Almost half of North American’s young baby boomers would consider postponing retirement because of Savings concerns, a survey out Wednesday finds. Even so, more than half surveyed had to retire early, often because of circumstances beyond their control.

Almost half of North American’s young baby boomers would consider postponing retirement because of Savings concerns, a survey out Wednesday finds. Even so, more than half surveyed had to retire early, often because of circumstances beyond their control.

Franklin Templeton’s 2019 Retirement Income Strategies and Expectations (RISE) survey found that 21 per cent of Canadian young baby boomers (ages 55 to 64) in pre-retirement have not saved anything for retirement. And in the United States, 17 per cent of young boomers are in a similar predicament.

13 to 15% expect to work until they die

As a result, 46% of young Canadian boomers and 48% of young American boomers are considering postponing retirement, with roughly 15% of Canadians and 13% of Americans expecting to work until the end of their life. Furthermore, 22% of self-employed Canadians don’t ever plan to retire.

However, things don’t always go as planned: 54% of young Canadian boomers and 60% of their American counterparts retired earlier than expected, compared to 32% and 37% of Canadian and American older boomers aged 65 to 73.

More Canadian young boomers retired due to circumstances beyond their control than Canadian older boomers (34% versus 20%, respectively). There was a slightly wider gap amongst Americans: more American young boomers retired due to circumstances beyond their control than American older boomers (33% vs 17%, respectively).

Boomers in different life situations after post 2009 bull run

“In 2009, when equity markets started to recover, many young boomers were moving up the career ladder; whereas older boomers were approaching retirement at the top of their earning years,” said Duane Green, president and CEO, Franklin Templeton Canada. “A decade later, after a long bull market run, young and older boomers are in different life situations once again. We see many older boomers benefitting from the transfer of wealth from their parents, yet the young boomers have had a challenging experience balancing more expensive lives – due to caring for elderly parents and still having financially dependent children – all while saving for that increasingly elusive retirement.”

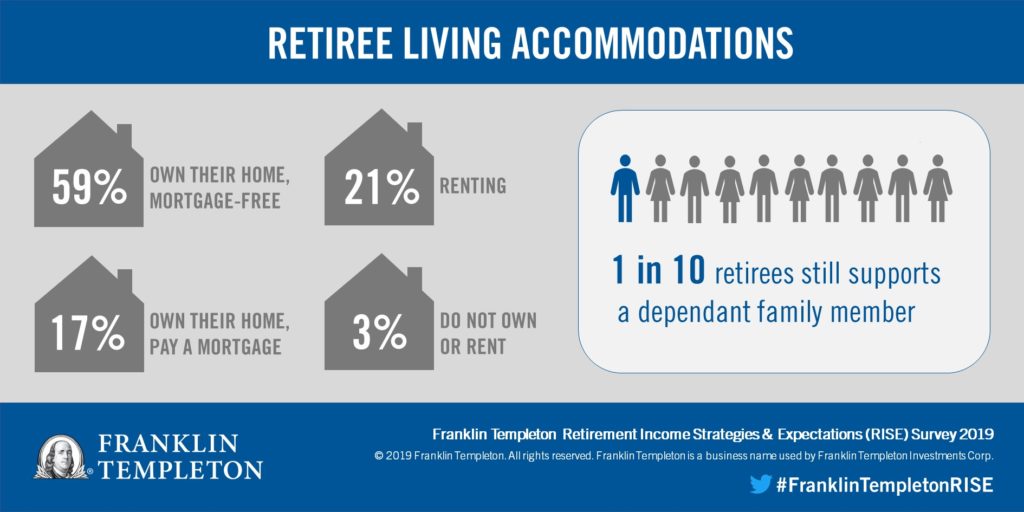

Nearly a quarter (24%) of Canadian young boomers in pre-retirement currently support a dependent family member, compared to 9% of retired older boomers. The top three sacrifices young boomers made for dependents were: saving less money, cutting back personal spending and withdrawing from personal savings. They were least likely to use employer vacation time or take unpaid time off work for caregiving.

“With life expectancy increasing and retirement savings becoming ever more challenging, due to the high costs of living, we are seeing increased concern over having enough money for retirement across all generations,” said Matthew Williams, SVP, Franklin Templeton Canada. “Although it’s never too late to start saving, the best time to start contributing to retirement savings vehicles is when a person starts out in their career and may not have big financial commitments like a mortgage or childcare costs: and to find a way to maintain healthy savings habits as they age.”

Those employed by companies offering group RSP or pensions that allows employees to make contributions directly from their paycheque — and perhaps receiving a company match to their contributions — should fully take advantage of this and potential ‘free’ money, as it will assist their retirement nest egg in compounding over time, Williams said.

Americans more concerned about medical expenses in Retirement

Of those Canadians who plan to retire within five years, 86% expressed concerns about paying expenses in retirement. 27% of these Canadians nearing retirement ranked lifestyle as their top concern, compared to 17% of Americans.

Instead, Americans who plan to retire within five years are most concerned about medical and pharmaceutical expenses (23%, versus 18% of Canadians. This is likely because 34% of Canadians nearing retirement, and 27% of Americans, do not know how they will pay for their medical expenses in retirement.

Surprisingly, 22% of Canadian millennials are concerned about medical and pharmaceutical expenses in retirement, perhaps because three in five (61%) do not know how they will pay for these expenses.

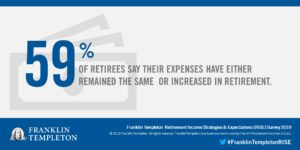

This concern appears well founded, as over one third of Canadians and Americans who are 11 or more years into retirement said their overall expenses have increased since they initially retired. Yet when Canadians 11 or more years into retirement were asked about what expenses they were concerned about, 27% are cited assisted living care expenses.

These expenses are weighing on those Canadians nearing retirement in the next five years as over half (52%) are concerned about outliving their retirement assets or having to make major sacrifices in their retirement. Yet Canadians 11 or more years into retirement are 21 percentage points less likely to be concerned about this (52% versus 31%).

Stressed and anxious about having enough for retirement

Nearly three-quarters (73%) of young boomers, in pre-retirement, and millennials experience stress and anxiety when thinking about their retirement savings and investments. This is likely because one-fifth (21% of young boomers and a quarter (24%) of millennials haven’t saved anything for retirement.

Nearly three-quarters (73%) of young boomers, in pre-retirement, and millennials experience stress and anxiety when thinking about their retirement savings and investments. This is likely because one-fifth (21% of young boomers and a quarter (24%) of millennials haven’t saved anything for retirement.

Over half (58%) of those who are self-employed feel they are behind on their retirement savings, which might be causing almost three-quarters (74%) of business owners stress and anxiety when thinking about their retirement savings.

Savings and the advice factor

The survey found 47% f young boomers currently work with a financial advisor. Those who do are 37 percentage points more likely to be saving for retirement compared to those who have never worked with an advisor (96% versus 59%).

When asked if their retirement strategy will generate enough income to last 30 years or more, 77% of retired young boomers who work with an investment advisor, said it will: compared to 45% of those who have never worked with an advisor. Of those retired young boomers who have never worked with an advisor, 37% said they don’t have a retirement strategy whatsoever.

Other key findings

- Over one-fifth (21% of Canadians planning to retire in the next five years still have children living at home and 31% are still paying a mortgage.

- Over one-third of millennials who rent their home have nothing saved for retirement, yet half have up to $50,000 saved for retirement when renting. Surprisingly 14% have saved between $50,001 – $250,000 while renting.

- One-third of millennials are most concerned about running out of money in retirement.

The survey was conducted online among a sample of 2,012 Canadians and 2,002 Americans 18 years of age or older. It was administered from January 17 to January 29, 2019, by Engine’s Online CARAVAN®, unaffiliated with Franklin Templeton. Generational groups in this release were defined as: millennials (ages 21 to 38), generation X (ages 39 to 54) and baby boomers (ages 55 to 73).

It was a wonder time while going through your article and I’ve got what

i was looking for. Best wishes and have a good day ahead.

Best wishes from:http://www.investructor.com