Over the course of the Covid pandemic the past year, almost two thirds of Canadians (63%) did not put aside anything for retirement, up from 58% last year, according to a study being released today.

Over the course of the Covid pandemic the past year, almost two thirds of Canadians (63%) did not put aside anything for retirement, up from 58% last year, according to a study being released today.

That’s according to the third annual Canadian Retirement Survey from Healthcare of Ontario Pension Plan (HOOPP) and Abacus Data.

Not surprisingly, the survey also found a widespread belief that better access to workplace pensions is needed to avoid a retirement crisis.

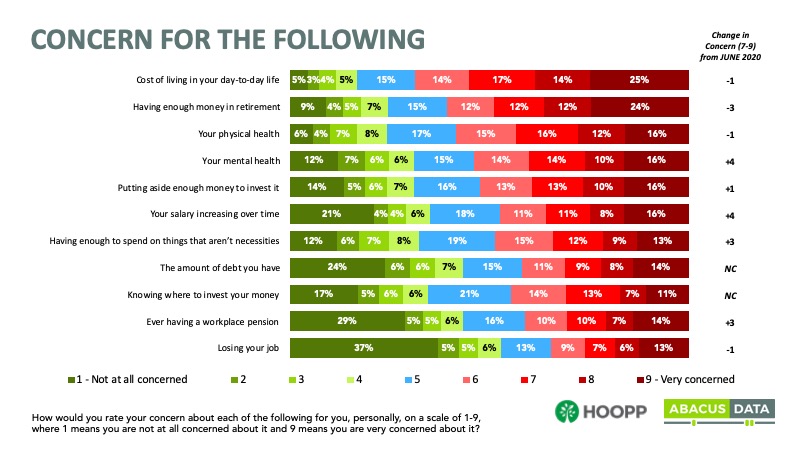

The findings, based on an April 2021 survey of 2,500 Canadians, affirm there is a high level of anxiety about ability to save for retirement. Half (48%) said they are “very concerned” about not having enough money in retirement. That was more than the concern for one’s own physical health (44%), mental health (40%), debt load (31%) and job security (26%). Only the daily cost of living was a greater concern than Retirement.

“After more than a year of COVID-19, Canadians remain steadfast in their personal and societal concerns around retirement security,” said Steven McCormick, SVP, Plan Operations, HOOPP in a press release [pictured on right]. “As day-to-day financial pressures mount for some and ease for others, Canadians across the board are acutely aware of the importance, and challenge, of saving for retirement.”

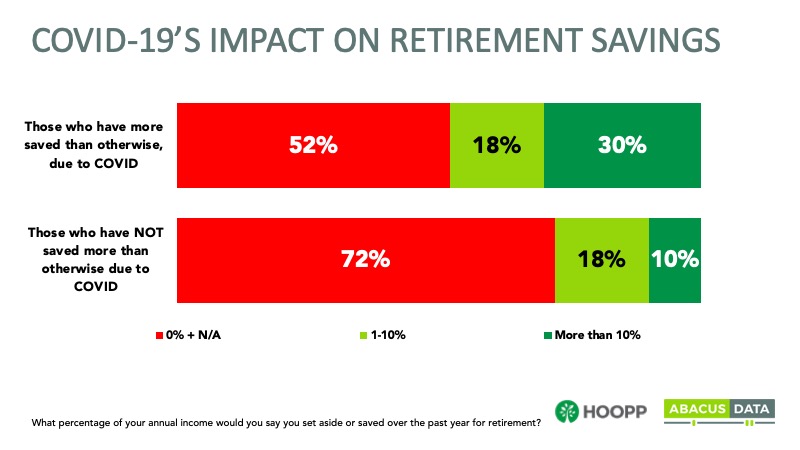

While 46% of Canadians said they saved more money during COVID than they otherwise would have, more than half (52%) set aside nothing for retirement during the past year. Of those who said they saved less than usual, 72% saved nothing for retirement.

McCormick added: “HOOPP is proud to do its part by providing retirement security to healthcare workers, many of whom fall into groups that often don’t have access to pensions, such as women, part-time workers and younger Canadians. For our membership, the impacts of this pandemic will continue to be felt even after we emerge from the immediate crisis; but they can take some comfort in knowing their pension is secure.”

Covid disproportionately hurt finances of younger low-income groups

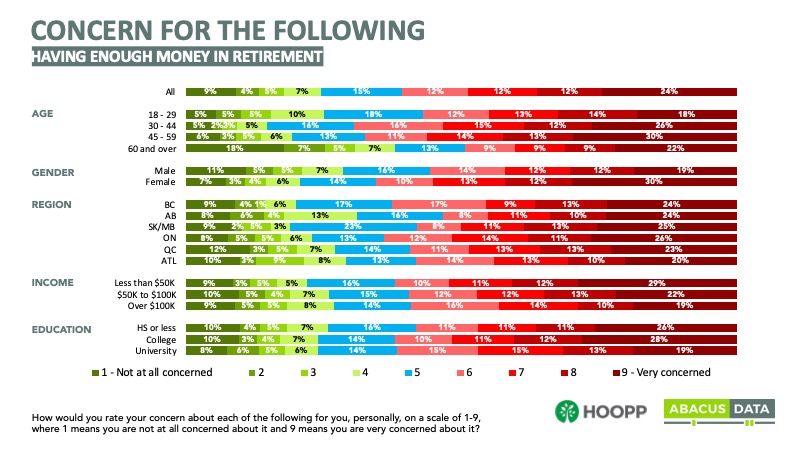

The COVID-19 pandemic harmed the finances of half of Canadians (52%) and did so disproportionately amongst younger and lower-income groups. Those aged 44 and younger are twice as likely to have had their finances greatly harmed (24%) than those 60+ (11%). Likewise, those earning less than $50,000 are twice as likely to have had their finances greatly harmed (25%) than those earning $100,000+ (12%).

“The pandemic has exacerbated the divide between those who can save for retirement and those who can’t,” said Abacus Data Chief Executive David Coletto [pictured left]. “Those who are the least likely to save – younger and lower-income Canadians – were the hardest hit by the health crisis. This year’s results also show widespread agreement that employers can play an important role in making saving for retirement more affordable.”

Regardless of current finances or COVID, there are widespread and consistent concerns about having enough money for retirement. Of those making $50,000 or less, 52% said they were very concerned; even among those making more than $100,000, a full 42% said they were very concerned. When asked why they hadn’t saved for retirement, the most common response was living paycheque to paycheque, with one in three (36%) identifying with this reality.

The results again confirm that Canadians continue to think long-term and big picture on retirement issues. Two-thirds (67%) agree there is an emerging retirement crisis and 65% said that saving for retirement is prohibitively expensive.

Recognition of ongoing need for Workplace pensions

For the third straight year, Canadians also widely recognize that workplace pensions are key to the solution:

- 71% are willing to forgo a higher salary for a (better) pension plan. (74% last year)

- A strong majority believe all workers should have access to affordable (85%) and efficient (84%)retirement savings arrangements. (85% and 86% respectively last year)

- 77% say employers have a responsibility to offer a pension plan. (76% last year)

- 75% agree that without good pensions in place, the economy will suffer; and 74% said that, inthe absence of good workplace pensions, individuals will become a burden on taxpayers. (77% and 76% respectively last year)

These findings, consistent with prior years, point to a clear desire among Canadians for greater access to workplace pensions,” said McCormick. “As business leaders and decision-makers plan for our post-COVID ‘new normal,’ it’s clear that Canadians would strongly support improvements to retirement security for everyone.”

The survey was conducted between April 19 and 27, 2021. The margin of error is + / – 1.96, 19 times out of 20.