Here’s my latest MoneySense blog, entitled Why you should re-think Early Retirement. This is a topic I’ve been researching for several months, going back to some blogs I wrote on Mark Venning’s ChangeRangers.com, which challenges readers to “envision the promise of longevity.” He also sensibly counsels that we should “plan for Longevity, not for Retirement.”

As you can see by clicking through to the blog (also reproduced below), some of this message was articulated in a speech delivered Wednesday evening at the Financial Show, and which I also gave Monday night at the Port Credit chapter of Toastmasters.

By Jonathan Chevreau

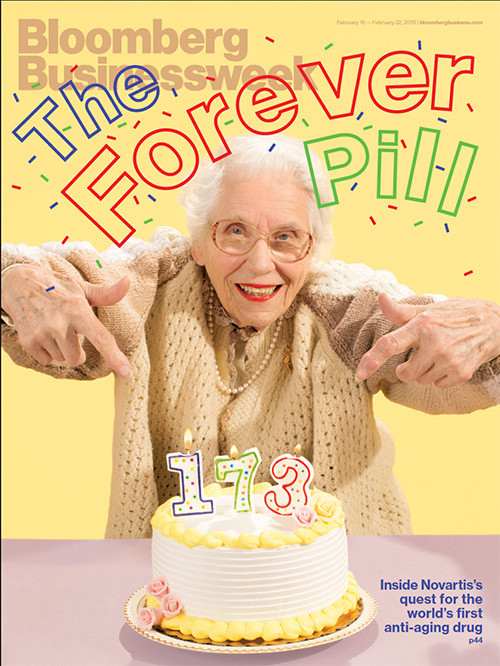

I recently delivered a talk about how longevity changes everything. I began by showing the front cover of the latest Bloomberg Business magazine, which shows a woman celebrating her 173rd birthday. It’s hypothetical of course, but describes a “forever pill” and scientific anti-aging research being undertaken by giant pharma companies like Novartis.

Nobody is saying such breakthroughs will occur in time to benefit aging baby boomers but it’s also true that more of them, and certainly the generations coming after them, will live to celebrate their 100th birthdays.

As we blogged last time here at MoneySense.ca, in reference to last week’s Unretirement survey by Sun Life Financial, I don’t find the general media’s topline finding that more Canadians expect to be working fulltime at age 66 than retired to be all that tragic. To the contrary, when I ran my speech past a couple of colleagues, they said they felt “inspired” when I got to the part about age 50 being possibly only the “half way” mark of life.

In the talk, I describe a 98 year old friend I call Minerva who still works two half-days a week so she can take monthly bus trips with her (younger) friends to places like Stratford and Niagara on the Lake.

I’ve mentioned Minerva in earlier blogs and while some readers argued she’s a statistical “outlier” I prefer to think she’s the canary in the coal mine about extended life expectancy and the need to stay active and possibly work at least part-time long past the traditional retirement age of 65.

Almost 6,000 centenarians in Canada

I have no doubt Minerva will live well past 100. In fact, almost 6,000 (5,825) Canadians were 100, according to the 2011 census. The number of centenarians is growing rapidly: one projection is that by the time the 1961 crest of boomers reach 100 in 2061 there will be 78,300 centenarians in Canada alone.

Note too that Minerva is a generation in front of the Baby Boomers. But in January, 2011 the first baby boomers born in 1946 started to turn 65 and according to Pew Research, 10,000 will turn 65 every day for the next 19 years.

Imagine the breakthroughs in longevity that may occur in the next few decades, some of which will happen in time for those boomers who have kept care of themselves.

Then consider the children of the boomers: the Millennials, or the generation X just before them. Does it make sense to “retire” in the classic sense at 65 or 67, or even worse, take “Early Retirement” in one’s late 50s? As I’ve said before, 40 years is a long time to go without a paycheque.

Greater longevity should be a blessing but it could become a curse if you run out of money before you run out of life. Even with traditional life expectations, near-retirees worry about outliving their money. Add in an unexpected five or ten more years, especially vibrant years where you’d like to spend a lot to travel, and you can see the extra financial pressure longevity can create.

The longer you live, the more you need financial planning

That’s where financial planning comes in. To me, a 50 year old making big money and who is on top of his career, is potentially only half way through life and the life cycle. One of the six blog sections of the Financial Independence Hub is called Encore Acts, which derives from a couple of books by Marc Freedman: Encore and The Big Shift.

I recently reviewed Freedman’s The Big Shift on the Hub. He suggests there’s a whole lot of life to be lived once you’ve left full time employment and before you enter Advanced Old Age. If you accept the premise that life expectancy is rising and will continue to do so, you should consider that this may also mean another long “Encore” stage that may last 20 years. Take a typical 57-year old corporate middle manager considering Early Retirement, perhaps with enticements from cost-cutting senior managers. It’s quite conceivable that he or she will decide to embark on a 15-year Encore Career that will go on until age 72, perhaps with the former employer as one of several clients.

While this site’s focus is on Financial Independence, remember that only half of that phrase is about money. I believe in establishing some level of “Findependence” so you have the financial resources as well as the personal freedom to pursue goals that can not always be accommodated within the average corporate situation.

It’s about life purpose, not money per se

Ultimately, it’s not just about money but about being engaged and understanding and fulfilling your life purpose. If you’ve not read Rick Warren’s book, The Purpose Driven Life, you should. Retirement or Findependence is just a means to an end: the end isn’t to do nothing; it’s to find your passion. Once you do, you won’t be obsessed with reaching the age of 66 so you can stop working. You’ll see yourself as only two thirds of your life over, with the best still to come.