Of the major North American cities that feel most like Toronto, Chicago is clearly the closest fit. It’s Toronto’s sister. Chicago is the third most-populous city in the U.S., behind New York and Los Angeles. According to the U.S. Census Bureau, Chicago proper has a population of 2.7 million, almost exactly the same amount as Toronto.1 Both cities have several million more living in the immediate suburbs. Chicago’s money resides mostly on one side of the city, with most of its poverty found on the city’s south and west sides. Wealthy suburbs span almost to Wisconsin in the city’s “North Shore” suburbs, which consist of some of the wealthiest zip codes in the U.S.

Like Toronto, Chicago is a money centre. It is widely considered to be in that tier of financial hubs that includes Boston and San Francisco, behind the center of it all in New York. Its construction is dense; people take trains and buses to commute into the downtown core. Critically, as far as desirability of property goes, Chicago’s weather is miserable, just like Toronto’s. The two cities are also characterized by left-leaning politics, so there isn’t much of a difference on that front either.

When we engage Torontonians about the U.S. and Chicagoans about Canada, time and again the answer comes back: the city that is most like Toronto is Chicago.

Except in one way.

Chicago homes are one third or half of similar homes in Toronto

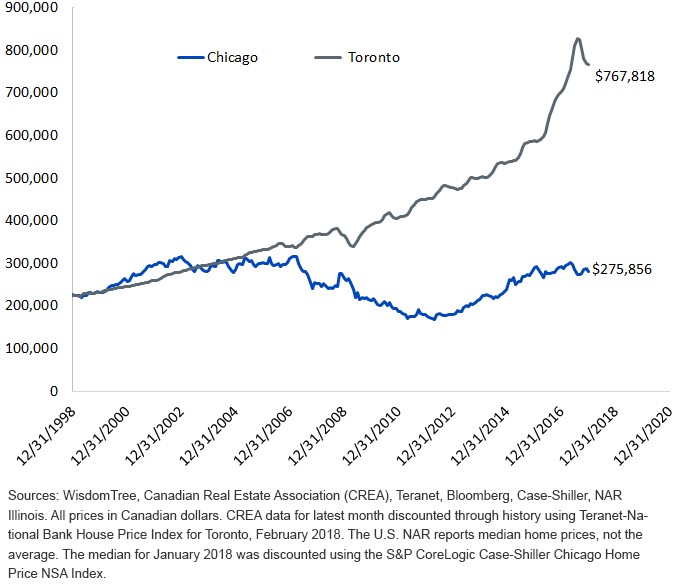

There is a major arbitrage just sitting there for anyone who liquidates Toronto property, hops on a 75-minute flight and purchases a mirror-image property for one-third or half the price in Chicago. Yes, Chicago is riddled with violence, but not in the neighbourhoods where someone would spend C$767,818, the average Toronto home price in February.2 In those neighbourhoods, the biggest risk is having a $500 stroller run over your toe.

Just what could C$767,818 get in Chicago?

According to the National Association of Realtors’ (NAR) Illinois chapter:

In the nine-county Chicago Primary Metropolitan Statistical Area (PMSA), home sales (single-family and condominiums) in January 2018 totaled 5,777 homes sold, down 8.0 percent from January 2017 sales of 6,277 homes. The median price in January 2018 was $224,000 in the Chicago PMSA, an increase of 7.2 percent from $209,000 in January 2017.

Converting US$224,000 to Canadian dollars at the January exchange rate of $1.231, that is C$275,856 for the median house in Chicago. Granted, U.S. housing data tends to be measured by the median, whereas the Canadian norm is to take the average, but there is still not much of a comparison; the gap is yawning, and this all started happening only in recent years.

And it isn’t because of Chicago’s well-publicized crime, which, aside from the last two years, has been collapsing for a quarter century. The trains are safe, and that wasn’t the situation a few decades back. Neighbourhoods that were once left for dead are centers for Michelin-starred restaurants. The truth is that Chicago is Toronto’s comparable, and the residential real estate price gap in figure 1 is cause for pause.

We believe a reversion to the mean is coming for Toronto real estate, and when it comes, it is logical to anticipate that there will be a rise in the number of mortgages in arrears. As we pointed out in “Toronto Real Estate: Behind the Math,” if the percentage of delinquent mortgages reverts to historic norms or overshoots them, the Street would seemingly have to revise its 6.2% and 7.1% earnings growth prognostication for the Big Five banks in 2018 and 2019, respectively.3

And if that happens, the nine-year bout of Canadian financial sector outperformance over the broad market may come to an end.

An answer to the conundrum

The WisdomTree Canada Quality Dividend Growth Index ETF (DGRC), may help solve the riddle. By screening its components for return on equity, return on assets and earnings growth, it is not currently identifying any of the major banks for inclusion in its underlying Index. If they get their earnings growth and profitability up, they may pass our rules-based screens in the future. But if Toronto real estate has a 2018 or 2019 that looks anything like the second half of 2017, financial sector earnings may be vulnerable.

The WisdomTree Canada Quality Dividend Growth Index ETF (DGRC), may help solve the riddle. By screening its components for return on equity, return on assets and earnings growth, it is not currently identifying any of the major banks for inclusion in its underlying Index. If they get their earnings growth and profitability up, they may pass our rules-based screens in the future. But if Toronto real estate has a 2018 or 2019 that looks anything like the second half of 2017, financial sector earnings may be vulnerable.

DGRC solves Canada’s sector concentration problem because it is an all-cap Canadian equity exchange-traded fund that can be treated as a core portfolio holding, especially for anyone who saw Nortel dominate the indexes in the late 1990s and would like to avoid MSCI Canada’s 43% exposure to financials.4

Remember, the S&P/TSX Composite Financials Index underperformed the S&P/TSX Composite Index by 3,312 basis points from September 29, 2006, to June 30, 2008, and it was U.S. housing that tipped over the cart. Granted, that was a huge storm that engulfed the globe, but the key is this: when housing hit a roadblock, financials underperformed.

If Toronto housing goes, it may be best to avoid doubling down by being heavy in the banks.

1Source: Statistics Canada, 2016 Census.

2Source: Toronto Real Estate Board average Toronto home price.

3Source: WisdomTree, Bloomberg, as of 4/9/2018.

4Source: MSCI, as of 02/28/2018.

Jeff Weniger, CFA serves as Asset Allocation Strategist at WisdomTree. Jeff has a background in fundamental, economic and behavioral analysis for strategic and tactical asset allocation. Prior to joining WisdomTree, he was Director, Senior Strategist with BMO from 2006 to 2017, serving on the Asset Allocation Committee and co-managing the firm’s ETF model portfolios. Jeff has a B.S. in Finance from the University of Florida and an MBA from Notre Dame. He is a CFA charter holder and an active member of the CFA Society of Chicago and the CFA Institute since 2006. He has appeared in various financial publications such as Barron’s and the Wall Street Journal and makes regular appearances on Canada’s Business News Network (BNN) and Wharton Business Radio.

Jeff Weniger, CFA serves as Asset Allocation Strategist at WisdomTree. Jeff has a background in fundamental, economic and behavioral analysis for strategic and tactical asset allocation. Prior to joining WisdomTree, he was Director, Senior Strategist with BMO from 2006 to 2017, serving on the Asset Allocation Committee and co-managing the firm’s ETF model portfolios. Jeff has a B.S. in Finance from the University of Florida and an MBA from Notre Dame. He is a CFA charter holder and an active member of the CFA Society of Chicago and the CFA Institute since 2006. He has appeared in various financial publications such as Barron’s and the Wall Street Journal and makes regular appearances on Canada’s Business News Network (BNN) and Wharton Business Radio.

WisdomTree disclaimers: This material is intended for residents of Canada only. It contains the opinions of the author, which are subject to change, and should not to be considered or interpreted as a recommendation to participate in any particular trading strategy, or deemed to be an offer or sale of any investment product and it should not be relied on as such. There is no guarantee that any strategies discussed will work under all market conditions. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results. This material should not be relied upon as research or investment advice regarding any security in particular. The user of this information assumes the entire risk of any use made of the information provided herein. Neither WisdomTree nor its affiliates provide tax or legal advice. Investors seeking tax or legal advice should consult their tax or legal advisor. Unless expressly stated otherwise the opinions, interpretations or findings expressed herein do not necessarily represent the views of WisdomTree or any of its affiliates. Commissions, management fees and expenses all may be associated with investing in WisdomTree ETFs. Please read the relevant prospectus before investing. WisdomTree ETFs are not guaranteed, their values change frequently and past performance may not be repeated. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. “WisdomTree” is a marketing name used by WisdomTree Investments, Inc. and its affiliates globally. WisdomTree Asset Management Canada, Inc., a wholly-owned subsidiary of WisdomTree Investments, Inc., is the manager and trustee of the WisdomTree ETFs listed for trading on the Toronto Stock Exchange.