Expanding by acquisition can be risky in any business, but it carries even more risk in a new industry like marijuana production. Buyers could end up with companies whose revenues are completely dwarfed by their outsized market caps.

Many marijuana producers continue to grow quickly by acquisition.

Some are looking to diversify: either from medical marijuana into recreational cannabis, or into new areas like edibles. Most are/were simply looking to grab as much market share as possible before legalization on October 17, 2018. That’s because buying an existing grower is a much faster way to boost output than building a greenhouse from the ground up.

Canadian producers are also looking to expand internationally, including buying marijuana sellers overseas as medical marijuana becomes increasingly legal worldwide.

Higher chance of unpleasant surprises

In general, growth by acquisition is riskier than internal growth for a variety of reasons, but especially because acquisitions carry an above-average chance of unpleasant surprises. The buyer of something rarely knows as much about it as the seller. If a company makes enough acquisitions, it is bound to buy something with hidden problems. Eventually, those problems come out in the open and hurt the buyer’s earnings. Growth by acquisition in unrelated areas is especially risky.

That kind of expansion also tends to load up a company’s balance sheet with goodwill. Generally speaking, “goodwill” is the total price a company has paid for all acquisitions it has made over the years, minus the value of tangible assets that it acquired as part of its acquisitions. Goodwill is an intangible asset whose value can drop overnight if it turns out that the company made a bad acquisition.

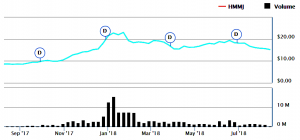

The purchases that marijuana producers are making are particularly risky. That’s because they are mostly buying firms with huge market values: but with limited revenues and little chance of making a profit anytime soon.

Pat McKeough has been one of Canada’s most respected investment advisors for over three decades. He is the founder and senior editor of TSI Network and the founder of Successful Investor Wealth Management. He is also the author of several acclaimed investment books. This article was first published on Aug. 22, 2018 and has been republished on the Hub with permission.

Pat McKeough has been one of Canada’s most respected investment advisors for over three decades. He is the founder and senior editor of TSI Network and the founder of Successful Investor Wealth Management. He is also the author of several acclaimed investment books. This article was first published on Aug. 22, 2018 and has been republished on the Hub with permission.

I am looking at share dilution and wondering if the NYSE listing for acb will help tighten their float.

Also certain companies have had profits.

Also trst s ceo now is a former banker

Canopy is a good news story for smith falls. As is organigram for New Brunswick where badly needed jobs are being offered

These companies by the way are not given the same level of tax light treatment as our big banks and hopefully will be value creators rather than value extractors. It would help if there were some articles focusing on the latter