By Graham Chevreau

Special to the Financial Independence Hub

Rocco Galati Versus the Bank of Canada

“I have a firm basis to believe that the Government has requested or ordered the mainstream media NOT to cover this case,” said Consitutional Lawyer Rocco Galati after winning his latest battle in the Federal Court of Appeal on January 26, 2015. He went on to say: “This case is on solid legal and constitutional grounds. It should win, but not all meritorious cases win in our judicial system.”

Mr. Galati was speaking about his recent success in Federal court, where three judges have ruled that the case against the Governor of the Bank of Canada and the Finance Minister of Canada can proceed. As described in my January 21, 2015 article, Rocco Galati on behalf of the Council of Monetary and Economic Reform (COMER) has brought a legal action against the Bank of Canada and the Finance minister for, amongst other charges, failing to give interest-free loans to the Federal and Provincial governments, (which was the reason the Bank of Canada was set up in 1937). The statement of claim also seeks to prove the Governor of the Bank of Canada and the Finance Minister have relinquished and abdicated their constitutional duty to govern under various provisions of the constitution act.

As noted above, when asked why many of his other cases get “wall to wall” coverage across the country, Mr. Galati explained why this present case is being covered by almost none of the mainstream media: “I have a firm basis to believe that the Government has requested or ordered the main stream media NOT to cover this case.”

We believe Canadians should be kept informed about what is transpiring in the Federal Courts.

Broad Strokes Description of the Lawsuit

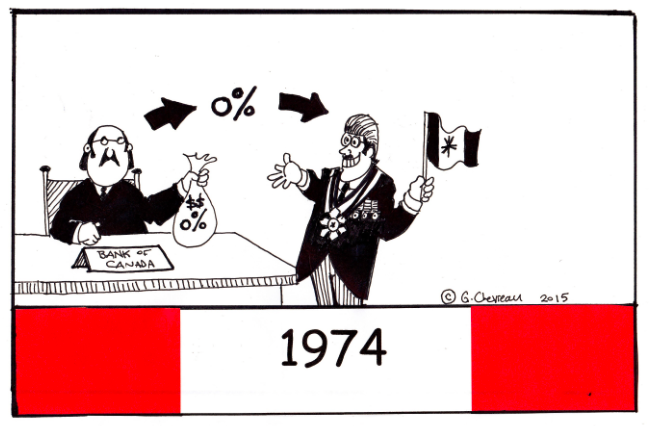

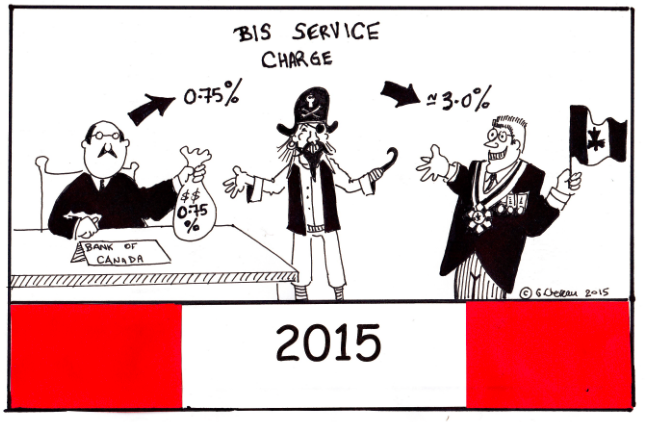

I should mention that the January 21, 2015 article was my first sojourn into the blogosphere and, based on feedback I have received, I have endeavoured to keep this current article as simple as possible. The following graphics are intended to illustrate the essence of the Bank of Canada lawsuit.

From 1937 until 1974, the Bank of Canada provided interest-free loans to the Government of Canada. During this period, the country was able, amongst other things, to construct the St. Lawrence Seaway, build the Trans Canada highway, pay off World War II debts, and finance the construction of Canada’s Colleges and Universities, all while keeping the national debt per capita less than 20 billion dollars.

1974 was the last year that interest-free loans were made to the Federal and Provincial governments. Then, at some point in 1974 (the precise circumstances are difficult to determine), operational control of the Bank of Canada was turned over to the Bank of International Settlements (BIS), a private central bank owned by the private banks of Europe and Great Britain. From 1974 until 2014 Canada’s national debt ballooned from $18 billion to approximately 620 billion dollars; of the $620 billion it is estimated that 75% or more is a result of interest paid to the Private Bank of International Settlements (BIS).

1974 was the last year that interest-free loans were made to the Federal and Provincial governments. Then, at some point in 1974 (the precise circumstances are difficult to determine), operational control of the Bank of Canada was turned over to the Bank of International Settlements (BIS), a private central bank owned by the private banks of Europe and Great Britain. From 1974 until 2014 Canada’s national debt ballooned from $18 billion to approximately 620 billion dollars; of the $620 billion it is estimated that 75% or more is a result of interest paid to the Private Bank of International Settlements (BIS).

The current arrangement between the Bank of Canada and the Private Banks, which are “branches” of the BIS, works like this:

- The Bank of Canada loans money to the BIS private banks at less than 1%.

- The private banks then lend it back to the Government of Canada with a markup; and

- the taxpayers pay the interest!

When asked for specifics as to how much and to whom at the BIS the interest is paid, Rocco informed us that the meetings attended by Governor of the Bank of Canada with the BIS are kept secret. Hopefully the details will emerge when the lawsuit goes to trial.

Mr. Galati summarized the lawsuit in the following simple terms:

Mr. Galati summarized the lawsuit in the following simple terms:

- The lawsuit seeks to challenge the Bank of Canada and the Minister of Finance for refusing to give interest-free loans to the Federal and Provincial Governments, which was the reason the Bank of Canada was set up in 1937.

- The lawsuit also seeks to challenge that the Bank of Canada and the Minister of Finance have relinquished and abdicated their constitutional duty to govern under various provisions of the constitution act.

- The lawsuit seeks to examine the budget process that currently allows what could be termed “sleight of hand” to conceal from parliament the full extent of taxes collected, or which could be collected but which are not, due to creative accounting by the use of transfers and tax credits.

- The lawsuit seeks to bring out into the light of day the details of the secret meetings attended by the Governor of the Bank of Canada at the BIS in Basel Switzerland, during which the Bank of Canada is given its “marching orders.”

Next Steps for the Lawsuit

Rocco Galati explained that the Crown has 60 days to appeal the January 26, 2015 Federal Court ruling to the Supreme Court. If there is no Crown appeal, the case then moves on to the Supreme Court.

Findependence.TV Coverage

You can find Findependence.TV’s coverage of Mr. Galati’s January 24, 2015 update on the background of the lawsuit at this link. In addition, you can also find Mr. Galati’s January 26, 2015 update on the Federal Court of Appeal’s judgement of the merits of the case at this link.

Stay tuned to Findependence Hub for updates, because you likely won’t find comprehensive coverage elsewhere.

Graham Chevreau is an EHS (Environment, Health and Safety) Management Consultant in Waterloo, Ontario, practicing as Chevreau Consulting Ltd. He is the only sibling of Hub CFO Jonathan Chevreau.