Will Monday February 5th go down as the worst day ever for stocks? On this day the Dow Jones industrial average lost more than 1,175 points: the worst single-day point drop in its history. But was it really the worst day ever? Investors need some context.

Will Monday February 5th go down as the worst day ever for stocks? On this day the Dow Jones industrial average lost more than 1,175 points: the worst single-day point drop in its history. But was it really the worst day ever? Investors need some context.

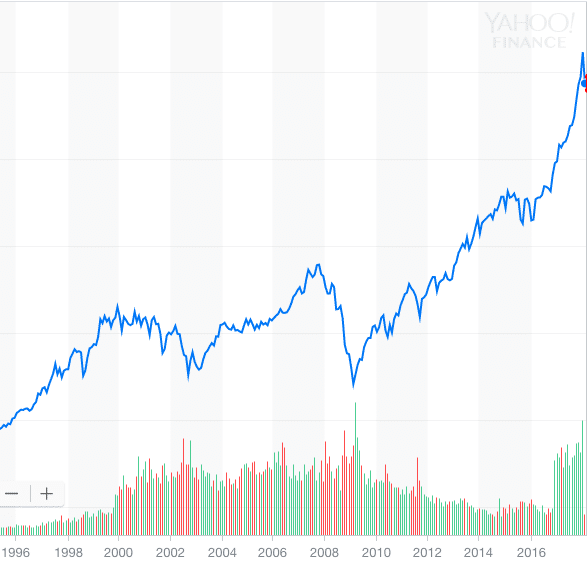

The 1,175 point drop was indeed the biggest single-day point loss the Dow has ever sustained. But let’s remember the Dow has been soaring almost uninterrupted since March 2009 when it bottomed-out at 6,627 points during the global financial crisis. By the end of January 2018 it had reached a record 26,616 points.

Related: Have we reached peak stock market?

Better to forget about points and focus instead on percentage gains and losses. Taken in this context the headline reads a bit different. The Dow plunged 4.6 per cent: its worst day since August 2011. It doesn’t sound nearly as gloomy.

Another way to frame this day is that the stock market has erased its gains from the start of the year. But 2018 is just one month old.

Where does this day rank in terms of largest one-day percentage drops in history? Will it live on in infamy like Black Monday, Black Tuesday, the Flash Crash, or the aftermath of the September 11th attacks?

Nope, not even close.

If you were thinking Monday’s 4.6 percent drop was a bloodbath then how would you have reacted to one of the top 20 largest daily losses of all time? This wasn’t even a blip on the radar.

Related: What can you do about the upcoming stock market crash?

A day like Monday is why it’s important to ignore the daily headlines and stick with your plan. One day’s gains or losses can be highly volatile, but that volatility tends to smooth out over time. Look at any 20-year investment chart and you’ll barely notice the daily losses as the stock market makes its steady march higher.

Final Thoughts

What does a one-day drop like this mean for you and your investment goals? Hopefully not much.

I used this worst day ever as an opportunity to make my final $3,000 RRSP contribution for 2017. After all, it has been six-and-a-half years since the stock market has fallen this hard in one day. I figured I’d take advantage of the sale and add to my retirement account.

Related: How to invest when markets are at an all-time high

This is not market timing, mind you. I have no idea whether the market will go up, down, or sideways for the rest of the year. All I know is that I budgeted for an RRSP contribution this month and thought this was as good a time as any to make it.

Daily market gyrations shouldn’t have any effect on your investing plan. If your time horizon is 20+ years away then what the market does today, or how some stock market pundit “feels” about its direction, is irrelevant to your goals.

Tune out the noise. Stick to your plan. Better days are always ahead.

In addition to running the Boomer & Echo website, Robb Engen is a fee-only financial planner. This article originally ran on his site on Feb. 5th and is republished here with his permission.

In addition to running the Boomer & Echo website, Robb Engen is a fee-only financial planner. This article originally ran on his site on Feb. 5th and is republished here with his permission.