By Robb Engen, Boomer & Echo

Special to the Financial Independence Hub

I don’t know if I’d describe myself as a voracious reader, but I do enjoy a good book and like to read the latest on personal finance, investing, behavioural finance, and leadership or motivational topics. In fact, this year I found myself putting down my phone or laptop more often and picking out a good book to read instead.

Some of the good ones included Carl Richards’ One-Page Financial Plan, and Losing the Signal: The Untold Story Behind the Extraordinary Rise and Spectacular Fall of BlackBerry.

I also enjoyed Ben Carlson’s A Wealth of Common Sense, about why simplicity trumps complexity in any investment plan. Mark Goodfield of The Blunt Bean Counter fame rewarded us with a compilation of his best work in Let’s Get Blunt About Your Financial Affairs. And finally, one of my favourite authors is Michael Lewis and I read his latest – Flash Boys – about a group of Wall Street guys who figure out how the stock market is rigged to benefit insiders.

Reading list for 2016

One of the most influential books I’ve ever read was Daniel Kahneman’s Thinking, Fast and Slow. This book convinced me that my investing success up to that point likely had more to do with luck than skill or hard work, so I finally made the switch from picking individual stocks to indexing.

Since then, behavioural finance, economics, and psychology have been topics of interest. A couple of books in this area have caught my eye and I’ve put them on my reading list for 2016:

First, Richard Thaler published a new book last year called Misbehaving: The Story of Behavioral Economics. Like his mentor, Daniel Kahneman, Thaler uses observations and experiments to explain how our behaviour is often so inconsistent with the economists’ model of rational choice.

First, Richard Thaler published a new book last year called Misbehaving: The Story of Behavioral Economics. Like his mentor, Daniel Kahneman, Thaler uses observations and experiments to explain how our behaviour is often so inconsistent with the economists’ model of rational choice.

I might also read: Nudge: Improving Decisions About Health, Wealth, and Happiness

Dan Ariely is a professor of psychology and behaviour economics at Duke. He wrote a book this year that I want to check out called, Irrationally Yours: On Missing Socks, Pickup Lines, and Other Existential Puzzles.

I might also read: The Honest Truth About Dishonesty: How We Lie to Everyone–Especially Ourselves

I’m a big believer in keeping things simple and that especially applies to personal finance and investing. There’s no need for things to be as complicated as the financial services industry makes it out to be. That’s why I was excited to hear that Helaine Olen, author of Pound Foolish, is coming out with a new book in January called, The Index Card: Why Personal Finance Doesn’t Have To Be Complicated. Check this out:

“When University of Chicago professor Harold Pollack interviewed Helaine Olen, an award-winning financial journalist and the author of the bestselling Pound Foolish, he made an offhand suggestion: everything you need to know about managing your money could fit on an index card. To prove his point, he grabbed a 4″ x 6” card, scribbled down a list of rules, and posted a picture of the card online. The post went viral.

Now, Pollack teams up with Olen to explain why the ten simple rules of the index card outperform more complicated financial strategies.”

I might also read: The Incredible Shrinking Alpha: And What You Can Do to Escape Its Clutches

Following the topic of simplicity, Randall Munroe, author of the hilarious comic XKCD, came out with a new book called Thing Explainer: Complicated Stuff in Simple Words.

Following the topic of simplicity, Randall Munroe, author of the hilarious comic XKCD, came out with a new book called Thing Explainer: Complicated Stuff in Simple Words.

“Funny, interesting, and always understandable, this book is for anyone—age 5 to 105—who has ever wondered how things work, and why.”

I might also read: How to Fail at Almost Everything and Still Win Big: Kind of the Story of My Life

I’m really excited about this one. Jason Zweig, financial columnist at the Wall Street Journal, wrote a survival guide to the hostile wilderness of today’s financial markets with The Devil’s Financial Dictionary.

I’m really excited about this one. Jason Zweig, financial columnist at the Wall Street Journal, wrote a survival guide to the hostile wilderness of today’s financial markets with The Devil’s Financial Dictionary.

I might also read: Your Money and Your Brain: How the New Science of Neuroeconomics Can Help Make You Rich

Fred Vettese is an expert on Canada’s retirement income system and sits on the Pension Policy committee of the C.D. Howe Institute. His latest book is called, The Essential Retirement Guide: A Contrarian’s Perspective. It debunks typical retirement rules of thumb and reveals how you can calculate your personal wealth target – the amount of money you will need by the time you retire to live comfortably.

Fred Vettese is an expert on Canada’s retirement income system and sits on the Pension Policy committee of the C.D. Howe Institute. His latest book is called, The Essential Retirement Guide: A Contrarian’s Perspective. It debunks typical retirement rules of thumb and reveals how you can calculate your personal wealth target – the amount of money you will need by the time you retire to live comfortably.

I might also read: The Real Retirement: Why You Could Be Better Off Than You Think, and How to Make That Happen

Final thoughts

It looks like I’ve got a ton of reading to do next year. Of course, all of these books will get tossed aside if and when George R. R. Martin finally publishes The Winds of Winter, the sixth instalment in the A Song of Ice and Fire (Game of Thrones) series.

What’s on your reading list for 2016?

In addition to running the Boomer & Echo website, Robb Engen is a fee-only financial planner. This article originally ran on his site on December 20th and is republished here with his permission.

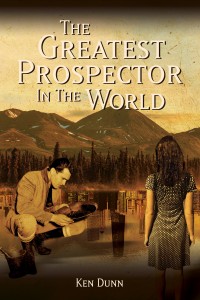

The Greatest Prospector in the World is the title of a new work of “Business Fiction” focusing on the six “secrets” of sales prospecting success. The author is Ken Dunn, CEO and Founder of Las Vegas based Next Century Publishing.

The Greatest Prospector in the World is the title of a new work of “Business Fiction” focusing on the six “secrets” of sales prospecting success. The author is Ken Dunn, CEO and Founder of Las Vegas based Next Century Publishing.