By Dale Roberts, CuttheCrapInvesting

Special to the Financial Independence Hub

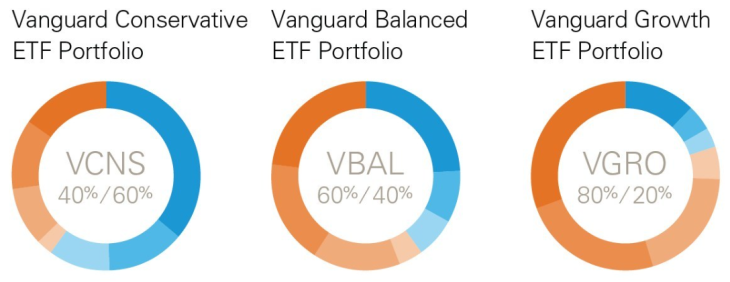

In February 2018 Vanguard Canada changed the investment game in Canada with the launch of complete Balanced Portfolios that you can purchase by entering one ticker symbol. For example, once logged into your discount brokerage account you would enter the symbol VBAL, and press buy to get a complete globally diversified Balanced Portfolio. The Portfolio is 60% Canadian, US and International stocks with 40% of those shock absorbers known as bonds.

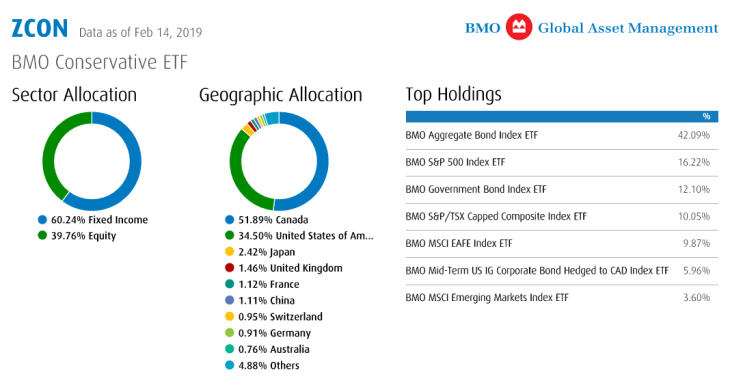

Vanguard offers One-ticket Portfolios at five different risk levels. With an MER of .22% these portfolios are a game changer. (In the pie charts below, Orange shows equities and blue fixed income percentages).

iShares has also had One-ticket solutions available for several years. The asset allocation was ‘weird’ and the fees were not that low. considering the low fees on the underlying ETF assets. In response to Vanguard, iShares recently took the scrub brush to the funds, cleaned up the asset allocations and then cut the fees. In fact they undercut Vanguard just slightly with an MER of .20%. Here’s the link to the iShares product page; this will take you to XBAL, their Balanced Portfolio.

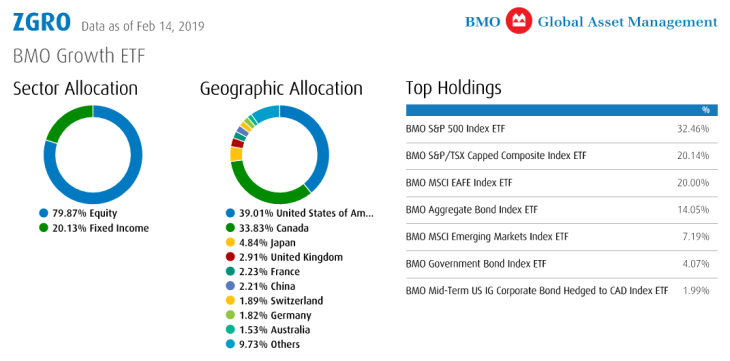

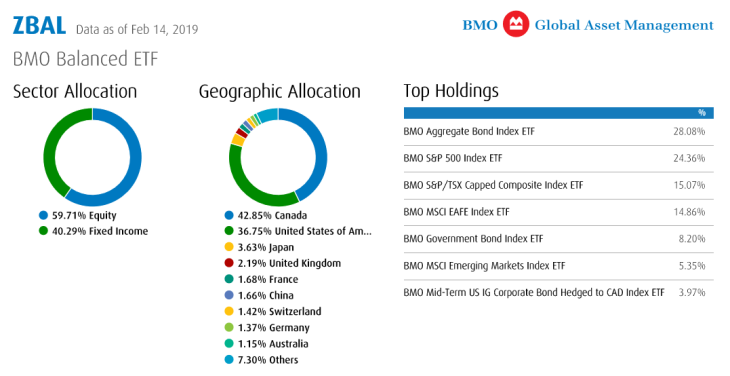

And then last week along comes one of the big banks with their own One-ticket offering. Here’s my review at the Hub: BMO keeps it simple with its One-ticket Portfolio Solutions.

The one-ticket solutions are the most cost-effective managed portfolios available in Canada. This should be the final dagger in the heart of the high fee mutual fund industry.

The one-ticket solutions are the most cost-effective managed portfolios available in Canada. This should be the final dagger in the heart of the high fee mutual fund industry.

Which One-ticket provider is best?

Let’s call it a draw. The portfolios are equally great. They include the basic and sensible asset allocation building blocks of Canadian, US and International stocks supported by a bond component. All the One-ticket providers use Canadian and foreign bonds to manage the risks.

How to select the right portfolio

Nothing is more important than investing within our risk tolerance level. We could argue it is the most important ‘part of it all.’ The Portfolios do not come with an owner’s manual for when and how to use them. Matching the appropriate portfolio to your risk tolerance level, time horizon and objective is key.

We have to invest within our risk tolerance level; bad things happen when we invest outside of our comfort level – usually permanent losses. We must be comfortable with the percentage and dollar value that the portfolio could decline.

Are you comfortable with a portfolio that could decline by 5% in a major correction, 10%, 20%, 30%, 40% or 50%?

Remember those bonds work like shock absorbers to soften the blow and smooth out the ride during periods when the stock markets tank. And tank they can; Canadian and US and International markets have declined by some 50% or more twice in the last 20 years.

US markets were negative 3 years in a row from 2000-2002. Most of us can remember (and perhaps still feel) the major correction that occurred in 2008-2009 when US, Canadian and International stocks offered the steepest declines since The Great Depression of the 1920s.

Here’s an example of those shock absorbers at work. Courtesy of portfoliovisualizer.com here’s a look at an all-stock portfolio vs a 50/50 stock to bond portfolio. Dividends are reinvested. The portfolios are rebalanced on an annual schedule.

Portfolio 1 is all stocks – Canada, US and International.

Portfolio 2 is 50% stocks and 50% Canadian bonds.

The stock portfolio fell by some 50%. The conservative portfolio was down by some 24%. We see that by the end of 2011 the more conservative portfolio is already in positive territory while the all-stock portfolio is still under water.

The portfolio recovery period is important, your time horizon is important. That’s why we don’t invest shorter term monies in all-stock or stock-heavy portfolios.

You need a 4-5 year time horizon to even consider investing

Yup. If you have monies that you need in 3 years or less, off to the bank you go for a high interest savings account or GICs.

You might invest in Conservative and Balanced Portfolios if you have a time horizon of 4-5 years or more and can check that box for risk tolerance level.

Vanguard Portfolios – VCIP, VCNS and VBAL

iShares – XBAL

BMO – XCON and XBAL

We’ll use the Vanguard Portfolios to demonstrate the potential declines of the more Conservative Portfolios.

- VCIP – potential decline of 5-10%

- VCNS – potential decline of 10-20%

- VBAL – potential decline of 15%, 20%, 30%

Growth-oriented portfolios

Stock-heavy portfolios take much longer to recover after a major market correction. In fact, it could take several years for a Balanced Growth or All-Equity Portfolio to get back to square after a major correction. You should have at least 6-9 years or more to invest in a portfolio that is 70%, 80%, 90% or 100% in stocks. Personally I would only invest in an All-Equity Portfolio if I had a time horizon of 10 years or more.

Of course, there’s no guarantee that you’ll make money in these funds over a 6-9 year period. But market history suggests that if you invest in a sensible well-balanced portfolio and keep your fees low, there’s a high probability of positive returns.

Time Horizon of 6-9 Years or More

Once again you would need to have a High Risk Tolerance Level to invest in these Growth Portfolios. You would have to be able to withstand a 30-50% portfolio decline.

Keep in mind these are general frameworks or guidelines based on market history. As my friends in compliance like to write, past performance does not guarantee future returns – or future performance characteristics.

You might use these Portfolio Selector tools

Check out the Personal Portfolio Selector Tool with Tangerine Investments. There you will input details on your risk tolerance level, your objective and your time horizon. You will be offered a portfolio recommendation displaying the stock to bond allocation. You could use that as a guideline for selecting the appropriate One Ticket Portfolio.

Keep in mind that the Tangerine Portfolios are also simple index-based Portfolios and might be a great solution for you if you do not want to self-direct at a discount brokerage. The MER on the portfolios is 1.07%. You might also consider one of the Canadian Robo Advisors. If you have taxable monies and a more complicated scenario you might even consider getting more robust advice by way of a fee-for-service financial advisor.

You can also use the Asset Allocation (Portfolio Selector) tool at Vanguard US. Once again, the keys will be to match the Portfolio to your time horizon, your objective and risk tolerance level.

Please ensure that you know what you’re doing before you self-direct. If you don’t know what you’re going, don’t do it.

Questions? Send ‘em to cutthecrapinvesting@gmail.com

Thanks Jon. Again, happy to answer any questions for readers. If I don’t know the answer I’ll find someone much smarter than me, ha That’s usually the way it works.

Excellent overview of these great new product choices.