Special to the Financial Independence Hub

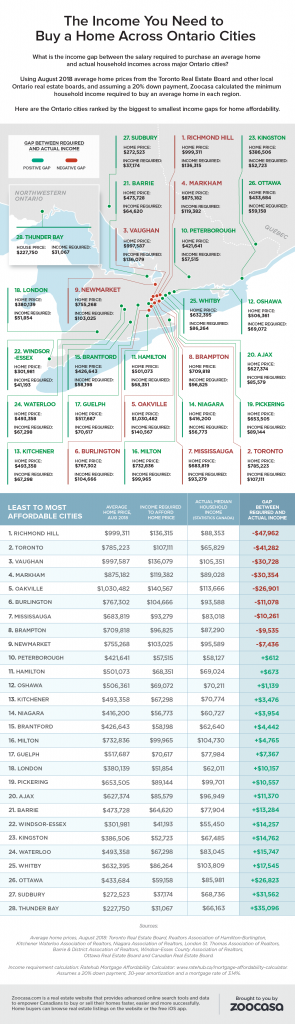

Where in Ontario are buyers most out of pocket when trying to purchase a home? Toronto invariably comes to mind as the province’s least affordable market – but new numbers reveal a pricey GTA suburb actually takes top spot.

New income and price data compiled by online brokerage Zoocasa finds that, when it comes to unaffordable housing, half of Richmond Hill buyers would find themselves a whopping $47,962 short on a home priced at the city’s average. That’s because the median income earned in the municipality clocks in at $88,535, when a total of $136,315 would be required to purchase and carry a property priced at $999,311.

Toronto comes in at a close second, with half of buyers falling $41,282 short of affording the average home price of $785,223.

Incomes must support housing prices

To determine the extent of affordability, Zoocasa collected the average August home price in each of Ontario’s 23 major markets, as reported by their local real estate boards, and calculated the minimum household income required to actually afford such a property (assuming a 30-year mortgage at a rate of 3.14 per cent). This amount was then compared to the actual median incomes earned in each municipality, as reported by Statistics Canada.

Whether or not a market falls within the realm of affordability for buyers depends on a few factors. For example, among the top five least affordable markets (Richmond Hill, Toronto, Vaughan, Markham, and Oakville, each had an average home price of at least $700,000 and, with the exception of Toronto, had pricier detached houses make up the majority of their August sales.

Northern Ontario takes top affordability spot

In contrast, the most affordable markets (Thunder Bay, Sudbury, Ottawa, Whitby, and Waterloo) were each supported by unique resource or service-based economies and higher median wages, with an average home price under $500,000.

For example, a prospective home buyer perusing Ottawa real estate or London, Ontario real estate would enjoy greater purchasing power in relation to their household income, compared to a household in Mississauga who would incur a $10,000-gap in their budget. Meanwhile, those making the move to Hamilton in search of relative affordability will find it, as the local median income of $67,298 remains perfectly in line with the average home price of $501,073.

Wondering which Ontario markets offer the best affordability? Check out where buyers can afford the most house at the most competitive median incomes, in the infographic on the left.

Penelope Graham is the Managing Editor of Zoocasa.com, a leading real estate resource that uses full brokerage service and online tools to empower Canadians to buy or sell their home faster, easier, and more successfully.

Penelope Graham is the Managing Editor of Zoocasa.com, a leading real estate resource that uses full brokerage service and online tools to empower Canadians to buy or sell their home faster, easier, and more successfully.