By Sean Cooper

Special to the Financial Independence Hub

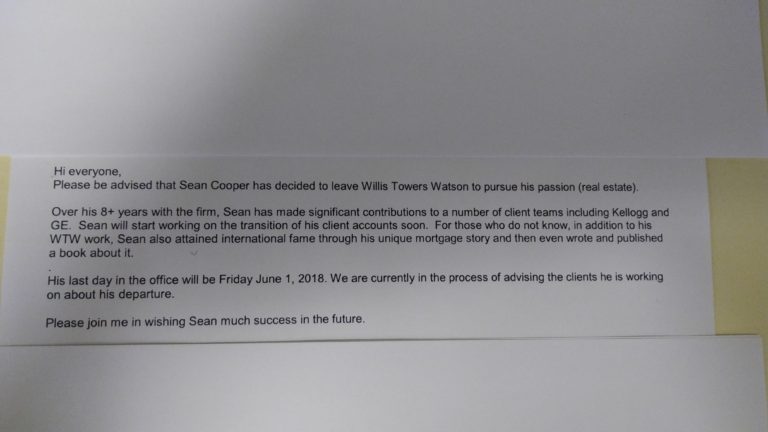

If you follow me on Instagram, you may have already heard the big news. After 8 years, I’m quitting my full-time job at the pension consulting firm. I gave my employer plenty of notice. I handed in my resignation 2 months ahead of time. June 1st will be my last day in the office. To celebrate this big career milestone, I’ve booked a weeklong trip to New York City and Boston.

I always planned to quit my full-time job. I just didn’t think it would happen so soon. I’m at a crossroads in my life. I’m 33 years old and not getting any younger. It’s time to make some tough “adult” decisions. I can either take the easy road and keep working for a company where I’m comfortable, or take the hard road and become a full-time entrepreneur. I chose the latter.

Keeping a promise to myself

A promise I made to myself after I burned my mortgage in September 2015 is that I’d slow down and get a better work-life balance. Unfortunately, that just wasn’t happening.

I’m someone who’s super ambitious. So, 6 weeks after burning my mortgage papers, I started writing a book. With the success of my book and speaking career, I’m finding myself busier than ever. I’m probably working harder now than when I was paying down my mortgage (no joke).

I’m still putting in the 80+ hour workweeks, waking up at 6:30AM and working until midnight or 1AM most days – and for what? I’m mortgage-free. I don’t have to work this many hours, but the problem is I love what I do. I enjoy my side hustle as a personal finance journalist, money coach and speaker more than my full-time job. I couldn’t keep working at this insane pace forever. I was tired all the time. Something had to give.

So with mixed emotions, in early April I made the difficult decision of choosing my budding career as a personal finance expert over my full-time career. It wasn’t an easy choice, but I was ready to make the jump.

Taking a risk

This was probably the most difficult decision I’ve ever had to make. It wasn’t easy to walk away from a steady, full-time job with benefits and a defined benefit pension plan. It was especially difficult for someone as risk adverse as me (I did after all pay off my mortgage in record timing in 3 years).

When I shared the big news with those closest to me – friends, family and coworkers – I didn’t know what to expect. Thankfully everyone has been supportive of my decision. Saying goodbye to my coworkers will be especially tough. My coworkers are like family to me. They were there when I burned my mortgage and launched my book.

It’s going to take me a while to get up and running. Luckily I have time and money. My house is paid off. I also (still) rent out the main floor of my house. The rental income alone can support me. I also have savings to last me for the years to come.

From a personal standpoint, it helps that things are less complicated. I’m single (I’m half joking when I say I’m still looking for a frugal girlfriend). I don’t have a spouse or children to look after. (Although this is a double-edged sword since I don’t have a spouse’s income to rely on either.) I’d probably hesitate to do the same thing if my circumstances were different and I was married with children.

You’ll never get rich working for someone else

I’m of the strong belief that you’ll never get rich working for someone else. You have to be willing to take risks, otherwise it can really hold you back.

I came to the point in my career where I just couldn’t go into the office, punch in and work on someone else’s time anymore. If I’m going to work hard, I’d rather work hard for myself and reap the rewards. I know it isn’t going to be easy, but I’m after 8 years at the same company, I’m up for this new, exciting challenge.

I want to strike while the iron is hot. My biggest fear is that my mortgage burning story will be forgotten. I want to take advantage of the personal brand I’ve worked so hard to build. I don’t want to live a life of regrets and look back years later and regret not taking a chance.

As silly as it may seem, my goal is to one day be a Dragon on Dragon’s Den. That’s not going to happen if I stay comfortable in my 9 to 5 gig. Life is short. Sometimes you have to be willing to take risks and go for the brass ring. I felt like I wasn’t living up to my true potential and that’s why I had to make a change.

My sister Laura Cooper is the perfect example of how risk taking can pay off. A couple years ago she left her steady, full-time job as a receptionist at a real estate brokerage to get licensed as a real estate agent. Now she’s a super successful real estate agent. This would have never happened if she wasn’t willing to take a leap of faith and leave her full-time job.

Travelling more

When I achieved financial freedom, my goal was to make travelling more of a priority. It’s been almost 3 years since I paid off my mortgage. While I’ve been to San Francisco and Western Canada, I still haven’t travelled as much as I would have liked to. I’ve really wanted travel to Europe, but it’s been too tough with my busy schedule. 3 weeks’ vacation simply wasn’t enough. While I enjoy public speaking, I found I was using most of my vacation time to speak without taking a real vacation.

That’s going to change going forward. I’m planning to go to Europe in the coming months and eventually Australia. Since I’ll be able to set my own work schedule, I won’t be limited by a lack of vacation time at work. I’ll be able to travel when I want and where I want. Since most of my work can be done remotely, I can travel and work at the same time.

Getting to know myself better

During my journey from first-time homebuyer to mortgage-free homeowner, I got to know myself a lot better.

I’ve realized that I’ve changed a lot of as a person. I’m no longer the quiet, shy person I once was. I’m not afraid to pick up the phone ask and ask for what I want. I no longer have a fear of rejection.

I’m someone who’s happy no spending a lot of money. Besides travelling more, I largely live the same as when I was paying off my mortgage (although I do splurge on occasions and buy the Kraft Dinner with white cheddar, but I digress).

I’m also a self-starter. Through goal setting and hard work, I was able to pay off my mortgage in 3 years – less time than it takes to graduate from high school. Being an entrepreneur isn’t easy. You’re your own boss. It’s up to you to win clients, build your book of business and get work done. Some people are cut out to be self-employed, others aren’t. I strongly believe that I’m up to task.

Growing my side hustle

As I embark on my new journey as an entrepreneur, I have a newfound sense of excitement.

Besides travelling a lot more, something else I’m looking forward to doing is growing my personal brand. I found it tough to grow my brand while working within the confines of a 9 to 5 work schedule. I missed out on a lot of opportunities because I simply didn’t have the time to make phone calls or attend meetings during the day. This will no longer be a problem. Now the sky’s the limit!

I’m a strong believer in developing different streams of income. I’ve been able to build a successful career as a personal finance journalist, speaker and money coach, all while working a full-time job. I’m taking a temporary pay cut to put my full focus behind growing my side hustle to be even more successful.

I’m not someone who is satisfied with being mediocre or the status quo. I have some ambitious plans for my first year as an entrepreneur.

I’m currently accepting freelance writing gigs. If you’re a financial planner, real estate agent or mortgage broker looking for ghostwriting services, or you’re looking for an experienced journalist to join your roster, don’t hesitate to reach out.

Transferring out your pension is a major financial decision. If you could use an unbiased second opinion on your defined benefit pension plan, feel free to reach out and take advantage of my pension consulting services.

I also plan to do a lot more media appearances going forward. I have some other plans in the works, but those remain top secret for the time being.

It’s only upwards and onwards for me. Thank you for your support over the years. I look forward to making the most of this newfound opportunity. of the new book, Burn Your Mortgage: The Simple, Powerful Path to Financial Freedom for Canadians, available at Amazon, Indigo and major bookstores.

Sean Cooper is a personal finance journalist, speaker, pension consultant and money coach. He is the author of the new book, Burn Your Mortgage, available at Amazon, Chapters, Indigo and major bookstores. This blog first appeared on his website and is republished here with his permission.