By Robb Engen, Boomer & Echo

Deferred sales charges – or DSCs – are a clever little trick designed by the mutual fund industry to compensate advisors and keep investors locked-in to their investments for a minimum length of time.

According to MoneySense’s Preet Banerjee, mutual funds originated in Canada in 1932 but didn’t take off until the invention of deferred sales charges in 1987:

I think the invention of DSC sales options has contributed to the success of the mutual fund industry. pic.twitter.com/nyTwLyFIDQ

— Preet Banerjee (@preetbanerjee) April 2, 2015

A deferred sales charge schedule might look like this:

- 1st year penalty – 5.5%

- 2nd and 3rd year penalty – 5.0%

- 4th and 5th year penalty – 4.0%

- 6th year penalty – 3.0%

- 7th year penalty – 2.0%

- After 7 years – 0.0%

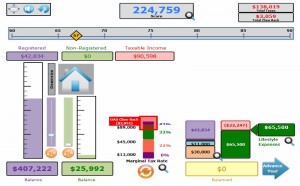

Let’s say an investor has $50,000 tied-up in high MER mutual funds at Investors Group. The average MER for her funds is 2.76% and she wants to switch to a portfolio of TD e-Series funds, which cost just 0.42%. But she’s only held her investments for four years and so she’d have to pay a $2,000 penalty (deferred sales charge) to sell the funds and make the move to TD.

Related: My two-fund solution

Now, most fund companies allow investors to redeem up to 10% of their units fee-free each year, meaning that this investor could withdraw $5,000 without penalty, reducing her total deferred sales charge to $1,800.

Some investors might feel compelled to stay put until the DSC schedule has lapsed or the fees have been reduced further, but at what point should the investor say, “screw it”, and just make the switch to the lower cost funds?

First, you’ll want to do some quick math to see the difference in dollar terms between the funds you’re leaving and the funds you’re moving to. In this case, the Investors Group funds cost the investor $1,380 annually, while the TD e-Series funds would cost just $210 per year – an annual savings of $1,180. It would take less than two years for the investor to come out ahead after making the switch, even though she ended up paying the $1,800 penalty.

Besides the mathematical solution, there are a number of behavioural reasons to make the switch sooner rather than later. I reached out to Canadian personal finance experts Rob Carrick, Preet Banerjee, and Dan Bortolotti to find out their thoughts on when (and why) it makes sense to pay the deferred sales charges on mutual funds.

Mr. Carrick, The Globe and Mail’s personal finance columnist, said he’d lean toward ripping the band-aid right off.

“A lot of this comes down to the total dollar cost of the deferred sales charges and what percentage of total assets they represent. The MER-related cost savings as shown (in the above example) are substantial and could probably offset the DSC in a few years at most.”

The decision also depends on what the investor is switching to. Moving from Investors Group to a do-it-yourself portfolio of stocks or ETFs can mean significant cost savings and a stronger argument for eating the DSCs right away.

“By contrast, if she’s moving to a fee-only advisor then the breakeven period is longer because the cost savings is lower,” said Canadian Couch Potato blogger Dan Bortolotti.

Banerjee says paying the fees and going forward for behavioural reasons makes a lot of sense because the investor can move ahead with one plan and start developing better habits right away. She’d also avoid second-guessing herself while she waits for the DSC fees to expire.

Related: How to transfer your RRSP from one bank to another

Gradually transitioning out of a DSC schedule sounds appealing, but Bortolotti says that some investors just won’t follow through, since it would require them to keep a close eye on things over a couple of years and send the instructions at the right time.

“I’ve seen investors fail to do this, in part because it’s just so discouraging to drag around those crappy funds for so long.”

Finally, Bortolotti suggests that investors evaluate just how bad their advisor relationship is. He says some DSC advisors are harmless, but others are aggressive in promoting loans and other destructive practices.

“If the client and advisor have a bad relationship I would be more inclined to just pay the fee and get out. If the advisor is willing to help you transition gradually, then that can make more sense.”

Readers: What is your experience with deferred sales charges? Did you make a clean break, transition out over time, or are they still holding you hostage?

In addition to running the Boomer & Echo website, Robb Engen is a fee-only financial planner. This article originally appeared on his site on April 9th and is republished on the Hub with his permission.