By Scarlett Swain

(Special to Financial Independence Hub)

It’s that time of year. The leaves have started to shift to brilliant shades of crimson, orange, and yellow. The days are getting shorter. And, suddenly, it’s “jacket weather” again. For many Canadian families, the transition into cooler months signals a time to begin the process of reviewing their finances from the past year with the goal of being better prepared in the years ahead.

With the cost of living in Canada incrementally higher than it has been in recent memory, there is a renewed opportunity for families to ask a familiar question: what is a simple, one-step investment strategy that they can use to help stretch the most out of their money, both now and for the long haul?

Well, like the changing seasons, it may be a good time for families to consider changing up a dated investment approach in favour of one that will take their money a little further. That is, using a low-fee, low-touch, robo-advisor in place of costly mutual fund investments … and, here are a few reasons why:

Accessibility

Robo-advisors have ushered in a new era of accessible investing. Designed to be user-friendly from the get-go, they are an excellent choice for both novice and experienced investors. With just a few clicks, investors can select a portfolio that matches their risk tolerance and fund it with little to no hassle.

Diversification

A well-constructed portfolio needs variety. Robo-advisors excel at this by spreading investments across different asset classes, thus reducing risk. Mutual funds, while also diversified, often lack the customizability and personalization offered by low-fee robo-advisors.

Automated Rebalancing

Investing with a robo-advisor provides nimble, automated rebalancing, ensuring that investments stay aligned to goals, even as market conditions shift. Mutual fund investors often need to manually (and worse, reactively) adjust their portfolios, potentially missing out on market opportunities or exposing them to unnecessary risk.

24/7 Monitoring

With a robo-advisor, investments are monitored 24/7, from sunrise to sunset. Families can rest easy knowing their portfolio is being closely watched with an eye to ongoing refinement to improve returns.

Cost-Efficiency

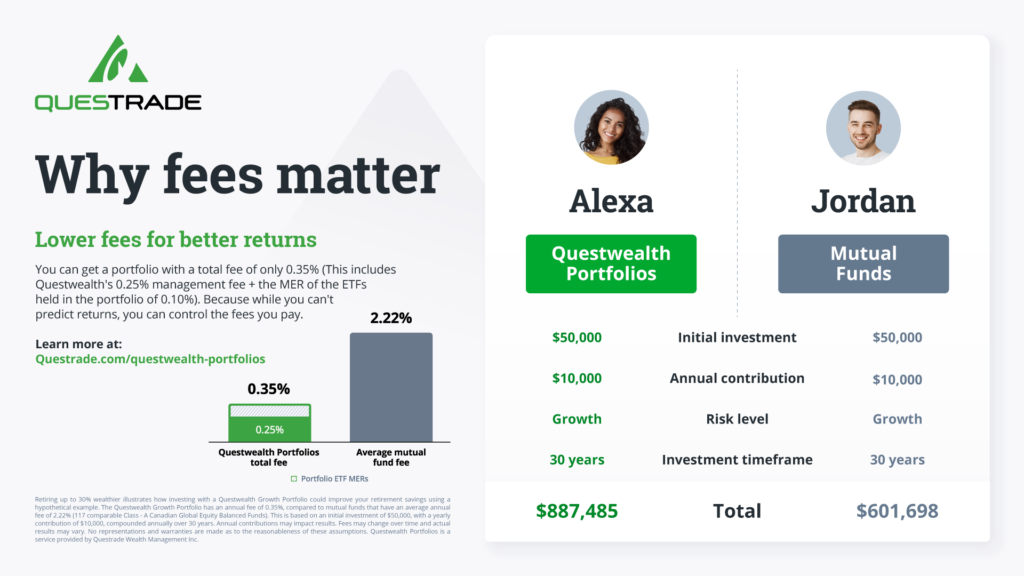

Low-fee robo-advisors are the epitome of cost-efficiency. Traditional mutual funds come with management fees that hover around an average of 2% annually, which can cut into returns over time. In contrast, robo-advisors typically charge lower fees (see MoneySense’s best low-fee robo-advisor Questwealth Portfolios for some of the markets most competitive rates) allowing families to keep more of their hard-earned money while still benefiting from active, professional investment management.

Food for Thought

Simply put, high fees add up. This is especially apparent when we consider that many Canadians with mutual funds give up 2% annually in fees (on average) as compared to a robo-advisor at 0.5% (on average); not to mention, the compounded value of that money over time. That’s a significant piece of a potential nest egg.

As the end of the year draws closer, it’s a reminder of the opportunity for growth, change, and renewal ahead. Similarly, embracing the benefits of a low-fee robo-advisor can help your wealth grow efficiently, adapt to changing market conditions, and provide a sense of financial renewal. Offering lower fees, accessibility, and transparency, robo-advisors make a compelling case over traditional mutual funds – the question is, will you and your family seize the opportunity to take your money a little bit further? There’s no better time than now.

Scarlett Swain joined Questrade in 2018 and is currently Director of Investment Products for Questrade Financial Group. In her role, Scarlett is responsible for the business’ roadmap of investment products, tools, and services. With over 20 years of experience in the financial sector, she has spent the past 5 years leading her team in developing innovative tools and platform enhancements to keep Questrade’s trading experience leading-edge and maintain its standing as Canada’s Best Online Broker, as awarded by MoneySense.

Scarlett Swain joined Questrade in 2018 and is currently Director of Investment Products for Questrade Financial Group. In her role, Scarlett is responsible for the business’ roadmap of investment products, tools, and services. With over 20 years of experience in the financial sector, she has spent the past 5 years leading her team in developing innovative tools and platform enhancements to keep Questrade’s trading experience leading-edge and maintain its standing as Canada’s Best Online Broker, as awarded by MoneySense.