Special to the Findependence Hub

In the 2022 Federal budget a surtax of 1.5 per cent on bank profits over $100 million was proposed along with a one-time 15 per cent charge on income above $1 billion for the 2021 tax year. Canadian banks are already among Canada’s largest taxpayers.

The six largest of Canada’s banks accounted for more than $12 billion in tax revenue and more than double that in dividend income. They contribute 3.5%, or over $65 billion, to Canada’s gross domestic product. Over 280,000 are employed by these banks.

When Toronto-Dominion Bank’s chief executive, Bharat Masrani, recently stated that a proposed corporate tax rate increase that targeted financial institutions ““could lead to unintended consequences,” you could see the battle lines being drawn.

The pawns in this high-stake battle looming on the horizon are the millions of Canadian pensioners, charities, endowments, mutual fund investors, bank shareholders, pension funds, RRSP investors and others dependent on bank dividend payments. The banks will do their best at every opportunity to frighten their 34,000,000 customers with dire predictions of the harmful, personal financial consequences these proposed taxes will cause.

The banks have your phone number, your e-mail address, and your street address. Every time you deposit or withdraw funds, I would expect them to remind you of how you are being impacted by the proposed taxes. Every bank statement could carry their message their message that the tax is hurting you more than them. They are far better organized and motivated than the civil servants.

The stakes are huge. The Royal Bank of Canada (RBC) would likely pay the most, an estimated additional $334.7 million. The Toronto-Dominion Bank would pay about $285.5 million, the Bank of Nova Scotia (Scotiabank), approximately $191.9 million, the Bank of Montreal would owe about $137.9 million, the Canadian Imperial Bank of Commerce around $120.2 million, and the National Bank around $42.0 million.

The Federal government is already anticipating the pushback. It has stated they will not tolerate “sophisticated tax planning or profit-sharing” by the financial institutions to dilute the new measures. As well, new “targeted anti-avoidance rules” will be put in place. The federal Financial Consumer Agency of Canada will be policing any “excessive” fee passed on to customers to offset the cost of the new corporate tax measures.

One thing to propose this tax, another to implement it

It is one think to propose such a tax. It is another thing to implement it.

Canadians tend to take their long-established, successful banks for granted. They have no idea that out of the thousands of banks in the world, their banks are in the top 35 of the safest. These are banks that dwarf any of the banks that rank ahead of them. In North America they are the top six safest banks. As commercial banks, they are in the top 18 of the safest banks.

What impact will the battle over the taxes have upon your shares in financial service companies? The taxes are still too hypothetical to base investment decisions on. All we can do now is work with the current financial information that is available.

In a March, 2022 an article that appeared in the publication Investment Executive, by Daniel Calabretta, was headlined, “Financial services firms in a good position to weather expected market volatility.”The article was not directed at investors’ main concern. Investors want to know ”For the long term, which Canadian financial service companies should you consider adding to your investment portfolio?”

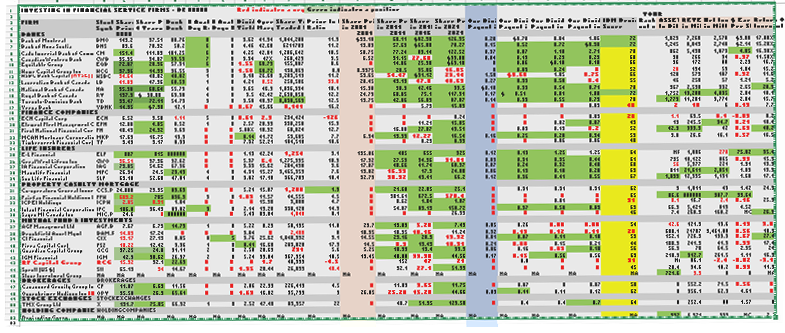

Charts in the Investment Executive article showed a comparison between 2020 and 2021 of “Assets, Revenues, Net Incomes and Earnings Per Share” for 40 financial service firms. However, whether these figures went up or down from one year to the next does not really address which of these companies are expected to provide share price gains and an increasing dividend income for investors. Thirty-seven of the forty stocks did pay dividends.

Speculators only control share prices. The experienced executives of these 40 companies, through their revenue and expense decisions, control profits. From profits come dividends.

There are many financially weak, marginally profitable companies who can motivate speculators to buy their shares based only on promoting the potential for eventual profits and skyrocketing share prices. There are also many financially strong, profitable companies that are ignored by speculators.

That constant debate between thousands of optimistic speculators who think a share price is going rocket up and the thousands of pessimistic speculators who think the same stock’s share price is going to crash makes accurate predictions of future share prices impossible. A stock can not be bought by a speculator until another speculator who owns the stock is prepared to sell it upon receiving an attractivebid from a buyer. To accommodate such investment uncertainties, wise investors, diversify their share ownership among the stocks of different sectors to account for unpredictable speculator bids.

The Great Canadian Financial Stock Challenge

Which of the shares of these 40 Financial Industry stocks would you confidently buy if you could review an Excel spreadsheet with the following additional eleven facts that go beyond assets, revenues, and net income?

Current Data

- Current share price

- The share price four years ago in the same month

- The share’s current book price

- Number of financial analysts giving it a buy recommendation

- Number of analysts giving it a strong buy recommendation

- The stock’s dividend yield percent

- The stock’s operating margin

- The average number of shares traded daily

- The stock’s price-to-earnings ratio

Historical Data

- The share price in 2001, 2011, 2016 and 2021

- The dividend payouts in 2001, 2011, 2016 and 2021

When such a spreadsheet is condensed to fit on this page, it is difficult to read. To participate in this challenge, you can request a copy of this spreadsheet to be emailed to you. Send your request to imacd@informus.ca

For this challenge, assume you have been handed a settlement of $1,000,000 in lieu of a pension and that you are 60 years old. This money must last for the rest of your life: which we hope will be another 30 years.

To protect and grow this nest egg you decide you want to invest it equally in 20 diversified financially strong dividend-paying stocks. Five of those stocks are to be chosen from the 40 Financial Services industry stocks that appeared in the March article and are detailed in the Excel spreadsheet. You will invest $50,000 in each stock.

The objective of this challenge is to achieve the greatest capital gain and greatest dividend income from the five “best” stocks over the next 30 years.

Following are the 40 Investment Service companies:

| FIRM | Stock | Share |

| Symbol | Price $ | |

| BANKS | Apr 22 | |

| Bank of Montreal | BMO | 147.11 |

| Bank of Nova Scotia | BNS | 89.6 |

| Canadian Imperial Bank of Commerce | CM | 151.37 |

| Canadian Western Bank | CWB | 35.95 |

| Equitable Group | EQB | 72.07 |

| Home Capital Group Inc | HCG | 37.96 |

| HSBC Bank Capital (NYSE) (US $) | HSBC | 34.64 |

| Laurentian Bank of Canada | LB | 41.83 |

| National Bank of Canada | NA | 95.38 |

| Royal Bank of Canada | RY | 137.32 |

| Toronto-Dominion Bank | TD | 99.47 |

| Versa Bank | VBNK | 14.95 |

| FINANCE COMPANIES | ||

| ECN Capital Corp | ECN | 6.52 |

| Element Fleet Management Corp | EFN | 12.08 |

| First National Financial Corp | FN | 40.49 |

| MCAN Mortgage Corporation | MKP | 17.69 |

| Timbercreek Financial Corporation | TF | 9.43 |

| LIFE INSURERS | ||

| E-L Financial | ELF | 887 |

| Great West Lifeco Inc | GWO | 36.51 |

| IA Financial Corporation | IAG | 73.85 |

| Manulife Financial | MFC | 26.94 |

| Sun Life Financial | SLF | 69.1 |

| PROPERTY CASUALTY MORTGAGE | ||

| Co-operators General Insurance | CCS.PR | 24 |

| Fairfax Financial Holdings (US $) | FFH | 689.18 |

| ICPEI Holdings | ICPH | 2.05 |

| Intact Financial Corporation | IFC | 186.79 |

| Sagen MI Canada Inc | MIC.PR.A | 24.6 |

| MUTUAL FUND & INVESTMENTS | ||

| AGF Management Ltd | AGF.B | 7.67 |

| Brookfield Asset Mgmt | BAM.PR.B | 14.09 |

| CI Financial | CIX | 19.17 |

| Fiera Capital Cor[ | FSZ | 10.22 |

| Guardian Capital Group | GCG | 37.25 |

| IGM Financial | IGM | 42.9 |

| RF Capital Group | RCG | 15.92 |

| Sprott (US $) | SII | 65.13 |

| Stone Investment Group | NA | NA |

| BROKERAGES | ||

| Canaccord Genuity Group Inc | CF | 11.87 |

| Oppenheimer Hodings Inc (US $) | OPY | 35.58 |

| STOCK EXCHANGES | ||

| TMX Group Ltd | X | 131.65 |

| HOLDING COMPANIES | ||

| Desjardins Group | NA |

(Note: if information could not be found “NA” was entered)

Prior to your analysis you may want to consider some of the following revelations the spreadsheet revealed to me:

- Although the Royal Bank of Canada had the highest net income of all the 12 banks it did not have the highest share price of the banks. The Canadian Imperial Bank of Commerce (CIBC) with its higher share price seems to have the greatest investor appeal.

- The highest net income of all 40 Financial Institutions was that of Brookfield Asset Management. It was so far ahead of the other financial services that it was in a league by itself. Yet, one of their shares could be purchased for only $14.09 and was paying a dividend of 3.04% which was a better dividend rate than the Equitable Group and Home Capital Group Inc that were grouped with the banks. However, Brookfield is a preferred share and there are many preferred shares paying dividend yields twice what Brookfield is paying. Was it originally issued at $25 a share, as most preferred shares are? A decline for a preferred share would not be unusual. Unlike common shares, preferred shares are unlikely to increase in value above their original issue price.

- The highest bank share price was CIBC’s $151.37 with a dividend yield of 4.25%. However, in the Life Insurance grouping, E-L Financial’s share price was $887. In the Property Casualty Mortgage grouping, Fairfax Financial Holdings was $688.18 and Intact Financial Corporation was $186.79. Both were paying less than half the dividend yield of the Canadian Imperial Bank of Commerce.

- The lowest share price was also in the Property Casualty Mortgage grouping. It was ICPEI Holdings with a share price of $2.05. Four years ago, the price had been 0.91 cents. The current price is a positive gain of 125%. This is the largest percentage gain of all the Financial Service firms. It did not pay a dividend. (Note, Sagen MI Canada Inc is also included in the Property Casualty Mortgage grouping. It is another preferred share. It appears to have been issued in the last four years. Since most preferred shares are issued at $25, the $24.60 share price would most likely not be a gain. Preferred shares are more loans than shares. Sagen’s dividend yield of 5.49% is typical of preferred shares).

- Versa Bank has doubled its share price in the last 4 years. Its dividend of 0.67% falls below that of any of the other banks. That perhaps explains why less than 10,000 of its shares are being traded daily. However, its operating margin of 45.66% beats all but 3 of the 12 other banks and all but 3 of the other financial service institutions. Two other banks, Equitable Group and Home Capital Group, had even better gains in share price over the last 4 years. Like Versa, they too have dividend yield percentages below 2%. These two with operating margins of 60.73% and 60.72%. are higher than the other banks.

- A mutual fund & investment company, Fiera Capital Corporation’s dividend yield of 8.41% is the highest dividend rate of all the 40 companies. The second highest was a Finance Company, MCCAN Mortgage Corporation paying 8.14%. The highest dividend bank rate was 4.46% by Bank of Nova Scotia. Interestingly Fiera Capital’s share price of $10.22 was 2 dollars lower than it had been in 2018. MCCAN was one dollar ahead of its 2018 share price of $16.75. The Bank of Nova Scotia was $11 a head of its 2018 share price. The IDM desirability score seems to accurately reflect the appeal of these 3 stocks: Fiera with a score of 44, MCCAN with a 53 and BNS with a score of 72. That 72, is the same as the Royal Bank and the Bank of Montreal. A 72 is the highest IDM scores for all the forty companies. As you look at Fiera’s share price and dividend payouts over the last 20 years you see that they are inconsistent. MCCAN’s historical performance, while better than Fiera’s, does not show the steady consistent growth of the Bank of Nova Scotia.

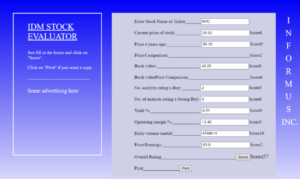

- The three lowest IDM scores are Brookfield Asset Management with a score of 20, ECN Capital Corporation with a 28 and RF Capital Corporation with a score of 31. The Brookfield low score is typical of preferred shares. The IDM scoring system was designed to pinpoint companies with the potential for a 9% annual capital gain and a 6% annual dividend yield. This seems to be almost impossible to achieve for any preferred share. The scores for ECN Capital and RF Capital reflect a lack of earnings. If you want to see the IDM’s scoring model go to www.saferbetterdividendinvesting.com for more information. (This scoring software is supplied with my books).

- The following is an example of the IDM score’s input page.

- The bank with the highest Earnings Per Share was CIBC at $4.05. This is reflected in its IDM score of 70. The lowest Earnings Per Share for a bank was the HSBC Bank Capital (Note: It is traded on the NYSE and not the TSX). Two of the forty companies were showing negative earnings per share. ECN Capital with a -0.03 is a Finance Company and RF Capital, with a -0.02, is a mutual fund/investment company. The highest Earning Per Share, by far, was a life insurer, EL Financial, at $75.82. None of the other Life Insurance companies show an Earning Per Share higher than $1.91. A “special dividend” EL Financial paid seems to be the explanation for the high Earnings Per Share.

- The company with the Highest Return On Investment at 40.2% was First National Financial Corporation whose IDM score was an acceptable 52(which is still twenty points below the major banks). No analysts recommended it as a buy. While it has shown a good share price increase over the last 4 years, from $24.32 to $40.49, several other stocks have shown better increases. It’s dividend yield of 5.90% is the 4th best dividend yield percent of the 40 companies.

CONCLUSION

Which 5 of the 40 financial services firms would you purchase for your portfolio to give you the best capital growth and an ever- increasing dividend income?

I ran an experiment over the last 12 months in which I tracked the 20 highest scoring stocks on the NYSE and the NASDAQ (as listed on page 76 of my book American High Dividend Handbook) just to see what would happen when a selection was made using purely objective scoring. This approach is contrary to most investors who seem to pick stocks based on emotions, rumours and market momentum. The following positive one-year results were not unexpected.

Many Investors who seek a balanced combination of portfolio stability, monthly income and share price appreciation invest in dividend stocks. While such investing may be seen as “boring” by some, dividend companies are often loaded with cash due to their ample operating margins and their strong economic moats. They have no hesitation in returning a portion of their profits to investors via dividends.

While Dividends are never guaranteed, my research has shown that carefully selected dividend stocks that deliver ever rising dividend payouts and share price increases, will continue to deliver these positive results 95% of the time, for years to come.

Ian Duncan MacDonald is the owner and creator of Safer Better Dividend Investing.com. He is also the author of 7 books on dividend investing. His career highlights include Vice President at Equifax, Senior Vice President at Creditel, President at Intercontinental Collections, General Manager at Screening Systems International and General Sales Manager at Dun & Bradstreet. He has managed operations with hundreds of employees; been a top salesman and sales manager; took an operation that was losing a million dollars a year to annual profits of 8 million dollars; built a commercial risk scoring system that is still used daily by thousands of risk managers, analyzed thousands of businesses for risk; ran the largest commercial collection operation in the country; screened hundreds of senior executive job applicants; established an international risk information exchange system; and merged the operations of two large corporations. Since 2005, Ian has been president of Informus Inc. It markets his books, art and consulting services. Investing and writing have been his passion since 2000.

Ian Duncan MacDonald is the owner and creator of Safer Better Dividend Investing.com. He is also the author of 7 books on dividend investing. His career highlights include Vice President at Equifax, Senior Vice President at Creditel, President at Intercontinental Collections, General Manager at Screening Systems International and General Sales Manager at Dun & Bradstreet. He has managed operations with hundreds of employees; been a top salesman and sales manager; took an operation that was losing a million dollars a year to annual profits of 8 million dollars; built a commercial risk scoring system that is still used daily by thousands of risk managers, analyzed thousands of businesses for risk; ran the largest commercial collection operation in the country; screened hundreds of senior executive job applicants; established an international risk information exchange system; and merged the operations of two large corporations. Since 2005, Ian has been president of Informus Inc. It markets his books, art and consulting services. Investing and writing have been his passion since 2000.