Vanguard has released its 2023 forecast. You can access it by clicking on this link to a PDF.

We first looked at this in this Hub blog on December 12: Vanguard says Balanced portfolios still offer best chance of success as Inflation gets beaten back.

In this follow-up blog, we’re looking in more depth on the Canadian portion of the report, which begins on page 23. We have reproduced some of the text and charts from that section in the second half of this blog.

“Generally, we are calling for a global recession next year, including a milder recession for Canada with economic growth pegged at 0.7% (for Canada),” says Matthew Gierasimczuk, spokesperson for Vanguard Investments Canada Inc.

Vanguard expects five key themes will shape the Canadian and global economic environment as we move into 2023:

- Central banks’ vigilance in the fight against inflation

- Spillover effects of global economy, energy, and real estate markets on the Canadian economy

- Economic effects of the energy crisis in Europe

- China’s long-term structural challenges as it aims to end its zero-COVID policy

- Last, but not least, a more positive outlook for long-term investors across bonds and equities

Fighting inflation: Central banks maintain vigilance

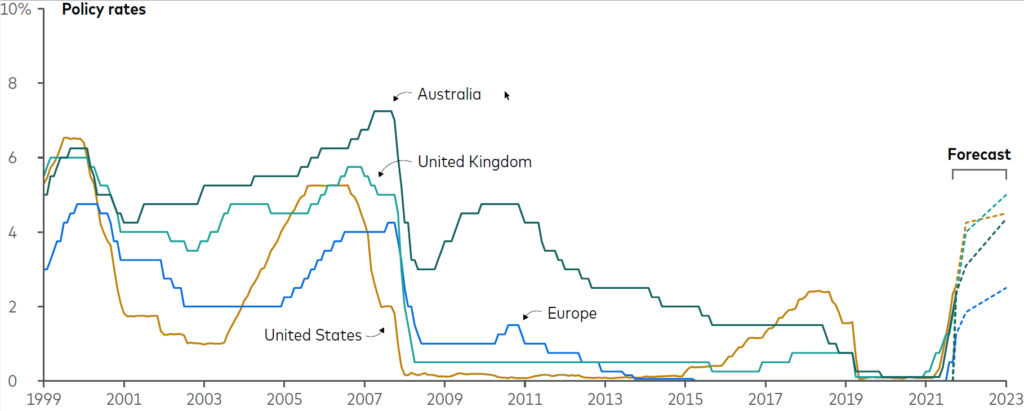

Vanguard says 2022 has proven to be “one of the most rapidly evolving economic and financial market environments in history. Across the globe, central banks have responded with coordinated monetary policy changes that have outpaced anything we’ve seen for several decades.”

A globally coordinated monetary tightening regime

“This is the greatest inflation threat we’ve seen since the 1980s,” it continues, “Central banks have a difficult path ahead that will require being more aggressive with policy, making additional rate hikes, and maintaining vigilance as the inflation situation shifts.In the U.S., the Federal Reserve has adopted the position that there is still work to be done, and it appears to have the resolve to stick with it.”

For the balance of this blog, we’ll drill down on the report’s prognosis for Canada, which starts on page 23 of the forecast. We’ve selected large chunks of text, which is as it appears in the report, with minor excisions such as references to some charts not reproduced here. Therefore, we are not using quotation marks. An ellipsis (3 dots as here: …) is used to indicate sections excised between passages. With one or two exceptions, most subheadings are from Vanguard. Readers who want the full report should of course click on the PDF link above.

Canada: Reining in an overheating economy

The year 2022 has seen persistent global inflation followed by rising policy rates as central banks across the world played catch-up. Over the course of 2022, inflation in Canada continued to tread higher driven by a combination of rising demand, tightening labor markets, and volatile energy and food prices as a result of ongoing supply constraints and geopolitical events. Heading into 2023, there are growing signs that inflation will moderate due to recovery in global commodity supply and slowing economic growth driven by tightening monetary policy.

In 2022 we discussed how policy tightening will be a crucial risk behind a lower growth environment among other factors such as high inflation, further supply disruptions, and new virus variants. Looking back most of these risks occurred throughout the course of 2022. The unexpected Russian invasion of Ukraine added to supply disruptions and pushed headline CPI inflation to its historically highest level of 7.9% YoY.

However, despite rising prices, demand remained strong through the first half of 2022. During that period, Canadian real GDP grew by just above 3% and the unemployment rate fell from 6.5% to historical lows of 4.9%. With high and rising inflation and tight labor markets, the Canadian economy showed signs of overheating. In response, the Bank of Canada quickly enacted a series of higher than normal rate hikes starting in late Q1, 2022, bringing the monetary policy rate to 4.25%, well into restrictive territory. …

While financial tightening has already driven gradual slowdown in the economy relative to the pre-pandemic growth trajectory, the full impact of monetary policy tightening will only become apparent next year. That said, the most recent GDP data for Q3, showed that real GDP grew at a quarter-on-quarter annualized rate of .9%, stronger than many expected.

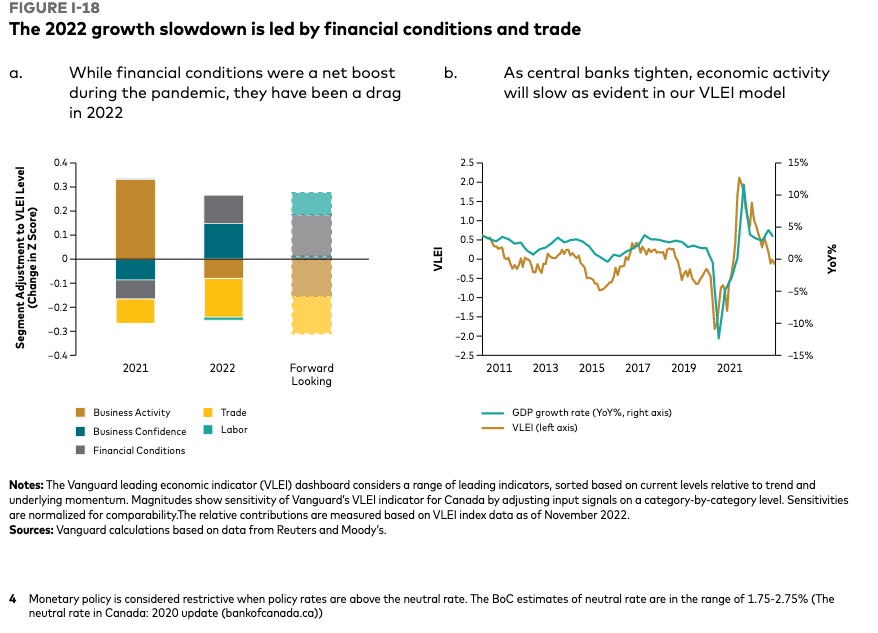

In 2023 we expect the Canadian economy to grow at only 0.7%. By the end of 2022 tightening financial conditions and a global slowdown in demand had already become a drag on growth offset by still strong labor market and more optimistic business sentiment. (Figure I-18a above.) However, as we head into next year, we expect growth to slow further as business sentiment catches up with the pessimism seen in financial conditions and trade. (Figure I-18b.) Rate sensitive sectors such as construction and manufacturing account for around 17% of employment in Canada and will likely experience significant impact from slowing demand.

Through 2022, Canadian labor markets have been considerably tight, as highlighted by multiple key metrics … In contrast with the U.S., however, participation rates have held strong in Canada through 2022, rebounding quickly after a brief dip at the onset of the pandemic. Looking ahead, we expect unemployment rates to rise due to both supply and demand factors. On the supply side, some labor tightness has already begun to unwind in tandem with improvement in supply chain shortfalls. The most recent Bureau of Statistics survey in Q3 2022 reveals a concurrent plateauing of labor and supply-chain driven bottlenecks across sectors. Even though current wage inflation remains elevated, forward looking wage inflation expectations have begun to dip.

As both global and domestic demand is expected to slow down in 2023, employment demand will likely follow suit. With ongoing post-pandemic transition of consumption from goods into services, however, service industry employment may remain stable despite deteriorating overall labor conditions. Especially in sectors such as accommodation and food services, technical services, and recreational services which have< maintained particularly low labor saturation relative to a resurgence in industry employment demand …

Meanwhile, certain segments of the labor market such as in educational services, financial services, and trade services may deteriorate substantially. Historically, jobs in manufacturing, construction, trade services, and transportation have had the highest cyclical exposure to economic growth and significant sensitivity to higher interest rates. In the current rising rate environment, employment in these sectors has already begun to stagnate and could decline further as conditions worsen …

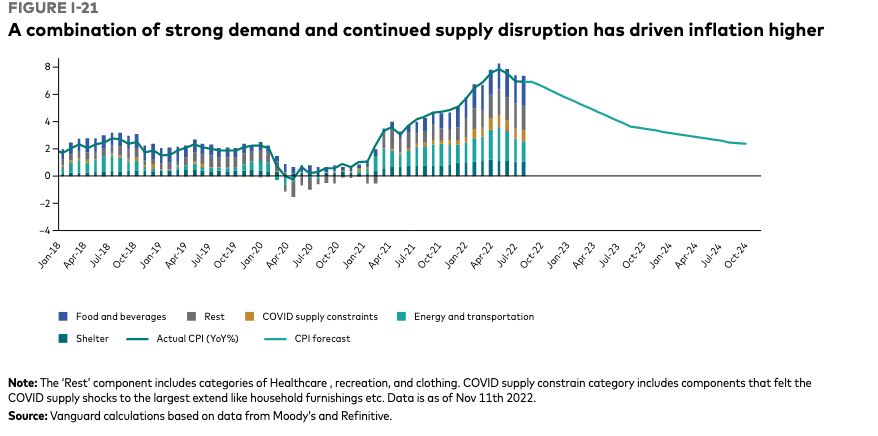

… Inflation has risen at historically high rates throughout 2022, first in specific goods components and then later in services. Goods inflation drove higher due to a combination of pandemic and geopolitical supply disruptions alongside robust consumer demand. As COVID restrictions were lifted demand for services recovered and the shortage of labor supply added fuel to the fire pushing headline inflation to 7.9% by mid-2022.

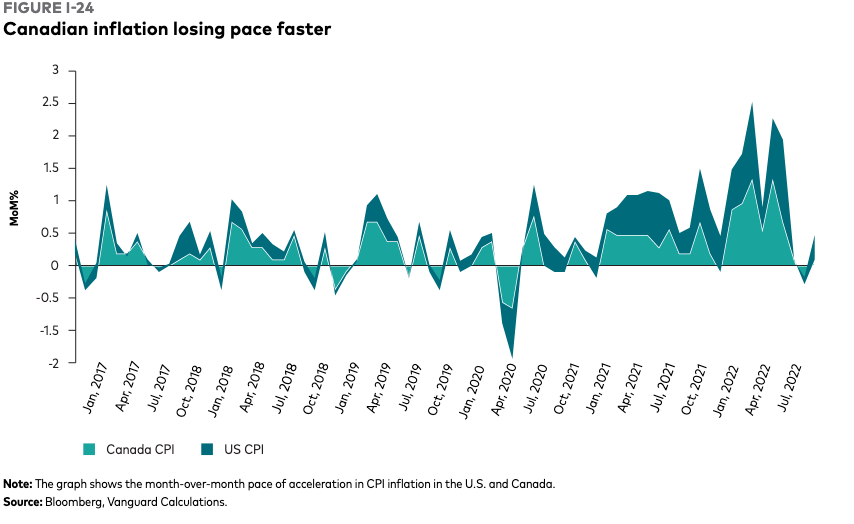

… As we move into 2023, we expect inflation in Canada to trend lower. (Figure I-21) Cumulative impact of monetary and fiscal tightening on growth is already evident and should lower tension in labor and commodity markets, allowing inflation to head towards the BoC’s target inflation range. Canadian households are more leveraged than most of their developed market peers, which increases the possibility of a substantial drop in consumption in response to rising rates relative to other developed economies.

Housing accounts for 30% of Canada’s inflation

… Housing, which forms about 30% share of Canada’s inflation index, is another component that will drive inflation lower through 2023. Within shelter inflation the sub-component of owned accommodation inflation is driven by a combination of home prices and mortgage interest rates. While mortgage rates remain elevated currently, as inflation nears BoC’s target range in 2023, the likelihood of further rate hikes will decrease. This may help temper Canadian interest rate swap prices down and hence fixed mortgage rates lower, acting as a drag on inflation. Moreover, home sales have already started to decline, and we expect they will continue to fall, putting further downward pressure on inflation.

Overall, the combination of a global slowdown, impact of monetary tightening on consumption and the housing sector, and normalizing supply chains will likely contribute to bringing inflation lower during 2023. The Canadian residential real estate market has faced considerable supply pressure throughout the pandemic which caused average home prices to jump by 33% from March 2020 to March 2022.