When should you take your Canada Pension Plan (CPP) benefits? Like many personal finance decisions, the answer depends on your unique circumstances. In general, it makes sense to defer taking CPP until age 70. The caveat is that you need to have other resources to draw from while you wait for your CPP benefits to kick in. After all, who wants to delay spending in their “go-go” retirement years just to shore up their income in their 70s and beyond?

I’ve written before about when it makes sense to take CPP at age 60, why taking CPP at age 65 is never the optimal decision, and why taking CPP at age 70 can lead to $100,000 or more lifetime income.

But one question I often receive from readers and clients is when should early retirees take CPP? Here’s a reader named Keith, who decided to retire at the end of last year at age 60:

“My understanding is that since I won’t earn any income from now to 65, those five years will add to the CPP average calculation and potentially lower my eligible monthly amounts. If that’s the case, should I apply for CPP right away, or choose to defer it to 65 or 70? If I apply today, will those five years of zero income still be included in the average CPP calculation?”

It’s a great question. CPP is a contributory program based on how much you contributed (relative to the yearly maximum pensionable earnings) and how many years you contributed between ages 18 to 65.

To receive the maximum CPP benefit at age 65 you would need 39 years of maximum contributions. You can drop out your eight lowest years (more if you are eligible for the child rearing drop-out provision) from the calculation.

Related: How Much Will You Get From Canada Pension Plan?

You can see the problem for early retirees. They’re going to have more “zero” contribution years, which will reduce the amount of their CPP benefits.

Not so fast.

You will always get more CPP by waiting, even if you’re not working.

CPP expert Doug Runchey says that your “calculated (age-65) retirement pension” may decrease if you’re not working between age 60 and 65, but the age-adjustment factor will always make up for that decrease, and then some.

“In that situation I use the expression that you will receive a larger piece of a smaller pie if you wait, but you will always get more pie,” he said.

CPP checklist for early retirees

Here’s what to do if you’re in the early retirement camp and want to know when to take your CPP benefits. Log into your My Service Canada Account online and click on “Canada Pension Plan / Old Age Security.”

Scroll down to the “contributions” section and click on “Estimated Monthly CPP Benefits.”

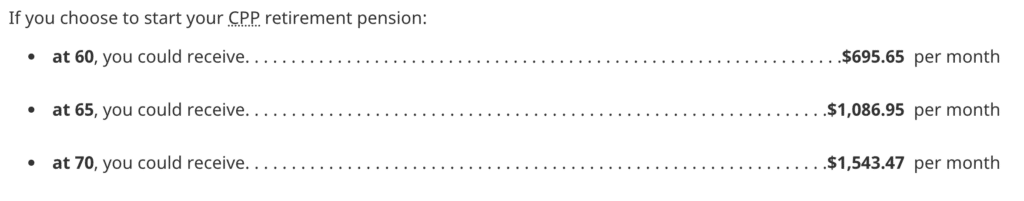

You’ll see your expected CPP benefits at age 60, age 65, and age 70.

Now take that calculation and throw it in the garbage because it’s completely useless. That’s right. The CPP estimates you see here assume that you continue contributing at the same rate until age 65. That’s problematic if you plan to retire at age 58 or 60 and will no longer be contributing to CPP.

Go back to the previous screen and click on your CPP contributions. There you will find a web version* of your Statement of Contributions – a history of your contributions dating back to age 18. Right click on this page and “save as” (format: webpage, HTML only).

*Note you can request a copy of your Statement of Contributions in the mail, but you won’t need that for the next step.

Now visit www.cppcalculator.com and sign up for the website with your first name and email address. You’ll receive a confirmation email from the site founder David Field (co-created by Doug Runchey) to activate your account, followed by another email to login to the site and run your own unique CPP calculation.

Upload the statement of contributions that you saved earlier (or manually enter your pensionable earnings year-by-year). The beauty of the CPP Calculator website is that it allows you to manually enter future years, including future “zero” years if you plan to retire early.

I ran this calculation for myself because, as of right now, I am paying myself dividends from our corporation and not making CPP contributions (it’s a decision I continue to wrestle with, as I’d have to switch from dividends to salary and then pay both the employer and employee portion of CPP each year).

The estimate I shared above from My Service Canada is my own estimate based on 15 years of max contributions, plus another eight years of lower-than-max contributions. I did not contribute to CPP in 2020 or 2021, but it looks like Service Canada assumes I will continue making contributions until age 65.

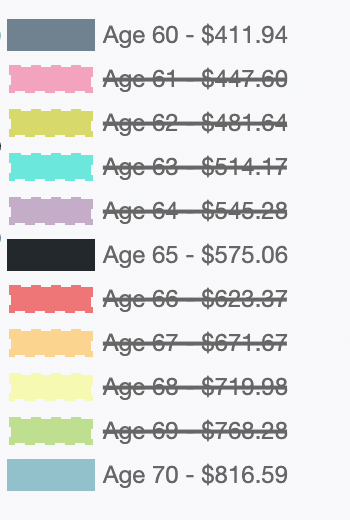

When I ran the numbers in CPP Calculator I assumed no more contributions to CPP from age 43 to 65. Look at the difference that makes for my CPP at ages 60, 65, and 70:

Instead of receiving $1,086.95 per month at age 65, I should only expect to receive $575.06 per month. That’s about $125 per month less than what the average new CPP recipient will receive in 2022. In other words, it’s a huge difference.

Final Thoughts

When should early retirees take CPP? There’s no definitive answer, but having the right data will help inform your decision.

The My Service Canada estimator assumes you work until 65. Use the CPP Calculator website and manually enter “zero” years if you plan to retire earlier than 65. That will give you a more accurate estimate of your CPP benefits.

Remember that you will always get more CPP by waiting, even if you retire early. Your calculated age-65 CPP benefit may decrease, but that will be more than offset by the age-adjustment factor or deferral credit (7.2% per year from 60 to 65, and 8.4% per year from 65 to 70).

Disclaimer: If at any time you stopped work to raise kids or recover from a disability, or you have been widowed, divorced or separated then the CPP Calculator will not provide you with an accurate calculation. It is recommended that you have your benefit amount manually calculated by Canada Pension Plan expert Doug Runchey, who charges a nominal fee but guarantees the accuracy of your estimate.

In addition to running the Boomer & Echo website, Robb Engen is a fee-only financial planner. This article originally ran on his site on Sept. 5, 2022 and is republished here with his permission.

In addition to running the Boomer & Echo website, Robb Engen is a fee-only financial planner. This article originally ran on his site on Sept. 5, 2022 and is republished here with his permission.