By Billy and Akaisha Kaderli

Special to the Financial Independence Hub

We decided to take Social Security at age 62. We know there are as many ways to consider this decision as there are days in a year. And many experts advise against taking social security “early” so that you get a bigger check at full retirement age. It is hard to argue against that.

We have always lived an unconventional lifestyle and the fact that so many experts agree on waiting for payment gives us pause for thought. Here is our logic.

First, the S&P 500 index has averaged over 8% per year, plus dividends, since we retired in 1991. If we take social security early and invest it, we won’t be losing the 8% per year the experts claim is the annual increase of waiting – although one is guaranteed and the other is not. Maybe the markets will trend sideways or go down or even up, no one knows. For the last 30 years we have lived off of our investments through up and down markets, so investing the monthly check is definitely an option. More likely, we will just not spend our stash and look for opportunities in the markets as our cash positions grow. Plus we have control of the money at this point, adding to our net worth.

Next let’s look at some numbers

For easy math, say at 62 you are going to receive $1000.00 per month in benefits, but if you wait until you are 66, your payment will be $1360 ($1000 x 8% for the four years you have waited). Sounds great, right? However, you would have missed receiving $48,000 dollars in payments from the previous 48 months.

How long is it before you make that money back? Using this example it would take 133 months or a little over 11 years ($48,000 divided by $360) and that would put us at 77 years of age, just to break even. In that time frame, the Social Security we are receiving plus our investments should grow far outpacing the extra money received by waiting.

For some people deferring until their full retirement age could make sense, especially if they do not have the assets to support themselves, are poor at handling money or if they are still working. However this is not our situation and therefore we decided to take the money and run.

It’s really a question of who you think can handle your money better; You or Uncle Sam?

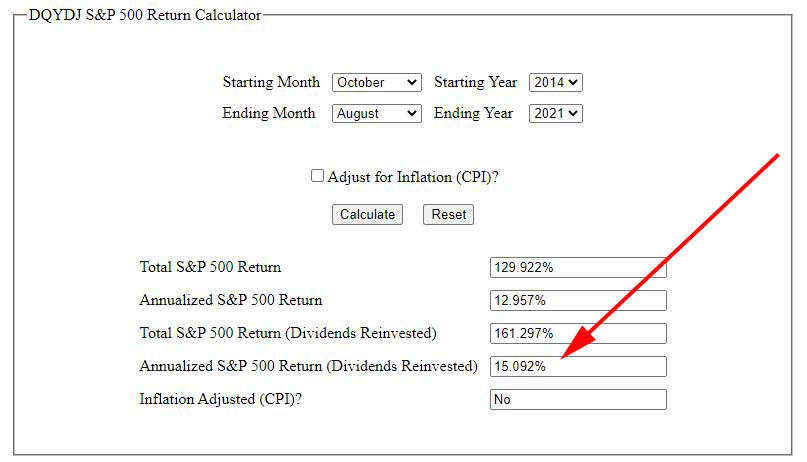

Update: Below is the return of the S&P 500 Index since we took Social Security at 62.

Akaisha Kaderli and her husband, Billy, are recognized retirement experts and internationally published authors on topics of finance, medical tourism and world travel. With the wealth of information that they share on their award winning website RetireEarlyLifestyle.com, they have been helping people achieve their own retirement dreams since 1991. They wrote the popular books, The Adventurer’s Guide to Early Retirement and Your Retirement Dream IS Possible available on their website bookstore or on Amazon.com. This blog originally appeared on their site and is republished on the Hub with permission. Information current as of September 2021.

Title: A BIRD IN THE HAND IS WORTH TWO IN THE BUSH

Hello Jonathon. I absolutely agree to this approach by Billy and Akaisha above and I am taking my CPP at 65 next month and investing the cash in a dividend etf or stock annually for 5 years. That 5 years of after tax CPP will more than double by breakeven age of 82 rather than had I waited until age 70 for enhanced CPP. It should also be earning dividends of 3-4%. When I die, there will be something for the estate.

If we can defer spending our CPP from age 65-70, and investing it, its the best way to have it both ways. We end up equal to the enhanced CPP if we waited to age 70, but with an estate legacy too.

Now i will lose all my OAS by age 71 due to clawback. But for the next 5 years I can keep its equivalent invested if I dont need the cash. That produces some income and capital gains or defers RRSP or RIF withdrawals of other money.

Deferring to enhance OAS sounds attractive on paper for some people who do not get clawed back. But if we die early, there is nothing for the estate. If you can afford to defer both CPP and OAS, you are spending your estate using other investments. That should be avoided at all costs unless you have nobody that will need your estate. By deferring your CPP, you are loaning the government your pension for 5 years. They keep it if you die. They are your beneficiaries. Do you really want that? I see it that the taxman got enough of me over my life and will rake in a lot more in estate taxes. Im not giving them anymore on top because I lost this CPP deferral game they cooked up to attempt to seduce me towards an enhanced pension. .

What do you think Jon, i have read every blog from your site and others who continue to miss this key point. Deferring your CPP, your estate may lose. There is a way to have it both ways as long as the equity markets continue to grow at 7% over the next 17 years from age 65 to 82 and beyond. We cannot touch the invested first 5 years of CPP. Thats key. Plus you have to live on less CPP from age 70-82. Then, you can begin to tap your dividends around that age for your own generated enhanced CPP. Between age 70-82 you are building your estate and enhanced income stream. During good investment performance years you can tap into it a bit if you need to. But it is likely going to be obscured by your other income producing investments in the same account unless you open a separate account for it.

There is one other alternative to this. You could wait until age 70, and invest only the enhanced portion to build up an estate as well that produces an income. But you are 5 years behind in the markets when you do get started and you are investing smaller amounts that take you 12 years to age 82 to be equal in contributions as it was when you could have put all your CPP into it from age 65-70. Both choices leave you no CPP to spend from age 65-70. But I prefer my first choice and build something for the estate should I die younger than age 82, even as young as age 70. The latter wont reach the same value as it began 5 years later and built with smaller annual contributions over 12 years. By age 83 you can start spending the enhanced monthly portion of CPP but its unlikely the enhanced pool is equal to the first option of investing from age 65-70. You still have a long way to go.

Ive made my decision. I begin CPP next month. Its going straight to ZDV or large cap dividend paying stock.

A BIRD IN THE HAND IS WORTH TWO IN THE BUSH.

I hope this generated some interest and I apologize for its length and brevity. But it is an extremely important hypothesis that could change the way financial planners see this opportunity.

I hope to hear from you Jon. Feel free to email me directly to arrange to discuss further. I am sure my approach can be refined and ‘enhanced’. Haha.

Regards, Steve

Thanks Steve. The key sentence in your comment is this one: “as long as the equity markets continue to grow at 7% over the next 17 years.” Personally I took CPP at 66, after my wife retired but we hedged our bets by planning to defer her CPP until she is 70.

Hi Jon. When we have a spouse and two choices, we can pick one choice for one spouse and the other choice for the other spouse, like you have with your wife. I had considered that and it was originally our Plan A, but now its Plan B and off the table. Hedging it by choosing both ways possibly means you do not know which way is the best way, so play it in the middle and choose both ways. But I think the choice is now more obvious if you consider this first. If you want an estate legacy for your kids thats guaranteed each year you receive CPP, you must take it age 65. Will it grow 7%? It should or at least by its dividends at 3%. We are only deferring spending CPP the first 5 years. In the first 5 years I will have built up $50,000 after taxes that has been earning dividends and might be worth as much as $65,000. Your wife will have ZERO at that point. Im further ahead and earning dividends I can take now. Maybe $2500 a year. Do you really want to loan $65,000 earning dividends and growing in value, to the government and lose it all if she passes away? The government is investing her money. They win. By age 82 my $65,000 will be conservatively worth between $90,000 with dividends only or $110,000 with 3% growth. Either way Im further ahead as she will have just recouped the $70,000 CPP she lost by deferring. She is not going to catch up to me for a very long time if age survives long enough.

Fortunately, you can begin her CPP now or anytime up to age 70 but each year you wait you lose, she take on more risk of dying and maybe losing it all. I also can reverse my decision for up to 11 months and pay my CPP back if my thesis is flawed but I am confident its not flawed.

So the choice is, whether we loan 100% of our CPP pension to the government for 5 years and if we die, LOSE IT ALL, If we die between age 70-82, we lose the number of years of the initial 5 years of deferral prorated between year of death and age 82. The government has stacked the deck in its favour. They are the dealer at the casino card table. The majority of card players lose and a few win. We don’t have to play this game if we invest the proceeds or at least save the proceeds. Im stacking the deck in my favour and my estates favour. We can guarantee something for our kids instead and IT COSTS US NOTHING.

Thanks Jon.