As warm and cuddly and comforting as are dividends, the subject or investment approach can lead to some lively debates. Many will write (or build podcasts on the subject) that dividends simply don’t matter.

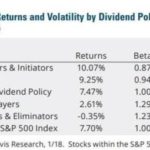

On that, here’s a measured response from Mike at The Dividend Guy blog. Please have a read of Should I Go With Dividend Growth Investing or ETFs. An Answer To Ben Felix. Of course many dividend and dividend growth investors will simply reference or pull out the Ned Davis research on S&P 500 constituents.

I like the evidence from the Dividend Aristocrats (NOBL) in the US and Canada (CDZ) that both have greater total returns compared to broad market funds through the last market cycle. There is a longer history of outperformance to observe in the US market with those Aristocrats that insist on at least 25 years of annual dividend increases. The threshold for a Canadian Aristocrat is 5 years of dividend increases.

All said, I will leave it to you to decide if dividends matter: to you. Given that nothing is more important than investor behaviour, if watching the dividends is a very useful distraction and those dividend payments allow you to stick to your plan, then they are more than worth the dollar value that shows up in your discount brokerage account.

And for the record I do think or know that the benefits of dividend growth investing do move beyond the emotional and behavioural and into the math and the types of companies that can be found by way of a meaningful dividend growth history. Even Ben Felix will admit that it can help us find certain types of companies and investment factors.

Canadian investors need help!

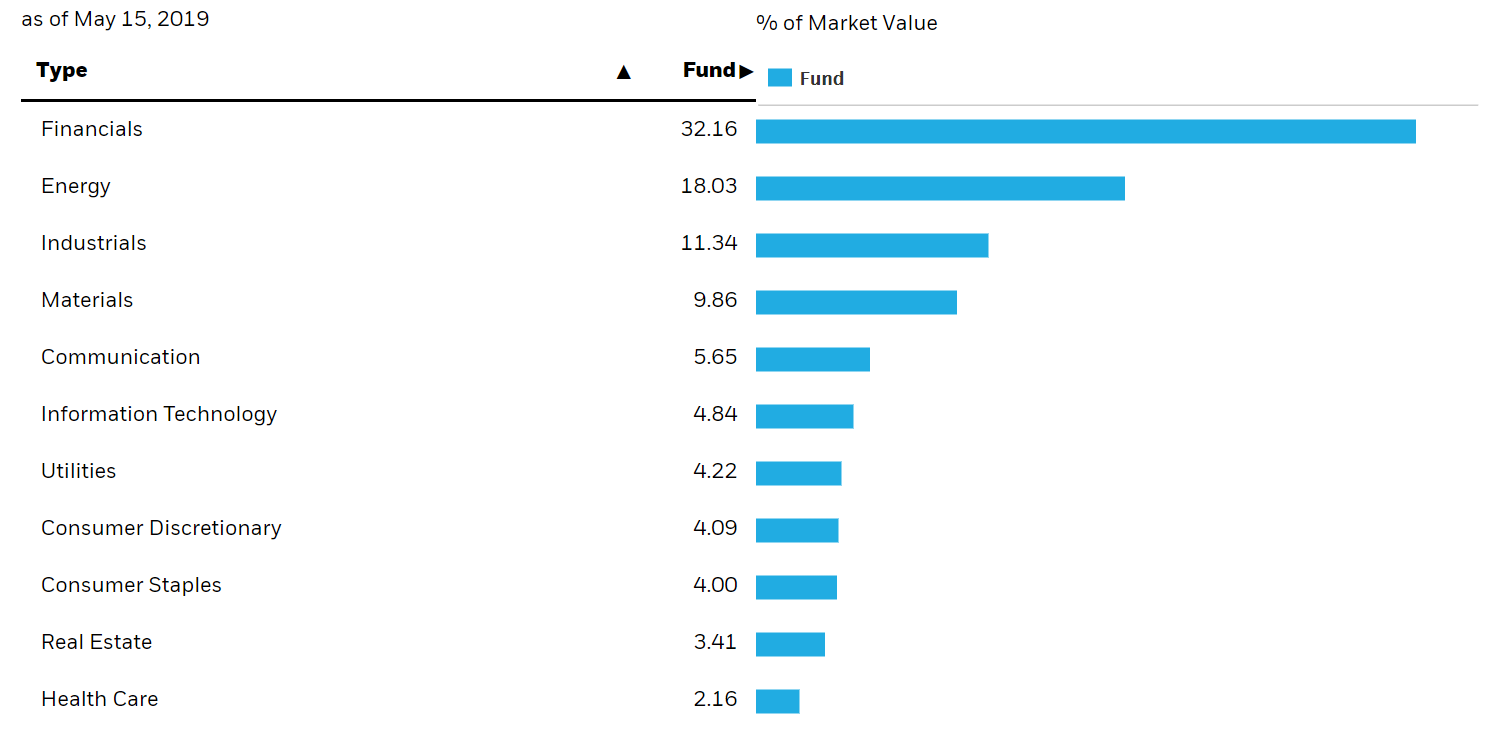

Let’s face it, the Canadian market is not well diversified. I would often state to clients that Canada makes for a terrible investment. The Canadian market is concentrated in financials and energy and commodity related sectors.

From iShares XIC, TSX capped composite.

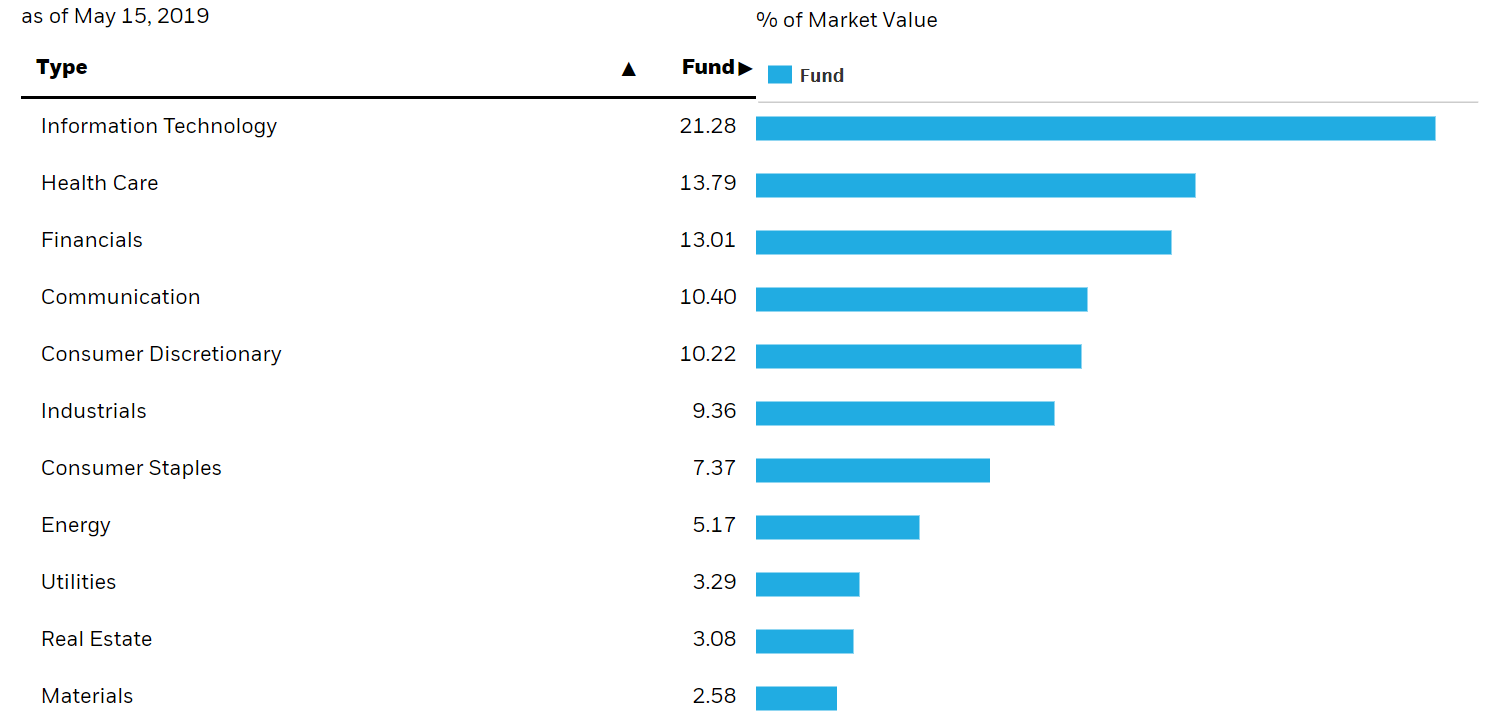

The Canadian investor needs the sector and geographic diversification offered by the US and perhaps International markets. Here’s the sector breakdown of the S&P 500, by way of iShares IVV.

The Canadian investor needs the sector and geographic diversification offered by the US and perhaps International markets. Here’s the sector breakdown of the S&P 500, by way of iShares IVV.

The basic principle of the need for added diversification holds true whether a Canadian investor embraces core index funds or dividend focused funds. How much you add by way of International exposure is certainly a personal decision. I am of the opinion that you might go light on that front given that the large and mega cap US companies earn a considerable percentage of their profits overseas. That said, in a recent CTCI investing post I suggested you might also look to developing markets where there is greater growth and growth potential.

The basic principle of the need for added diversification holds true whether a Canadian investor embraces core index funds or dividend focused funds. How much you add by way of International exposure is certainly a personal decision. I am of the opinion that you might go light on that front given that the large and mega cap US companies earn a considerable percentage of their profits overseas. That said, in a recent CTCI investing post I suggested you might also look to developing markets where there is greater growth and growth potential.

Canadian Dividend ETFs

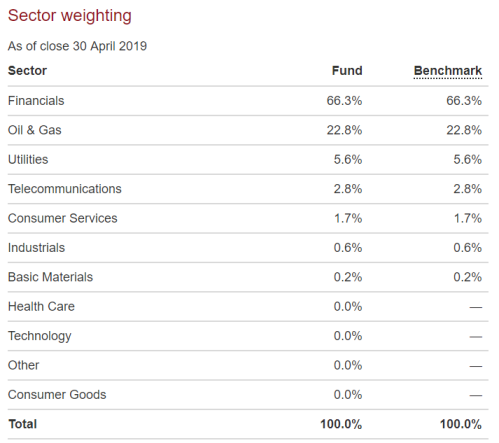

For my Canadian allocation in my personal RRSP account I hold a concentrated portfolio of individual bank stocks, plus pipelines and telcos. I do not expose my wife’s personal RRSP account to that concentration risk: we hold Vanguard’s High Dividend Yield ETF, ticker VDY. That is the core holding. Here is the sector breakdown for the VDY fund.

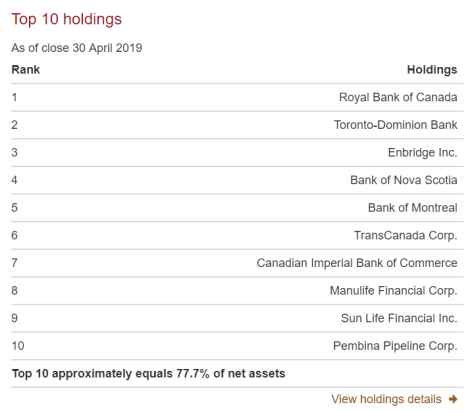

We are obviously increasing the concentration in the financial sector that will include the big Canadian banks and insurance companies, with the energy sector covered more by pipelines and utilities compared to energy producers that can be more cyclical and volatile. Here’s the top 10. It is certainly a concentrated fund.

We are obviously increasing the concentration in the financial sector that will include the big Canadian banks and insurance companies, with the energy sector covered more by pipelines and utilities compared to energy producers that can be more cyclical and volatile. Here’s the top 10. It is certainly a concentrated fund.

An investor who embraces the broad core index models will see this as concentration risk and lack of diversification. A dividend investor might argue the fund holds more of what works in Canada. The well-known Canadian dividend newsletter The Connolly Report (recently retired) had a long history of beating the markets by way of concentrating in dividend payers within those more wide moat oligopoly sectors. His market beat was to the tune of more than 4% annual. That is obviously significant.

An investor who embraces the broad core index models will see this as concentration risk and lack of diversification. A dividend investor might argue the fund holds more of what works in Canada. The well-known Canadian dividend newsletter The Connolly Report (recently retired) had a long history of beating the markets by way of concentrating in dividend payers within those more wide moat oligopoly sectors. His market beat was to the tune of more than 4% annual. That is obviously significant.

While the VDY inception date goes back to late 2012 and the period does not include a full market cycle the beat of VDY over XIC is just under 1% annual.

And of course dividend investors may be looking for (or looking at) that yield. The trailing yield for VDY is 3.92% compared to 2.83% for the TSX Composite. Retirees might like that yield boost for spending power. Other investors simply want control of more of those company profits. They can reinvest the dividends or move the dividends received to other assets as they please.

Of course, investors should always consider the tax consequences when the funds are within taxable accounts. While the dividends are qualified Canadian dividends and are eligible for the Canadian Dividend Tax Credit the juicier dividend is not always the most tax advantageous approach.

More Canadian Dividend ETF options

Here’s a great list and overview from Rob Carrick at the Globe and Mail. That article covers 11 of the most widely held ETFs. Not on that list is the iShares Core MSCI Canadian Quality Dividend Index ETF. Rob states that funds need to have a 5-year history before making his ETF overviews, but he’s keeping an eye on that fund.

Of course I have penned on that fund as that is the smart beta index approach used by the Tangerine Dividend Portfolio. One can use the Tangerine fund if they want a managed portfolio that offers exposure to Canadian (50%), US (25%) and International (25%) dividend payers. On Seeking Alpha I wrote Those Big Juicy Dividends Beat The Market In Canada, US and International.

For an overview and other dividend ETF lists you might have a read of Top Canadian Dividend ETFs for 2018 from Mark Seed at myownadvisor.

Canada for what works; US for diversification

The lack of sector diversification in Canada is not solved by holding a broad market index ETF. So one might embrace the dividend approach and hold more of ‘what works’ in Canada and take advantage of the unique oligopoly situations in Canada. That said, it’s just a personal choice; holding a traditional plain vanilla couch potato portfolio certainly does the trick. You’ll find those options at the top of the ETF Model Portfolio page.

Thanks for reading. I could say it’s good to be back in Toronto, but I certainly miss my daughter and the East Coast. We were recently in Halifax and PEI for our daughter’s graduation ceremonies. She earned a BSc in Chemistry with a minor in Biology, with distinction of course. We are so proud. She is now in Halifax preparing for grad studies.

Here’s a pic from our day trip to Peggy’s Cove. Take that Toronto.

Thanks for reading. Help spread the word, kindly hit those share buttons for Twitter, Facebook and LinkedIn. You can Follow Cut The Crap Investing at the very bottom of this page.

Thanks for reading. Help spread the word, kindly hit those share buttons for Twitter, Facebook and LinkedIn. You can Follow Cut The Crap Investing at the very bottom of this page.

Contact me, Dale @ cutthecrapinvesting@gmail.com or better yet, leave a message on this post.

Dale Roberts is the Chief Disruptor at cutthecrapinvesting.com. A former ad guy and investment advisor, Dale now helps Canadians say goodbye to paying some of the highest investment fees in the world. This blog originally appeared on Dale’s site on May 17, 2019 and is republished on the Hub with his permission.

Dale Roberts is the Chief Disruptor at cutthecrapinvesting.com. A former ad guy and investment advisor, Dale now helps Canadians say goodbye to paying some of the highest investment fees in the world. This blog originally appeared on Dale’s site on May 17, 2019 and is republished on the Hub with his permission.

The signup on your blog seems to be off. I tried entering two different personal emails, both were rejected and I was told to enter a “valid” email address. Huh?

Checking into this.

I have followed the dividend-only approach to Canadian investing for over 10 years. First with XDV and now all-in with XEI, which has a 0.22 MER. This is in a non-registered account. The yield is paid monthly and around 5%, which is a net of about 3.75 after tax. Nothing groundbreaking, but I plan to hold the ETF essentially forever and only collect the distributions over time in retirement as an income building block. Taxation will be close to 0% at my retirement income rate, which, including dividend growth should provide a fairly solid 5%. As long as I get my money at the end of the month, actual share price matters little. This is supplemented by a few individual dividend stocks, just to keep things interesting. I’ll just let the ETF provider rebalance over time and have no issue paying them 0.22 to do so.