourth quarter of 2017.

5Source: Big Five earnings aggregated by WisdomTree using Bloomberg data. Street consensus as of 3/16/18.

6Teranet Toronto’s peak was 254.93 in July 2017. A 33.5% retracement would be to 169.48. The index stood at 169.1 in May 2015.

Jeff Weniger, CFA serves as Asset Allocation Strategist at WisdomTree. Jeff has a background in fundamental, economic and behavioral analysis for strategic and tactical asset allocation. Prior to joining WisdomTree, he was Director, Senior Strategist with BMO from 2006 to 2017, serving on the Asset Allocation Committee and co-managing the firm’s ETF model portfolios. Jeff has a B.S. in Finance from the University of Florida and an MBA from Notre Dame. He is a CFA charter holder and an active member of the CFA Society of Chicago and the CFA Institute since 2006. He has appeared in various financial publications such as Barron’s and the Wall Street Journal and makes regular appearances on Canada’s Business News Network (BNN) and Wharton Business Radio.

Jeff Weniger, CFA serves as Asset Allocation Strategist at WisdomTree. Jeff has a background in fundamental, economic and behavioral analysis for strategic and tactical asset allocation. Prior to joining WisdomTree, he was Director, Senior Strategist with BMO from 2006 to 2017, serving on the Asset Allocation Committee and co-managing the firm’s ETF model portfolios. Jeff has a B.S. in Finance from the University of Florida and an MBA from Notre Dame. He is a CFA charter holder and an active member of the CFA Society of Chicago and the CFA Institute since 2006. He has appeared in various financial publications such as Barron’s and the Wall Street Journal and makes regular appearances on Canada’s Business News Network (BNN) and Wharton Business Radio.

Commissions, management fees and expenses all may be associated with investing in WisdomTree ETFs. Please read the relevant prospectus before investing. WisdomTree ETFs are not guaranteed, their values change frequently and past performance may not be repeated. Past performance is not indicative of future results. This material contains the opinions of the author, which are subject to change, and should not to be considered or interpreted as a recommendation to participate in any particular trading strategy, or deemed to be an offer or sale of any investment product and it should not be relied on as such. There is no guarantee that any strategies discussed will work under all market conditions. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results. This material should not be relied upon as research or investment advice regarding any security in particular. The user of this information assumes the entire risk of any use made of the information provided herein. Neither WisdomTree nor its affiliates provide tax or legal advice. Investors seeking tax or legal advice should consult their tax or legal advisor. Unless expressly stated otherwise the opinions, interpretations or findings expressed herein do not necessarily represent the views of WisdomTree or any of its affiliates. “WisdomTree” is a marketing name used by WisdomTree Investments, Inc. and its affiliates globally. WisdomTree Asset Management Canada, Inc., a wholly-owned subsidiary of WisdomTree Investments, Inc., is the manager and trustee of the WisdomTree ETFs listed for trading on the Toronto Stock Exchange.