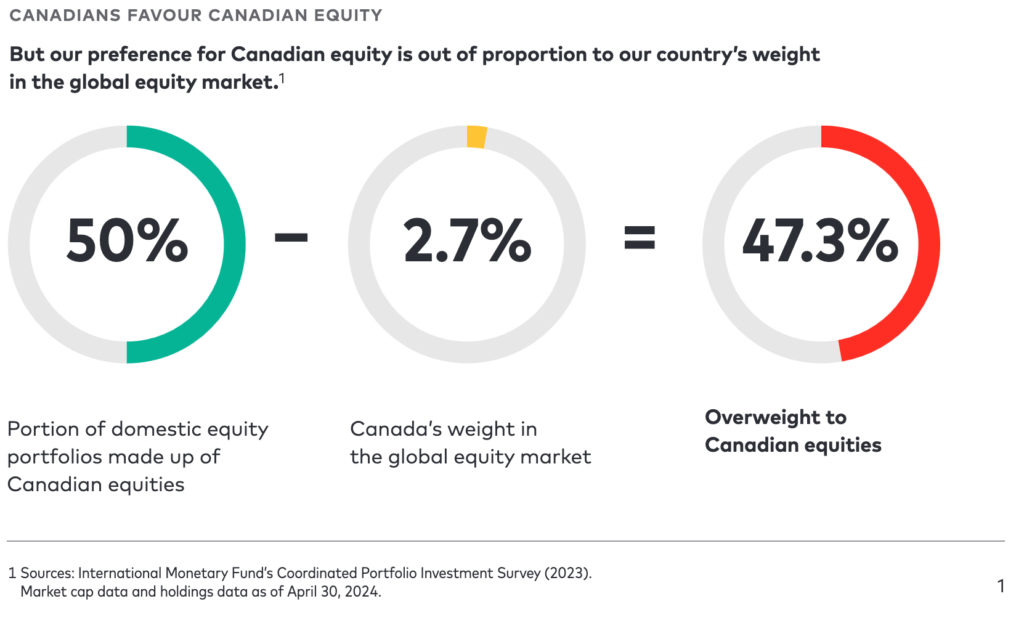

A just-released study from Vanguard Canada on Home Country Bias shows that Canadians have about 50% of their portfolios allocated to Canadian equities: well beyond what is recommended for a country that makes up less than 3% of the global stock market.

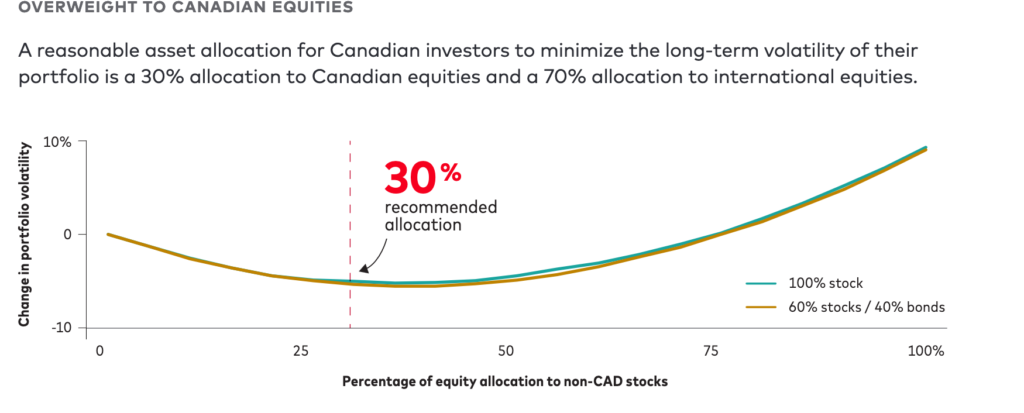

As the chart below shows, Vanguard recommends just 30% in Canadian stocks but notes that the domestic overweight is slowly decreasing as investors move to global and U.S. equities.

As the chart below shows, Vanguard recommends just 30% in Canadian stocks but notes that the domestic overweight is slowly decreasing as investors move to global and U.S. equities.

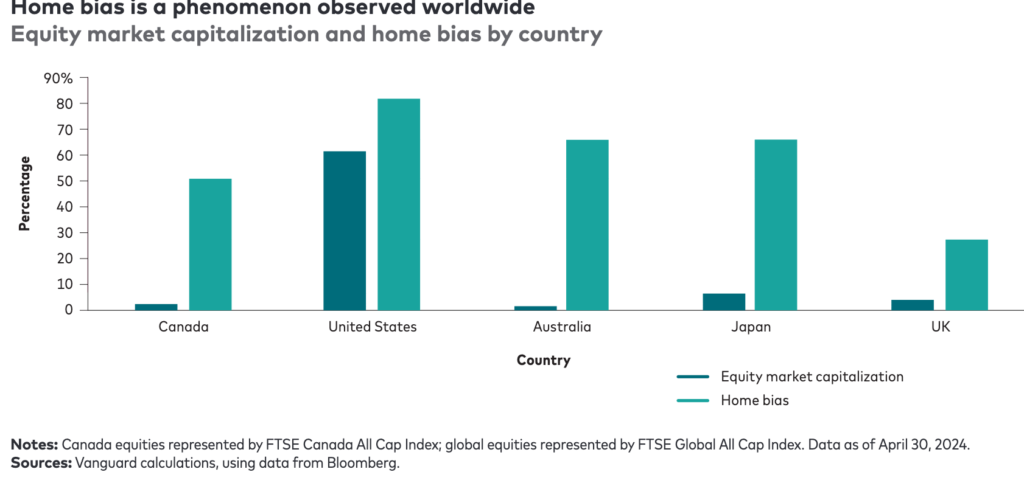

Vanguard says home country bias is not unique to Canada: Americans behave similarly with respect to the U.S. stock market. But as you can see from the chart below, because the U.S. makes up more than half of the global stock market by market capitalization, the gap between its relative overweighting is far less dramatic than in Canada. Canada’s home country bias is almost as pronounced as in Australia (a similar market to Canada in terms of resources and financial stocks), and Japan is not far behind.

However,Vanguard adds, “overall, Canadians and investors in other developed countries are trending towards a greater appetite for diversification through global equities.”

Too much Canada can be volatile

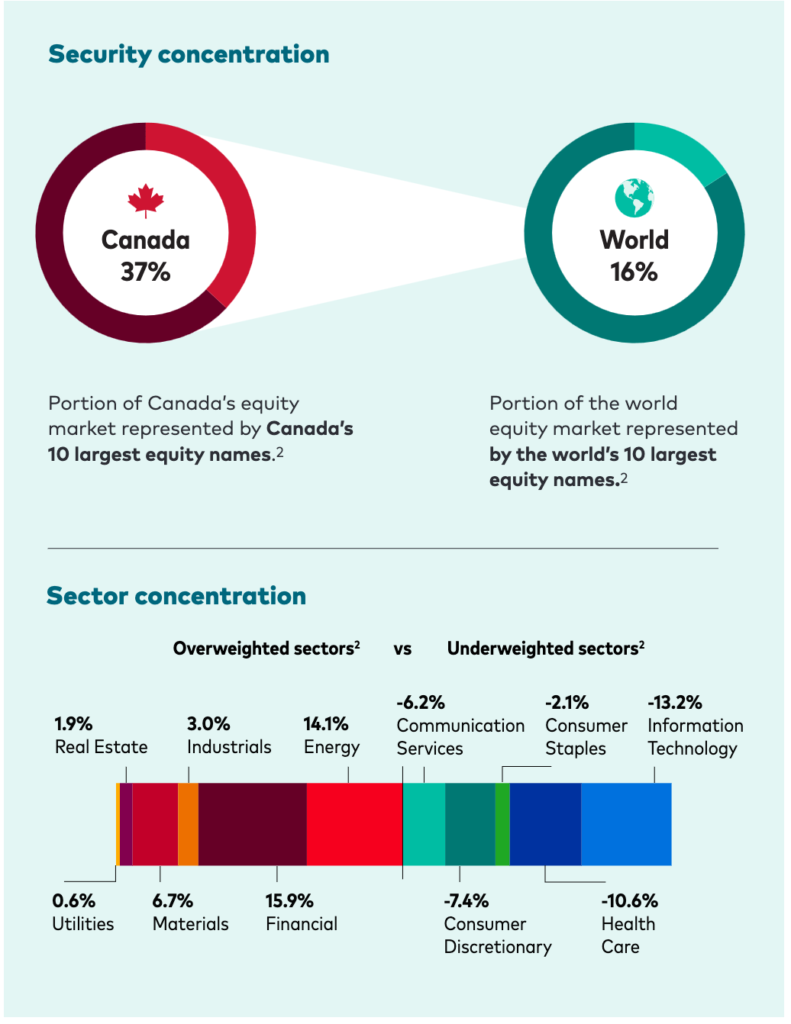

So what’s wrong with having too much Canadian content (both stocks and bonds)? Vanguard says portfolios overweight Canadian equity can be volatile because the domestic market is too concentrated in just a few economic sectors. “Relative to the global market, Canada’s market is concentrated within a few large names. It is also significantly overweight in the energy, financials and materials sectors, and significantly underweight in others.”

Because of this security and sector concentration, an all-Canada stock portfolio has “historically been more volatile than portfolios with international equity diversification. In fact, the Canadian stock market has historically been more volatile than the global market, but without a proportionate increase in return.”

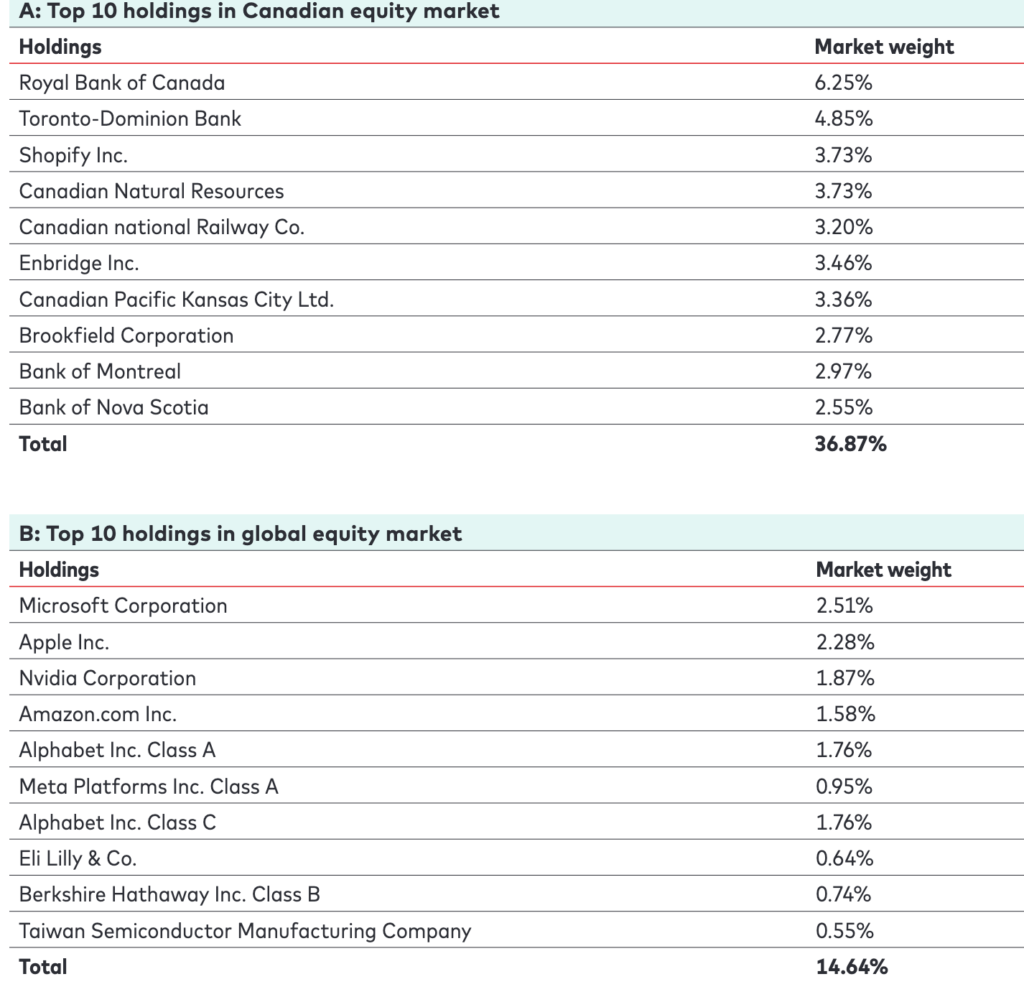

Top ten Canadian stocks hugely concentrated ownership versus Top ten global stocks

Just how overweight Canadians are to the top 10 domestic stocks relative to global ones is revealed in the chart below:

Vanguard says of the above chart that “It is evident that Canada exhibits a greater level of concentration compared to the global equity market. Specifically, the top 10 holdings in Canada constitute more than 38% of the index. Conversely, the top 10 global securities make up approximately 12% of the global market. This could contribute to idiosyncratic risk, a form of risk which is particular to investing in a certain geography or market and can be avoided with diversification. Idiosyncratic risk is risk which the investor is not compensated for taking.”

The Bottom Line

When it comes to the ideal long-term asset allocation for Canadian investors, “Vanguard believes 30% represent a reasonable tradeoff between the benefits of global diversification and the advantages Canadian residents derive from investing in Canadian securities.”

Typical propaganda from the sellers of mutual funds who think you generate income and wealth from a large number of over priced “popular” stocks without any regard to the operating margins, book values and dividend yields of the stocks. A self-directed investor making careful choices of individual stocks will generate much better results without the the funds fees and charges.