Special to the Financial Independence Hub

Despite the financial harm it causes to many, tax debt, or the difference between taxes owed and paid, is an issue that does not receive much coverage compared to other forms of consumer debt like student loan, mortgage, or credit card debt.

At the end of fiscal year 2018, the Internal Revenue Service (IRS) reported that there were 13.1 million delinquent taxpayer accounts. The combined tax debt in the United States is an estimated US$527 billion, with US$381 billion of that coming from federal taxes and the rest from state-based taxes.

If a tax debt case goes unresolved, the consequences can be severe, including things like wage garnishment, asset seizure, or an international travel ban.

Even with its considerable size and consequences, tax debt goes under-reported, but hopefully a new report published by LendEDU and Solvable will help raise awareness. Analyzing over 75,000 unique cases of tax debt, LendEDU’s report broke down tax debt by state, in addition to the most common reasons for tax debt in each state.

New Mexico posts lowest average Tax Debt, Vermont the highest

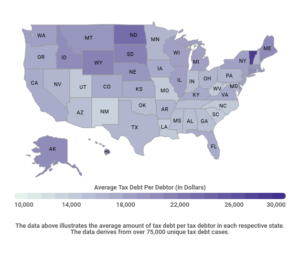

The national average tax debt was US$16,489, and 16 states had a figure below the average, while 29 states and Washington D.C. had higher-than-average tax debt.

New Mexico’s average tax debt of US$13,878 was the lowest in the country; following closely behind New Mexico was West Virginia ($14,325), North Carolina ($14,657), and Louisiana ($14,731).

On the other end of the spectrum, Vermont’s average tax debt of US$28,862 was the highest and was in the same neighborhood as North Dakota ($23,671), Wyoming ($21,095), and South Dakota ($21,071).

Regionally, states in the Northeast, Midwest, and West generally had very high tax debt, while states in the South had average tax debt figures on the lower end.

Main Reasons for Tax Debt include Back Tax Penalties and Divorce

A consumer can fall into tax debt for a variety of reasons, like underestimating how much in taxes he or she owes or not accounting for income made as a freelancer.

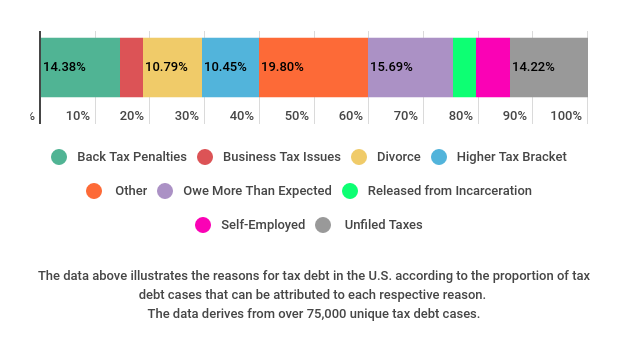

Nationally, LendEDU’s analysis of Solvable’s tax debt data found the biggest reasons for tax debt to be “owe more than expected (15.69%),” “back tax penalties (14.38%),” “unfiled taxes (14.22%),” and “divorce (10.79%).”

Other less common reasons for tax debt included being “self-employed (6.33%),” “business tax issues (4.28%),” and “released from incarceration (4.06%).”

No matter the reason, tax debt is something that needs to be resolved, and there are a few ways that can happen.

Solutions to Tax Debt

Oftentimes, both the IRS and state tax agencies are willing to negotiate a tax debt settlement for a portion of the money owed. This can save a consumer from the potentially damaging consequences of ignoring his or her tax debt.

In addition to seeking a tax settlement, a tax debtor can also look to file a request for an extension with the IRS to buy some more time to get his or her finances in order. Or, it is possible to request a payment plan that will allow the consumer to pay off the debt in installments.

Further, someone with tax debt can try other potential solutions like seeing if they will qualify for an offer in compromise, or requesting a “currently not collectible” status. Finally, a tax debtor can look into if he or she qualifies for “innocent spouse” relief, which could possibly relieve this person of tax debt if his or her spouse (or former spouse) improperly filed a joint tax return without their knowledge.

In his role at LendEDU, Mike Brown uses data, usually from surveys and publicly-available resources, to identify emerging personal finance trends and tell unique stories. Mike’s work, featured in major outlets like The Wall Street Journal and The Washington Post, provides consumers with a personal finance measuring stick and can help them make informed finance decisions.

In his role at LendEDU, Mike Brown uses data, usually from surveys and publicly-available resources, to identify emerging personal finance trends and tell unique stories. Mike’s work, featured in major outlets like The Wall Street Journal and The Washington Post, provides consumers with a personal finance measuring stick and can help them make informed finance decisions.