By Dale Roberts

Special to the Findependence Hub

I recently posted a portfolio concept for the all-weather portfolio for 2022. The idea behind an all-weather portfolio is that it can prosper during periods of sun, rain, storms, hurricanes, earthquakes and tsunamis. Of course, in the above analogy weather serves as a proxy for the economic conditions that might arrive. The all-weather portfolio is ready for most anything.

On Seeking alpha I posted the all-weather portfolio for 2022. The portfolio is designed for U.S. investors, though Canadians can certainly mimic the approach or apply the greater concepts. The big idea of the all-weather portfolio is to hold assets in four buckets. It is an extension of the Permanent Portfolio.

There is a bucket of investment assets ready to thrive no matter what the weather offers (economic conditions). For example, for the last 40 years or so we’ve had favourable weather. Inflation has been low and economic growth has been modest, but positive. We’ve been in a disinflationary environment. Inflation has been low and mostly falling.

The weather has been nice

Stock markets and bond markets perform quite well during these disinflarionary periods.

To view some longer dated returns have a look at the RBC Select Balanced Fund. Of course, you could do better by way of an all-in-one asset allocation ETF.

Stocks have performed quite well over time. That said, investors needed to be armed with some very impressive umbrellas (and risk tolerance) to withstand the Great Financial Crisis (2008-2009) and the dot-com crash of the early 2000’s. Stock markets declined in spectacular fashion in both of these events.

Given that we were still in the midst of a mostly disinflationary period, bonds did the trick in lowering the volatility of the typical balanced portfolio. Bonds will mostly go up when stocks go down, offering that useful inverse relationship. We can think of bonds as portfolio shock absorbers.

These two major stock market corrections came and went, and we returned to our mostly fair-weather disinflationary times. Modest economic growth returned as well.

And now for something completely different

Yes, the above subhead is referencing a catch phrase made famous by Monty Python’s Flying Circus.

The comedy troupe was certainly different. And so is today’s economic environment. We have inflation, real inflation. It might even turn into stagflation when most everything fails for the investor. Stagflation is a period of persistent inflation that is accompanied by economic decline. The worst of all worlds you might say. Some nasty weather.

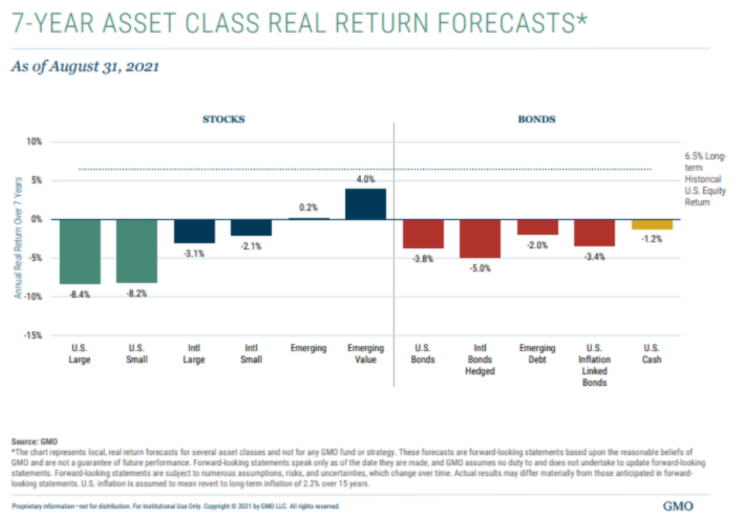

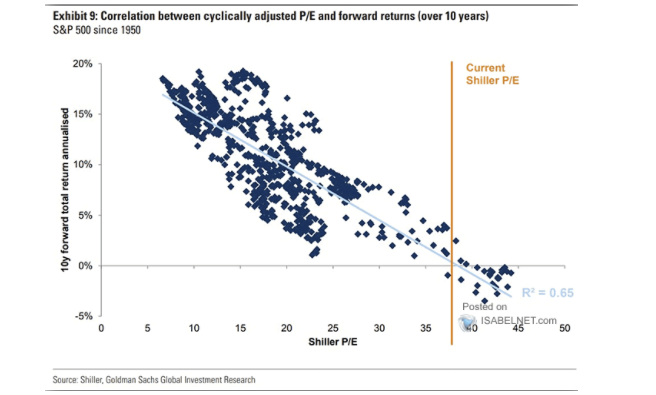

What works during stagflation or unexpected inflation (persistent inflation above those central bank 2-3% targets)? It’s not stock markets; it’s certainly not bonds. Oooops. That’s the traditional balanced portfolio. Continue Reading…