By Tony Porcheron

Special to the Financial Independence Hub

What everyone wants is for their money to grow without any risk. This is of course impossible, especially over a short time period.

Risk is usually measured by volatility, however risk and volatility are not exactly the same.

Risk for most investors is the chance that they lose money or do not meet their long term financial goals.

Volatility is the amount that your investments go up and down over a certain time period.

sigma is the usual definition of Volatility

Beta defines how much a return is based on an underlying index or other investment

Alpha is your return earned above your index and volatility.

This is the holy grail of investing.

What methods do professional investors use so that volatility does not turn into risk? Asset Allocation.

You may have heard the term, “Don’t put all of your eggs in one basket”, this is Asset Allocation.

In most investment research, 80 to 90% of your investment returns are from you asset allocation, not your individual investment picking. Given this fact, this is what you should be paying attention to more than picking your winning investments.

Asset Allocation is deciding on what percentage of your portfolio should go into asset classes. Generally this is broken up by:

- Asset Type (Equity, Fixed Income, Alternative)

- Size of the underlying company (Large, Mid and Small)

- Geographic Region (USA, Canada, Western Europe, Asia, Emerging Markets)

You then make the decision:

- Manager type (Index, Active, Hedge)

- What are your financial goals? How close are you to them? Are you contributing or withdrawing money?

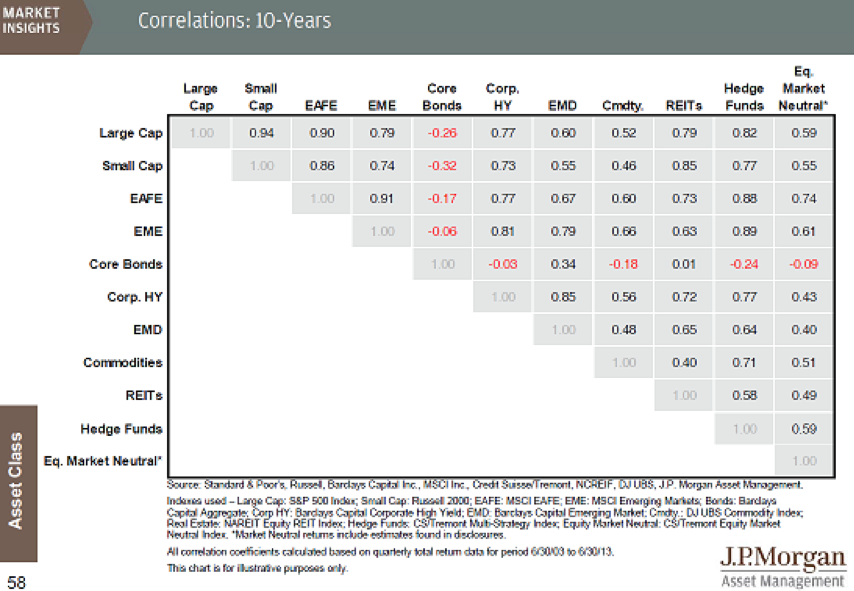

- What is the correlation between the different asset classes (how much do they go up and down together

The chart at the top of this blog shows a correlation analysis.

Strategic and Tactical Asset Allocation

The 2 main types of Asset Allocation are Strategic and Tactical. The adjustments to asset allocation are called rebalancing.

Strategic Asset Allocation is determining your asset allocation based on your long term investment return goals, volatility acceptance based on historical investment returns, volatility and correlation.

Tactical Asset Allocation is determining your investment mix based on your projections of the investment attributes for each asset class.

Rebalancing is the adjustment of your investment mix back to the initial allocation based on how each of your investments have performed. Most managers will readjust every 3 months or when one asset class is 5 to 10% more of the total portfolio then the initial set up.

When Equities are performing extremely well, you would be forced to sell and purchase more fixed income and other asset classes. When Equities are performing extremely poorly, you would be purchasing more equities. Rebalancing long term has proven to limit your investment risk which is losing money and not achieving your goals.

Asset Allocation may not be as discussed in the mainstream investment media, but it is the most important item that institutional investor spend their time on to achieve their investment goals.

Tony Porcheron is Managing Director Global Products and Strategy at OTP Bank Group. OTP is one of the largest independent financial services providers in Central and Eastern Europe, with a full range of banking services for private individuals and corporate clients. OTP Group comprises large subsidiaries, granting services in the field of insurance, real estate, factoring, leasing and asset management, investment and pension funds.

Tony Porcheron is Managing Director Global Products and Strategy at OTP Bank Group. OTP is one of the largest independent financial services providers in Central and Eastern Europe, with a full range of banking services for private individuals and corporate clients. OTP Group comprises large subsidiaries, granting services in the field of insurance, real estate, factoring, leasing and asset management, investment and pension funds.

The bank serves clients in 9 countries and has more than 36,000 employees serving 13 million clients in over 1,500 branches and through electronic channels on all the markets of the bank. OTP is the largest commercial bank in Hungary with over 25% market share. South and Eastern Europe is a Growing Stable region, partially part of Eurozone. OTP is expanding its asset management business globally and will be launching new investment products in 2019 and providing access to their existing funds.