While the traditional 60/40 balanced portfolio has suffered its worst year in decades, and Recession is likely in 2023, the Vanguard Group is optimistic that balanced portfolios will thrive beyond 2023 and over the rest of the decade.

While the traditional 60/40 balanced portfolio has suffered its worst year in decades, and Recession is likely in 2023, the Vanguard Group is optimistic that balanced portfolios will thrive beyond 2023 and over the rest of the decade.

“A balanced portfolio still offers the best chance of success,” is one of the top conclusions that will be unveiled Monday: Vanguard Canada is hosting its Economic and Market Outlook for 2023, with a global virtual press conference scheduled at 11 AM [Dec. 12]. It includes Vanguard economists such as Global Chief Economist Joe Davis.

Below, received last week under embargo, are highlights of a report titled Vanguard Economic and Market Outlook for 2023: Beating back inflation. It runs about 60 pages, including numerous charts.

The text below consists mostly of excerpts from the Vanguard report, with the use of an ellipsis to indicate excisions, so there are no passages in quotation marks. Subheads are also taken from the original document. Apart from a handful of charts reproduced below, references to numerous other charts or graphs have been removed in the excerpts selected below.

Base case for 2023 is Disinflation

Our base case for 2023 is one of disinflation, but at a cost of a global recession. Inflation has likely already peaked in most markets, but reducing price pressures tied to labor markets and wage growth will take longer. As such, central banks may reasonably achieve their 2% inflation targets only in 2024 or 2025.

Consistent with our investment outlook for 2022, which focused on the need for higher short-term interest rates, central banks will continue their aggressive tightening cycle into early 2023 before pausing as inflation falls. As such, our base case has government bond yields generally peaking in 2023. Although rising interest rates have created near-term pain for investors, higher starting rates have raised our return expectations for U.S. and international bonds. We now expect U.S. and international bonds to return 4%–5% over the next decade.

Equity markets have yet to drop materially below their fair-value range, which they have historically done during recessions. Longer term, however, our global equity outlook is improving because of lower valuations and higher interest rates. Our return expectations are 2.25 percentage points higher than last year. From a U.S. dollar investor’s perspective, our Vanguard Capital Markets Model projects higher 10-year annualized returns for non-U.S. developed markets (7.2%–9.2%) and emerging markets (7%–9%) than for U.S. markets (4.7%–6.7%).

Global inflation: Persistently surprising

Our base case is a global recession in 2023 brought about by the efforts to return inflation to target … growth is likely to end 2023 flat or slightly negative in most major economies outside of China. Unemployment is likely to rise over the year but nowhere near as high as during the 2008 and 2020 downturns. Through job losses and slowing consumer demand, a downtrend in inflation is likely to persist through 2023. We don’t believe that central banks will achieve their targets of 2% inflation in 2023, but they will maintain those targets and look to achieve them through 2024 and into 2025 — or reassess them when the time is right. That time isn’t now.

Global fixed income: Brighter days ahead

The market, which was initially slow to price higher interest rates to fight elevated and persistent inflation, now believes that most central banks will have to go well past their neutral policy rates — the rate at which policy would be considered neither accommodative nor restrictive — to quell inflation.

Rising interest rates and higher interest rate expectations have lowered bond returns in 2022, creating near-term pain for investors. However the bright side of higher rates is higher interest payments. These have led our return expectations for U.S. and international bonds to increase by more than twofold. We now expect U.S. bonds to return 4.1%–5.1% per year over the next decade, compared with the 1.4%–2.4% annual returns we forecast a year ago. For international bonds, we expect returns of 4%–5% per year over the next decade, compared with our year-ago forecast of 1.3%–2.3% per year.

Global equities: Resetting expectations

The silver lining is that this year’s bear market has improved our outlook for global equities, though our Vanguard Capital Markets Model (VCMM) projections suggest there are greater opportunities outside the United States.

Stretched valuations in the U.S. equity market in 2021 were unsustainable, and our fair-value framework suggests they still don’t reflect current economic realities.

Although U.S. equities have continued to outperform their international peers, the primary driver of that outperformance has shifted from earnings to currency over the last year. The 30% decline in emerging markets over the past 12 months has made valuations in those regions more attractive. We now expect similar returns to those of non-U.S. developed markets and view emerging markets as an important diversifier in equity portfolios.

Within the U.S. market, value stocks are fairly valued relative to growth, and small-capitalization stocks are attractive despite our expectations for weaker near-term growth. Our outlook for the global equity risk premium is still positive at 1 to 3 percentage points, but lower than last year because of a faster increase in expected bond returns

Figure I-3 outlines our projected probabilities of a recession along with the likely forces that tip the economy into recession.

… Only in 2001 was the probability of global recession as high as it is today without an actual recession taking place within the subsequent 12 months. From this we infer that the chances of a global recession in 2023 are very high.

Today, policymakers face a threat from global inflation brought on by a combination of a strong post-COVID recovery, lingering supply- chain disruptions, the war in Ukraine, and overly accommodative fiscal and monetary policy. In response, monetary policy has begun to swing toward restrictive conditions, much as it did during the 1980s … though on a more coordinated scale.

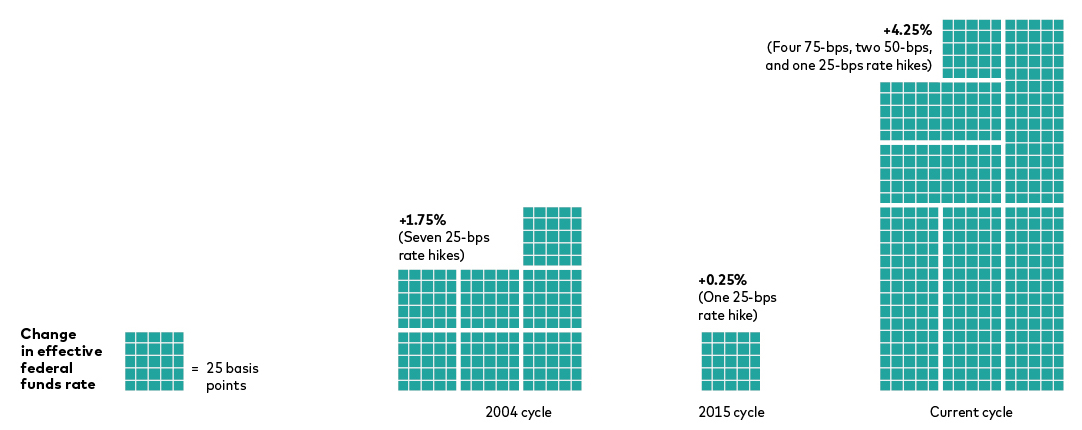

United States: A narrow path gets narrower

Economic outcomes in the U.S. for 2023 — much like in the rest of the developed world — will be dominated by monetary policy efforts to accelerate the path of inflation back to target. Growth slowed materially in 2022, but inflation has remained stubbornly elevated and the labor market strong. Further slowdowns in growth and a weakening of the labor market are necessary conditions for disinflation. Figure I-13 [shown below] illustrates the rapid rise in the policy rate over the last four quarters and relative to previous cycles.

Figure 1-13: The pace of rate hikes in 2022 has been historic

Compared with recent history, the current monetary tightening cycle is historic and leaves the narrowest of paths for the economy to escape without a period of recession.

Euro area: The European Central Bank (ECB) will continue to tighten despite recession

Inflation and the policies enacted to address it have played a large role in shaping the economic conditions in the euro area. The war in Ukraine added another layer of uncertainty, volatility, and price pressures in 2022. Activity held up well in the first half of the year, supported by a strong post-pandemic recovery. Growth momentum, though, slowed sharply in the second half as higher energy prices, tighter financial conditions, depressed sentiment, and weakening global growth all weighed on the economy. We expect euro-area GDP growth to slow from 2.5%–3% in 2022 to 0% in 2023.

Looking ahead, we are encouraged by Europe’s flexibility in adapting to the sharp reduction in Russian gas imports. Over 90% of its gas storage capacity has been filled, helped by additional imports from other pipeline and liquefied natural gas suppliers, and efforts have been made to use alternative energy sources in some industries. This should help soften the blow.

In our base case, we expect that the euro-area economy will have entered recession from the fourth quarter of 2022, with growth turning positive only in the second half of 2023. We anticipate that Germany and Italy will underperform, given their relatively large energy-intensive industrial sectors.

China: A cyclical bounce meets a structural downturn

As in major developed economies, policy has played and will play a large role in economic outcomes in China, but for different reasons. China’s economic fortunes are governed by what we have termed an “impossible trilemma,” in which policymakers must balance three competing priorities: maintaining a zero-COVID policy (ZCP), ensuring financial stability, and sustaining strong levels of economic growth. In 2022, policymakers focused on upholding ZCP and ensuring financial stability at the cost of growth. As a result, we forecast GDP growth to end 2022 at around 3%, well below the historical average and official targets of 5.5%. In 2023, we expect that policymakers’ focus is likely to gradually shift away from maintaining a strict ZCP toward achieving slightly stronger economic growth levels.

This will most likely result in a cyclical bounce in 2023 of 4.5% GDP growth, driven by gradual loosening of ZCP and a stabilizing real estate sector.

Emerging markets: Headline growth resilience meets underlying economic divergence

The story of emerging markets (EM) in 2022 has been one of remarkable resilience despite myriad macroeconomic shocks. Although food and energy prices rose, financial conditions tightened significantly, and Chinese growth disappointed, EM growth, foreign exchange, and inflation have not underperformed developed markets. However, the relative headline resilience masks the regional divergence ….

We expect EM growth of 3.4% in 2023 to significantly outperform developed-market growth of 0.3%, but we are likely to see notable divergence once again across regions. While Asia will benefit from a cyclical bounce in China and falling inflation, EM Europe will continue to face inflation pressures from uncertain energy supply and a weak European growth backdrop. In Latin America, growth is likely to disappoint consensus as U.S. growth slows materially in 2023, prompting central banks to adjust policy rates down from very high levels

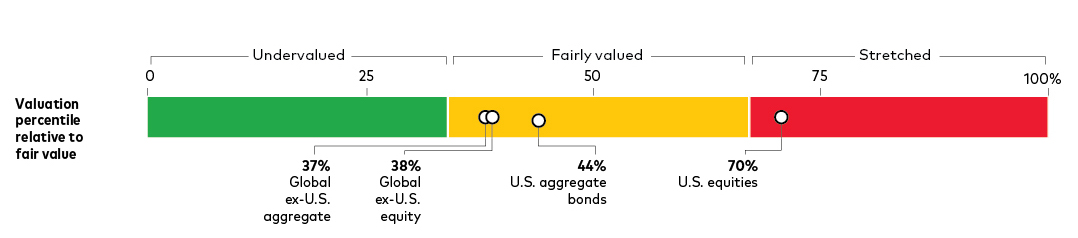

Global capital markets outlook

Looking ahead, our return outlook — which has been on a steady downward trajectory since 2009 — is ticking up. This is especially true in fixed income, where our U.S. and international bond forecasts are more than two times higher than they were a year ago. In equities, U.S. valuations are more attractive than they were last year but are still above our estimate of fair value. International equities, however, are at the low end of our fair-value estimates

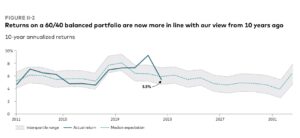

Returns on a 60/40 balanced portfolio are now more in line with our view from 10 years ago

FIGURE II-2 … [shown at the top of this blog] shows that our outlook for global stocks and bonds has reversed its downward trend in the last decade. This higher return outlook is in large part because of higher interest rates to fight inflation, which caused asset price declines through the equity valuation and bond yield channels. These forces also raised expectations for the next decade, because yields on developed-market sovereign debt are the foundation on which other risky returns are built.

Global fixed income markets: Sowing the seeds for brighter days ahead

The pain of rising interest rates has been felt most acutely in global fixed income markets. Both the Bloomberg U.S. Aggregate Bond Index and the Bloomberg Global Aggregate ex-USD Index have declined more than in any 12-month period in their histories, down 14.6% and 9.9%, for the year ended September 30, 2022 respectively.

Rising interest rates created near-term pain, but have raised our long-term forecast

Although rising interest rates have created near-term pain for fixed income investors, we expect that those with sufficiently long investment horizons will be better off in end-of- period wealth terms by the end of the decade than if they had just realized our return forecast from the end of last year … This is because of the effect of duration. When interest rates rise, bonds re-price lower immediately. However, cash flows can then be reinvested at higher rates. Given enough time, the increased income from higher coupon payments will offset the price decline, and an investor’s total return should increase.

Global equity markets: Normalizing return outlook

The sell-off in equity markets this year has been indiscriminate. U.S., developed ex-U.S., and emerging-market equity indexes have all posted losses greater than 20% in the last nine months. Valuation declines were more pronounced in U.S. markets, but a strengthening dollar meant U.S.-based investors realized larger losses on their unhedged international equity exposures than on their local ones. Even though this is negative from a short-term, realized-return perspective, it means that the global opportunity set is now more attractive than it was a year ago.

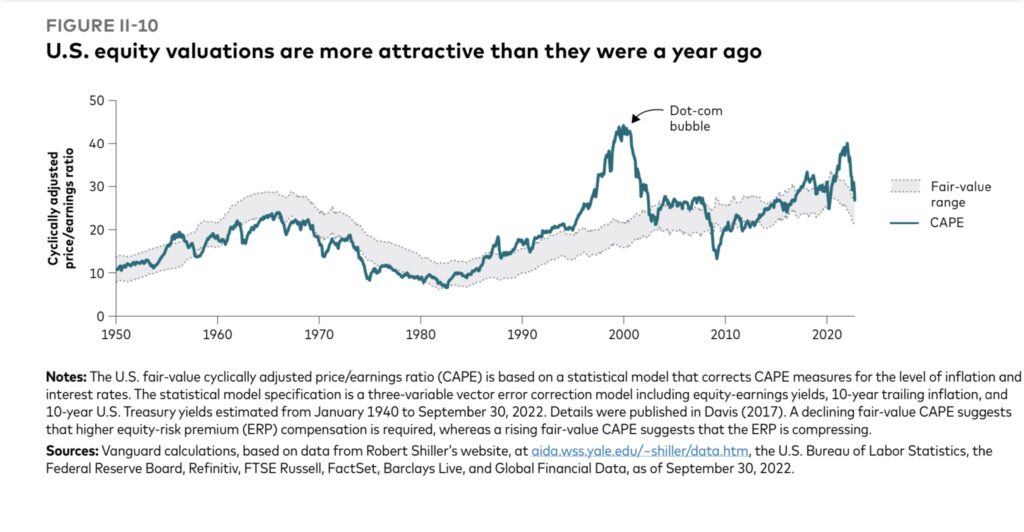

U.S. equity valuations are more attractive than they were a year ago

We expect U.S. earnings growth to average 5% per year over the next decade, which is slightly below the 6.4% that investors experienced over the last decade.

After value’s resurrection, the risks are more balanced

In the U.S. market, the return of value investing has been a notable narrative that has continued in 2022. Unlike in the first quarter of 2021, value’s outperformance over the last 12 months has had more to do with growth’s relative weakness than value’s relative strength.

The one part of the U.S. market where our fair-value frameworks see some opportunity is in small-caps, albeit to a much smaller degree than we saw in value last year.

Although more favorable valuations have improved our outlook for U.S. equities compared with last year, we still caution investors against expecting returns similar to the 11.7% per year they experienced in the last decade. In addition to our expected 5% annualized earnings growth, we expect dividend yields to average 1.9% per year (in line with the last decade) but valuations to contract 1.2% annually. All told, these factors underpin our forecast for U.S. equities to return 4.7%–6.7% annually.

International equities: More value with less growth

U.S. equities have outperformed their global peers by a very wide margin over the last decade. On a cumulative return basis, a portfolio of U.S. stocks bought in 2012 is worth twice as much as a portfolio of international stocks bought in the same period. Although many reasons have been cited for this outperformance — stronger U.S. growth, a less uncertain economic environment, and the sector composition of the U.S. market — our framework focuses on the durable sources of outperformance. To that end, we believe that the valuation-based expansion in U.S. equities is sowing the seeds for lower returns in the decade ahead. Our outlook is positive for international equities despite our view that the U.S. will have higher earnings growth, though we may need to see a weaker dollar for international outperformance to be sustained.

An improved return outlook and consistent diversification benefits from emerging markets

Within international markets, our fair-value framework shown in Figure II-15 suggests that emerging markets are attractively valued for the first time since the pandemic.

Our outlook suggests that emerging markets should return between 7% and 9% (2.3 percentage points higher than U.S. equities) over the next decade. Further, emerging-market equities still have a lower correlation with U.S. equities than developed ex-U.S. markets and a higher inflation beta to U.S. inflation. For these reasons, we believe that a balanced allocation to emerging- market equities plays an important role in investors’ portfolios.

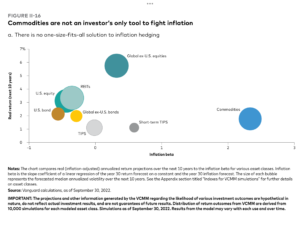

Inflation hedging is a multidimensional problem

There is no one-size-fits-all solution to inflation hedging — it depends on an investor’s objectives, investment horizon, and risk tolerance.

Figure II-16a breaks down the inflation-hedging properties of major asset classes across these three dimensions.

For investors looking to generate a positive real return over a very long horizon, equities — especially nonlocal ones — provide the best probability of beating inflation … Investors with a shorter investment horizon may prefer to maintain their purchasing power by matching inflation. To this end, traditional inflation hedges such as TIPS and commodities are useful. These securities, however, can introduce a real-return drag on the portfolio if they are held for extended periods. Commodities can also introduce high volatility, which could be incongruent with a shorter investment horizon.

Commodities are not an investor’s only tool to fight inflation

There is no one-size-fits-all solution to inflation hedging … to realize the full benefit of commodities as an inflation hedge, investors must be able to time their entry into and exit from the position or accept a persistent return drag because of a lower Sharpe ratio for commodities than for U.S. and international equities.

A balanced portfolio still offers the best chance of success

This TVAA strategy breaks down the major asset class into smaller sub-assets to provide additional portfolio tilt benefits. On the domestic equity front, we see a tilt toward the value factor given favorable risk and return characteristics. Within international equities, there is an equal allocation to emerging markets and developed (ex-U.S.) markets given emerging markets’ lower correlation with U.S. equities.