Source: Mercer Pension Health Index published October 2, 2017

Source: Mercer Pension Health Index published October 2, 2017

By Brent Simmons, Sun Life Financial

Special to the Financial Independence Hub

Recently, employees and retirees of Sears were stunned to learn they may not receive all of their defined benefit (DB) pension when it declared bankruptcy. They learned their pension plan was underfunded and the company had requested that it be allowed to stop making the contributions required by Ontario laws. The plight of Sears employees and retirees has left many Canadians wondering if their DB pension plan is healthy and if their DB pension is safe.

The pension challenge

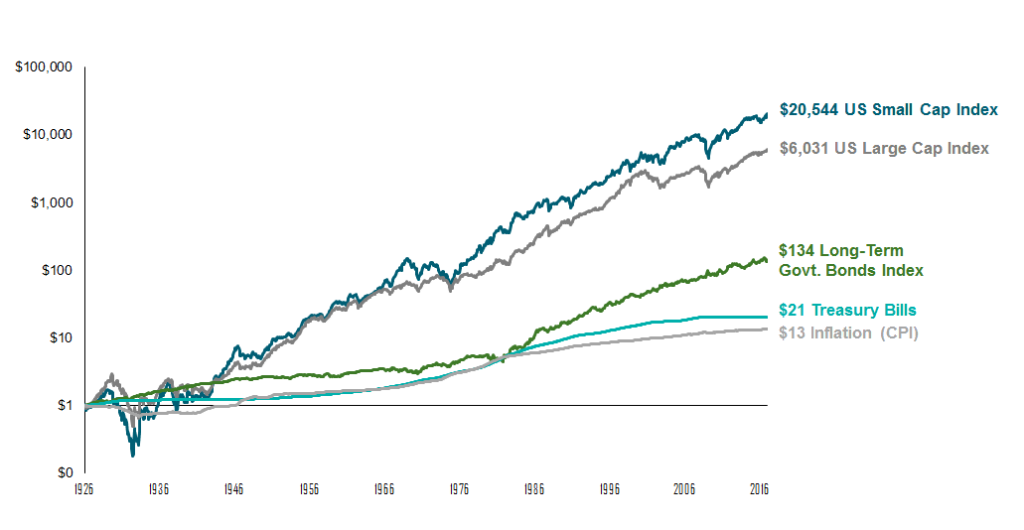

With a DB pension plan, a company promises their employees a pension for life and is responsible for paying the pension: whatever the cost ends up being. The problem is that low interest rates and choppy equity markets have made the funding level of many pension plans look like a roller roaster ride. This can be seen in the chart at the top of this blog.

Another challenge facing pension plans is that Canadians are living longer, meaning that pensions need to be paid for a longer time. A common rule of thumb is that one year of additional life expectancy at age 65 can increase the cost of the pension plan by 3% to 4%.

In a tough economy, the need to contribute to a pension plan can often come at a time when a company’s core business is also facing financial difficulties. If a company becomes bankrupt, then the company likely won’t be able to pay the contributions owed to the pension plan and employees may indeed face a shortfall in its pensions.

How Group Annuities protect their employees’ pensions

The good news is that a growing number of Canadian companies are taking steps to protect their employees’ pensions. They are buying group annuities to transfer the financial risk of their pension plans to insurance companies, which are subject to strict regulations and must have funds on hand at all times to pay promised pensions. With a group annuity, an insurer assumes responsibility for providing the pensions to a company’s retirees in exchange for a fee, and the retirees continue to receive their promised pension.