“Books are the bees which carry the quickening pollen from one to another mind.” — James Russell Lowell, poet and author

This week I highlight one of my best recommendations for Retirement. Invest in self-education with some quality reading. The critical factor is how to select just a couple of books.

Investors have a thirst for knowledge about their precious retirement journey. They seek detailed information to assist in navigating the capital accumulation process to achieve retirement. Then comes the desire of making that capital outlast the spending phase.

Walk into any well-stocked bookstore and the retirement section will seem like a maze. There are plenty of titles competing to become permanent occupants of your precious bookshelf space.

My two book selections provide insight and understanding into the design and management of the retirement nest egg. The authors are well known. The books complement one another.

The emphasis is understanding long-term principles, policies and best practices that steer the family’s retirement goals from dreams to realities. Getting fully acquainted with these two books helps craft better decisions about retirement. Something for everyone’s retirement toolbox.

The emphasis is understanding long-term principles, policies and best practices that steer the family’s retirement goals from dreams to realities. Getting fully acquainted with these two books helps craft better decisions about retirement. Something for everyone’s retirement toolbox.

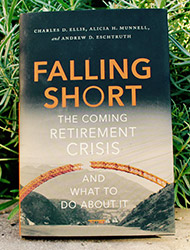

Falling Short: The Coming Retirement Crisis and What To Do About It, by Charles D. Ellis, Alicia H. Munnel, and Andrew D. Eschtruth

This century has clearly shown that we are living longer, health costs are rising and employer pensions are diminishing. That is the big picture applicable to retirees in the USA. However, similar arguments also exist for the Canadian retirement landscape.

The good news is that what is seemingly a dire retirement situation can be easily rectified by implementing a few coordinated steps. This book makes you appreciate the scope of that big picture. Working a little longer, saving a bit more, judicious use of government benefits and being smart about portfolio draws are some of the key answers that deliver.

The message for every retiree is that a successful retirement is about being empowered to look after the personal situation. At age 60, it is not unusual for retirement to last into the 90’s for at least one spouse.

Yes, long term retirement that spans decades is expensive. Sensible and methodical decision making is sound advice for all ages. It renders the scope of the big picture into realistic solutions.

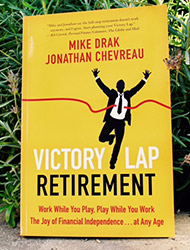

Victory Lap Retirement

By Mike Drak and Jonathan Chevreau

What I appreciate about this book is that it serves as a simple recipe for every retiree. Each of us can stop the fears, take complete control of the retirement destiny, focus on what the family has to accomplish and map out the personal journey. The book is logical; the advice is easy to follow. All the ingredients necessary for your retirement are mentioned.

The authors cover a multitude of retirement strategies in small doses. Everyone can take a pause from the nuances of personal finances then come back and pick up where they left off. The principles described in the book can be applied anytime.

The big picture of retirement is divided into bite-sized morsels of specific actions. In addition, no one has to feel overwhelmed by the tasks necessary to achieve the coveted personal retirement.

I embrace the principles depicted in these two books. Specifically, in the design and management of client retirements. They emphasise setting policies and strategies before tactics.

It is essential to me that the two books focus heavily on the fundamentals. Extensive planning is required to navigate the family’s changing retirement landscapes. The goal is to craft sensible game plans suited for the long term measured in decades.

My two book favourites have a striking resemblance to the bees that carry the pollen. Total outlay for this exercise is near $50. Well worth the price.

I am very glad to have these two retirement books on my bookshelf. The answers they provide are powerful and relevant. Next week I highlight two books on Investing for your long run.

Adrian Mastracci, Discretionary Portfolio Manager, B.E.E., MBA started in the investment and financial advisory profession in 1972. He graduated with the Bachelor of Electrical Engineering from General Motors Institute in 1971, then attended the University of British Columbia, graduating with the MBA in 1972. This blog is republished here with permission from Adrian’s new website, where it appeared on September 5th.

Adrian Mastracci, Discretionary Portfolio Manager, B.E.E., MBA started in the investment and financial advisory profession in 1972. He graduated with the Bachelor of Electrical Engineering from General Motors Institute in 1971, then attended the University of British Columbia, graduating with the MBA in 1972. This blog is republished here with permission from Adrian’s new website, where it appeared on September 5th.