By Penelope Graham, Zoocasa

By Penelope Graham, Zoocasa

Special to the Financial Independence Hub

It has now been four full months since Guideline B-20 – a slew of new mortgage qualification requirements – hit Canada’s borrowers in the wallet.

Under the new regulations, those applying for a new mortgage, and who are paying at least 20 per cent down on their home purchase, must qualify at either the Bank of Canada’s benchmark rate (currently 5.14 per cent), or their mortgage contract rate plus 2 per cent, whichever is higher. While the mortgage payments will be made at the borrower’s actual rate, this is the government’s way of shock-proofing lending, ensuring borrowers can still make their payments should rates rise exponentially.

Experts have stated that Guideline B-20 would slash the average home buying budget by 20 per cent, and knock as many as 10 per cent of buyers out of the market altogether. Market conditions have proven softer in the months following the new rule, with national prices falling 10.4 per cent in March, and an exodus from more expensive home types to the lower end of the market, such as condos for sale in Toronto.

But have they truly dissuaded Canadian home buyers from entering the real estate market?

To find out, Zoocasa polled just over 1,400 Canadians from all provinces, as part of the second-annual Housing Trends Survey. Respondents were asked for their sentiments and experiences as a result of B-20, and the overall rising interest rate environment.

Majority not impacted by Stress Test

According to the data, the majority of recent home buyers have withstood the introduction of Guideline B-20 unscathed; of those who purchased a home between October 2017 (when the new rules were first announced) and March 2018, 48 per cent say there was no change whatsoever to their buying timeline.

However, 27 per cent reported they rushed their purchase as a result, while 6 per cent delayed buying. An additional 19 per cent who bought homes weren’t actually aware of the new mortgage rules at all.

However, 27 per cent reported they rushed their purchase as a result, while 6 per cent delayed buying. An additional 19 per cent who bought homes weren’t actually aware of the new mortgage rules at all.

Also, the impact has been more significant on those who have no yet purchased their home: while 40 per cent stated B-20 hasn’t changed their mind about buying, 15 per cent will delay their home purchase, and a full 15 per cent now feel homeownership is out of reach altogether.

A total of 5 per cent reported they no longer wish to buy a home as a result of Guideline B-20.

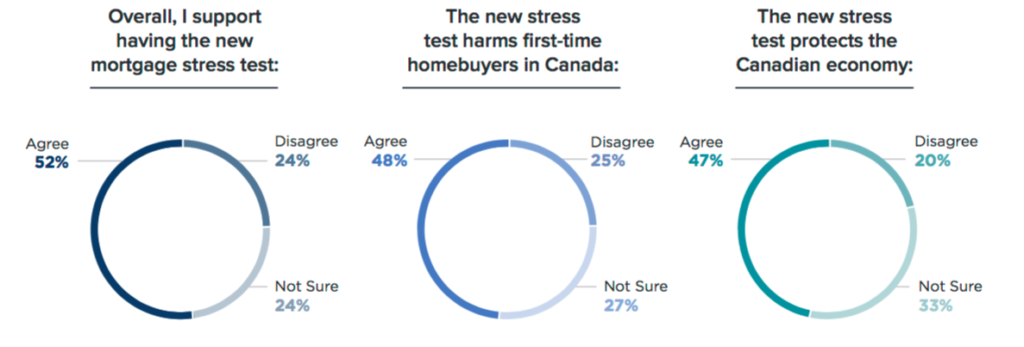

Despite this, support for the new mortgage regulation is strong, with 52 per cent of respondents indicating as such (24 per cent disagree, while 24 per cent are not sure). The majority of Canadians also feel the rule is helping protect the national economy with 41 per cent in agreement, 20 per cent disagreeing, and 33 per cent not sure.

Borrowers remain confident as rates rise

Respondents also seem adaptive to rising interest rates in general; as of last July, the Bank of Canada has increased its trend-setting Overnight Lending rate three times, to its current 1.25 per cent. This in turn impacts consumer lenders’ Prime rates, and, directly, the mortgage rates of variable product rate holders. However, this upward movement is also reflected in the fixed borrowing market, as five-year government of Canada bond yields rise above 2 per cent – the highest level in over five years. This has prompted TD, CIBC, RBC, and National Bank to increase their five-year posted rates between 15 and 45 basis points.

However, 56 per cent of respondents say they’re not phased by the BoC’s upward trend, indicating it had no impact on their purchase timeline. A total of 28 per cent, though, have pushed to purchase a home sooner, while 9 per cent have delayed buying (and 7 per cent weren’t aware that rates were rising at all).

Of prospective buyers, 40 per cent say increasing mortgage rates won’t impact their purchase, while 22 per cent would delay buying their property, and 13 per cent wish to buy their property sooner. However, 18 per cent now feel homeownership is out of reach, while 9 per cent don’t wish to buy a property at all as the result of rising interest rates.

While always a vital step in any home buying journey, obtaining a pre-approval before checking out those Toronto real estate listings is more important than ever in a rising rate environment: it effectively secures a rate that’s likely to be more competitive than pricing in the near future. A pre-approval can also remove some of the resulting price shock from the stress test, giving buyers a clear idea of their budget ceiling, and what is realistic within the realm of their affordability.

While always a vital step in any home buying journey, obtaining a pre-approval before checking out those Toronto real estate listings is more important than ever in a rising rate environment: it effectively secures a rate that’s likely to be more competitive than pricing in the near future. A pre-approval can also remove some of the resulting price shock from the stress test, giving buyers a clear idea of their budget ceiling, and what is realistic within the realm of their affordability.

Penelope Graham is the Managing Editor of Zoocasa.com, a leading real estate resource that uses full brokerage service and online tools to empower Canadians to buy or sell their home faster, easier, and more successfully.

Penelope Graham is the Managing Editor of Zoocasa.com, a leading real estate resource that uses full brokerage service and online tools to empower Canadians to buy or sell their home faster, easier, and more successfully.