By Ahmed Farooq, Franklin Templeton Canada

By Ahmed Farooq, Franklin Templeton Canada

(Sponsor Content)

Many advisors I speak with continue to struggle with the increasing complexities of today’s fixed-income environment and are looking for guidance. The combination of interest rate fluctuations, inflation threats, trade tensions and political upheavals is a challenging environment to make the right call for their clients’ portfolios. There is a real concern that volatility is on the horizon and fixed-income mandates will be needed to provide that cushioning to the overall portfolio.

Active management may be the best way for advisors to navigate this market. For advisors who want an expert’s opinion when it comes to managing future interest rates, credit quality or duration calls in their fixed-income allocation, I like to remind them that this is something that may be best left to a manger who can effectively deal with these factors and risks.

The trend towards active continues

This trend of more advisors switching to actively managed fixed income solutions can be seen in monthly ETF inflow reports over this past year. Within the world of fixed-income ETFs, actively managed products have seen the biggest area of growth. For example, National Bank of Canada’s January 2020 ETF Research & Strategy Report showed that at the end of January, the total AUM of fixed-income ETFs was $73.4 billion in Canada. Of that $22 billion was put into actively managed funds, which now amounts to nearly a third of all fixed-income ETFs.

Active strategies seek to achieve a specific investment outcome

The goal of passive indexing strategies is to minimize tracking error to the index, maintain index exposure by either fully replicating the index or though a stratified sampling approach; one thing a passive investment cannot do is adjust to any type of market events. This can certainly be a headache for most advisors as the onus on making any changes to their portfolio will be on them. Further, with the vast number of options available, this headache is something that cannot be easily solved. Active managers can adjust to different type of market events, changes to monetary policy and yield curve, adjustment from geopolitical events, and duration management. Outsourcing your fixed income exposure to align with your client’s outcomes will provide relief in this ever-tougher fixed income environment.

Improving client portfolios

As more advisors look at their options within the active fixed income space, I think they will be pleasantly surprised by the pricing of active fixed income funds.

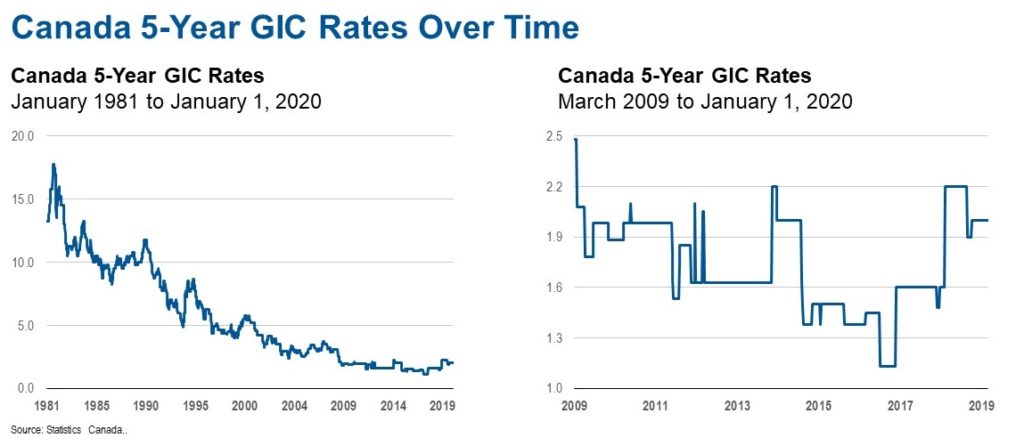

This can be especially attractive for advisors who may consider parking assets in Guaranteed Investment Certificates because they can’t find the right solution for their fixed income allocation. As seen in the charts below, GIC yields are not providing the type of historical returns that investors expect. Adding an actively managed fixed income fund provides the opportunity to improve client portfolios without adding much to costs. One actively managed solution is our Franklin Liberty Short Duration Bond ETF (FLSD), which provides investors with attractive yields compared to GICs by investing in Canadian federal and provincial government and corporate bonds and short-term notes. However, unlike GICs, which require lengthy investment periods during today’s uncertain investment rate environment, FLSD provides daily liquidity and experienced investment management at an attractive cost of 40 basis points.

Familiar territory

With over 750+ ETFs available as of January 2020, I find that many advisors are becoming overwhelmed with all the new options available to them. Despite plenty of new and exotic ETFs, many advisors are still looking for investment themes that they are comfortable and have a history with. That means familiar territory in terms of the investment approach and underlying exposure of the fund, but with the benefits that traditionally come with ETFs like: lower fees, tax-efficiency and liquidity.

Our growing lineup of fixed income ETFs cover many investment themes that advisors expect, such as income, diversification, capital preservation or navigating today’s changing bond market, but with the added benefit of active management. This includes: Global Aggregate Bonds, Canadian & U.S. government bonds, Canadian & U.S. Corporate Credit and more. Learn more about our lineup at www.franklintempleton.ca/getactive

Ahmed Farooq is Vice President of ETF Business Development for Franklin Templeton Canada. He is responsible for directing and expanding the Franklin LibertyShares ETF business across major Canadian Investment Dealers and financial professionals. Mr. Farooq has 12 years of experience in the ETF industry and 15 years in the investment industry overall.

Ahmed Farooq is Vice President of ETF Business Development for Franklin Templeton Canada. He is responsible for directing and expanding the Franklin LibertyShares ETF business across major Canadian Investment Dealers and financial professionals. Mr. Farooq has 12 years of experience in the ETF industry and 15 years in the investment industry overall.

Prior to joining Franklin Templeton in 2017, Mr. Farooq spent 10 years at BlackRock Canada supporting the promotion and growth of iShares ETFs. Recently, Ahmed was a senior wholesaler covering Toronto and Ottawa. Previously, he managed the internal sales team for the iShares ETF business across Canada and lead wholesaler activities in Atlantic Canada.

Mr. Farooq earned his Bachelor of Commerce degree with a specialization in Commerce and Finance, and a major in Economics from the University of Toronto. He has completed the Certified Financial Planner (CFP) and has earned his CIMA designation from the Investment Management Consultants Association in conjunction with the Wharton School of Business at the University of Pennsylvania. Mr. Farooq has also completed the Canadian Securities Course (CSC), Conduct & Practices Handbook (CPH), Professional Financial Planning Course (PFP), Wealth Management Techniques (WMT) and has received the designation of Financial Management Advisor (FMA).

Commissions, management fees and expenses may all be associated with investments in ETFs. Investors should carefully consider an ETF’s investment objectives and strategies, risks, fees and expenses before investing. The prospectus and ETF facts contain this and other information. Please read the prospectus and ETF facts carefully before investing. ETFs trade like stocks, fluctuate in market value and may trade at prices above or below the ETF’s net asset value. Brokerage commissions and ETF expenses will reduce returns. Performance of an ETF may vary significantly from the performance of an index, as a result of transaction costs, expenses and other factors. The indicated rates of return are the historical annual compounded total returns including changes in share or unit value and reinvestment of all dividends or distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any security holder that would have reduced returns. ETFs are not guaranteed, their values change frequently and past performance may not be repeated. Ahmed Farooq’s comments, opinions and analyses are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. Because market and economic conditions are subject to rapid change, comments, opinions and analyses are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. All investments involve risks, including the possible loss of principal. Investments in foreign securities involve special risks including currency fluctuations, economic instability and political developments. Investments in emerging markets, of which frontier markets are a subset, involve heightened risks related to the same factors, in addition to those associated with these markets’ smaller size, lesser liquidity and lack of established legal, political, business and social frameworks to support securities markets. Because these frameworks are typically even less developed in frontier markets, as well as various factors including the increased potential for extreme price volatility, illiquidity, trade barriers and exchange controls, the risks associated with emerging markets are magnified in frontier markets. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions.