I get a lot of questions from family and friends about investing. In most cases, these people see the investment world as dark and scary; no matter what advice they get, they’re likely to ask “Is it safe?” They are looking for an easy and safe way to invest their money. These people are often easy targets for high-cost, zero-advice financial companies with their own sales force (called advisors), such as the big banks and certain large companies with offices in many strip malls. An advisor just has to tell these potential clients that everything will be alright and they’ll be relieved to hand their money over.

A subset of inexperienced investors could properly handle investing in an all-in-one Exchange-Traded Fund (ETF) if they learned a few basic things. This article is my attempt to put these things together in one place.

Index Investing

Most people have heard of one or more of the Dow, S&P 500, or the TSX. These are called indexes. They are a measure of the price level of a set of stocks. So, when we hear that the Dow or TSX was up 100 points today, that means that the average price level of the stocks that make up the index was up.

It’s possible to invest in funds that hold all the stocks in an index. In fact, there are funds that hold almost all the stocks in the whole world. There are other funds that hold all the bonds in an index. There are even funds that hold all the stocks and all the bonds. These are called all-in-one funds.

Most people know they know little about picking stocks. They hear others confidently talking about Shopify, Google, and Apple, but it all sounds mysterious and scary. I can dispel the mystery part. Nobody knows what will happen to individual stocks. Bold claims about the future of a stock are about as reliable as books about future lottery numbers. However, the scary part is real. If you own just one stock or a few stocks, you can lose a lot of money.

When you own all the stocks and all the bonds, it’s called index investing. This approach to investing has a number of advantages.

Investment Analysis

Investors who pick their own stocks need to pore over business information constantly to pick their stocks and then stay on top of information to see whether they ought to sell them. When you own all the stocks and all the bonds, there’s nothing to analyze or track on a frequent basis.

Risk

Owning individual stocks is risky. Any one stock can go to zero. Owning all stocks has its risks as well, but this risk is reduced. The collective stocks of the whole world go up and down, occasionally down by a lot, but they have always recovered. We can’t predict when they’ll drop, so timing the market isn’t possible to do reliably. It’s best to invest money you won’t need for several years and not worry about the market’s ups and downs.

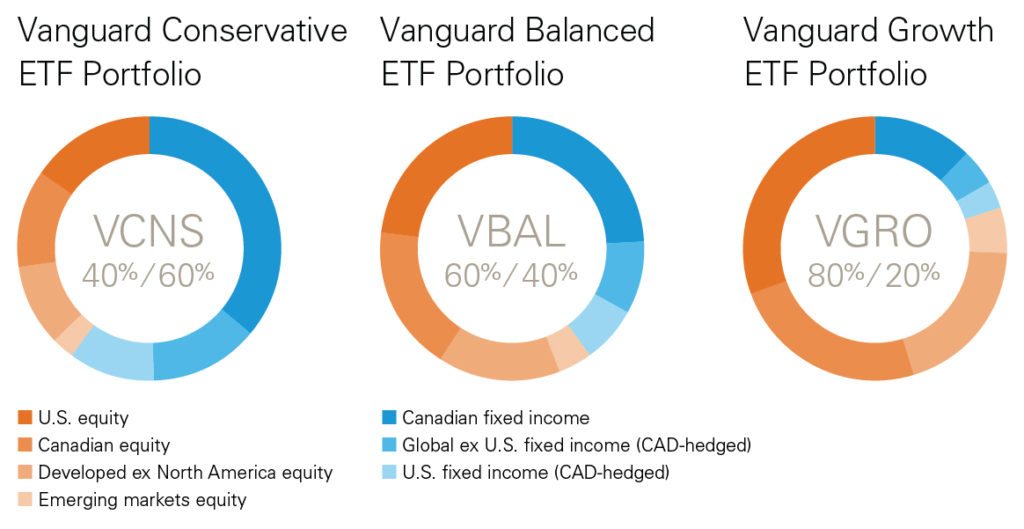

| ETF Symbol | Stock/Bond % |

|---|---|

| VEQT | 100/0 |

| VGRO | 80/20 |

| VBAL | 60/40 |

| VCNS | 40/60 |

| VCIP | 20/80 |

Cost

Sadly, many unsophisticated investors who work with financial advisors don’t understand that they pay substantial fees. These investors typically own mutual funds, and the advisor and fund company help themselves to investor money within these funds. There is no such thing as an advisor who isn’t paid from investor funds.

It’s common for mutual fund investors to pay annual fees of 2.2% or higher. This may not sound like much, but this isn’t a fee on your gains; it’s a fee on your whole holdings, and it’s charged every year. Over 25 years, an annual 2.2% fee builds to consume 42% of your savings. This is so bad that many people simply can’t believe it.

With Vanguard’s all-in-one ETFs, the annual costs are about 0.25%, which builds to only 6% over 25 years. Giving up 6 cents on each of your hard-earned dollars may not seem great, but it’s a far cry from 42 cents on the dollar.

Closet Index Funds

Can’t we just find a mutual fund run by a smart guy who can do better than index investing? Sadly, no, we can’t. Every year, experts analyze mutual fund results, and every year, they come up with the same answer: most mutual funds do worse than index investing. A few do better for a while, but sooner or later, they stumble and fall behind index investing. They simply can’t overcome their high fees for long. We can’t predict in advance which funds will beat the index in a given year, so jumping from fund to fund is a losing game.

But things get worse. A great many mutual funds aren’t even trying to do better than index investing. They are called closet index funds. They hold portfolios that look a lot like the indexes, but charge high fees anyway. They focus more on selling their funds to investors than they focus on investment performance. They hope their investors don’t notice that they’re not really doing much.

Canadians who invest at big bank branches and strip mall offices of big investment companies typically own closet index funds. If you take the trouble to look through the holdings of their mutual funds, you see a set of stocks and bonds that isn’t much different from Vanguard’s all-in-one ETFs. The difference is the cost.

Fear, Uncertainty, and Doubt

If index investing is so superior to the typical mutual fund, why doesn’t everyone switch to indexing? The answer is that there are many people who make their living from the high-fee model. Their salaries depend on extracting high fees from your savings.

Most advisors in big bank branches and in the strip mall offices of big retail investment companies have a list of talking points to scare people away from index investing. But the truth is that the only scary thing about indexing is the threat to their salaries.

Going on your Own

If you chose to invest in Vanguard Canada’s VBAL, which is 60% stocks and 40% bonds, you’re probably going to own close to the same stocks and bonds an advisor at a bank branch or strip mall would recommend. The differences are that lower fees would leave you with higher returns, but you’d have to open your own investment accounts and make some trades on your own instead of having an advisor tell you everything will be fine.

So, this would involve choosing a discount broker, opening an RRSP and a TFSA and possibly other accounts, adding some money, and performing trades to buy an all-in-one ETF with money you won’t need for several years. It’s best not to invest in stocks with money you may need soon, such as an emergency fund.

Handling your own savings this way can be scary at first, and it isn’t for everyone. The main challenges are getting started with making trades with large sums of money, avoiding selling out when the stock market goes down and you’re nervous, and avoiding changing your plan when something enticing comes along like day-trading, stock options, or cryptocurrencies.

Making the Switch

Getting started with investing on your own using all-in-one ETFs is easier for the beginning investor than it is for someone already working with an advisor. The good news is that you don’t have to make the switch by talking to your advisor. The process begins with opening new accounts at a discount brokerage and filling out forms to move your money from the accounts controlled by your advisor. Your advisor is likely to notice and might try to talk you out of it, but you’re not obligated to work with your advisor when making the switch.

One approach that might make the process easier is to open new discount brokerage accounts and only add small amounts of money first. After you’re more comfortable with trading and everything else at the discount brokerage, you can then fill out the paperwork to transfer the rest of your assets over to the new accounts.

Not for Everyone

Investing on your own isn’t for everyone. However, all-in-one ETFs make it as easy as it can be to invest on your own. As long as you can avoid the mistakes that come with fear and greed, you stand to save substantial investment fees over the decades.

Michael J. Wiener runs the web site Michael James on Money, where he looks for the right answers to personal finance and investing questions. He’s retired from work as a “math guy in high tech” and has been running his website since 2007. He’s a former mutual fund investor, former stock picker, now index investor. This blog originally appeared on his site on June 9, 2022 and is republished on the Hub with his permission.

Michael J. Wiener runs the web site Michael James on Money, where he looks for the right answers to personal finance and investing questions. He’s retired from work as a “math guy in high tech” and has been running his website since 2007. He’s a former mutual fund investor, former stock picker, now index investor. This blog originally appeared on his site on June 9, 2022 and is republished on the Hub with his permission.