By Billy and Akaisha Kaderli

(Special to Financial Independence Hub)

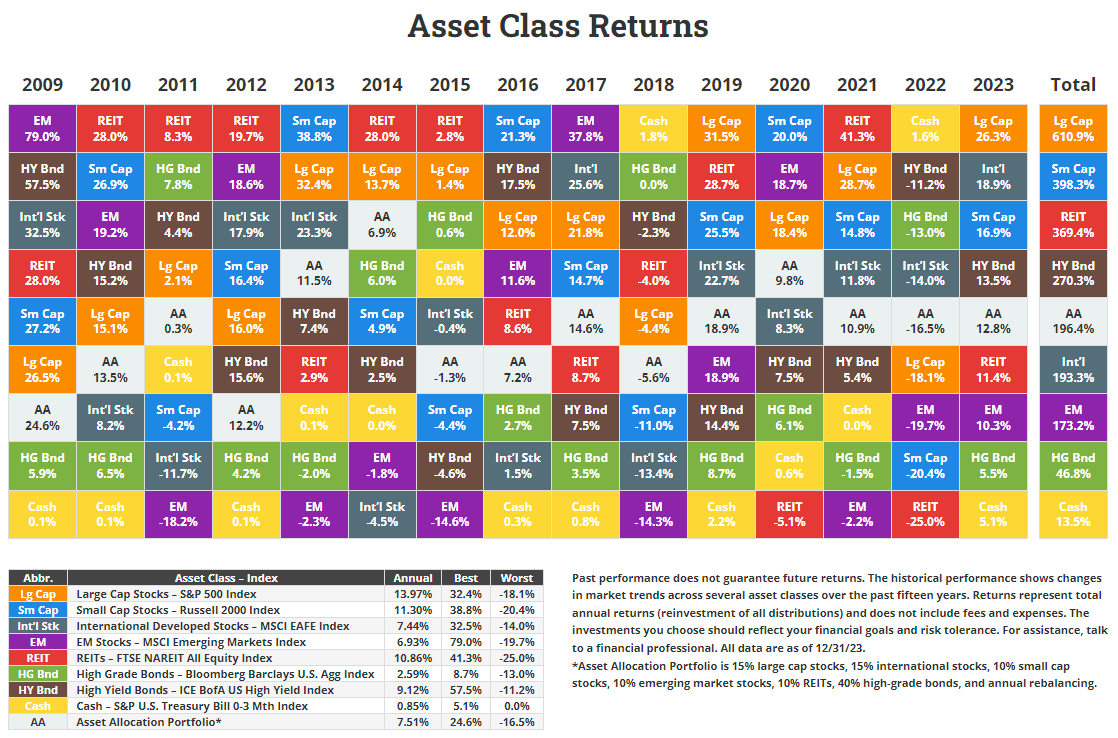

We like to keep informed about the topic of retirement from the perspective of money managers and those in the financial fields.

You might have read some of these articles also, you know, the ones that say Americans have not saved enough to retire.

Many of these pieces proclaim that you must save enough in your investments to throw off 80% of your current annual salary so that you can afford a comfortable life away from a job. Lots of them will say that you need US$2 million in investments (or more) and woe to the person who thinks they can do it on less.

Approximately 10% of the households in the U.S. have a net worth of one million dollars or more. What are the other 90% supposed to do? Not retire? What kind of common sense does this make? Expecting the regular “Joe”to meet this $2 million dollar mark is not realistic.

As you know, we have over three decades of financial independence behind us. And while everyone’s idea of a perfect lifestyle sans paycheck is different, we can tell you that for these 33-years, we have kept our annual spending around $30,000.

The secret: Living within your means

In all of our years of retirement and travel we cannot recall one retiree who regrets their decision to retire. In fact, most have told us that they wished they had done it sooner.

The Society of Actuaries (SOA) recently conducted 62 in-depth interviews of retired individuals across both the U.S. and Canada. These people were not wealthy and had done little to no financial planning. But the vast majority of them shared that they had adapted to their situation and live within their means. Translation: they have adjusted their spending to the amount of money they have coming in every month.

So basically, it’s really that simple and this is why we say if you want to know about retirement, Go to the Source.

It doesn’t have to be complicated

In our books and in our articles about finance, we say over and over that there are four categories of highest spending in any household. We personally have made adjustments in all four of these categories, and have therefore reaped the benefits of having done so. We discuss these four categories in more depth below.

The financial guys and gals will have you tap dance all over the place with investment products, and a certain financial goal you must achieve. They will press upon you the seriousness of the decision to leave your job for a couple of decades of jobless living. We say it doesn’t really have to be that complicated, but it’s very important to pay attention to these four categories.

Listen up

Housing is THE most expensive category for you to manage. It’s not just the house itself, it’s the maintenance, the property taxes, the insurance, and any updating you might want to do to a place where you are going to be living for years down the road.

If you want to rebuild that boat dock to the lake where your boat is parked during the summer, that takes money. If you are tired of the style of faucets, sinks, tile and tub areas of your bathroom and want to upgrade, that is a large expense. Now that you are retired and want a more modern kitchen, more counter space, better lighting, prettier cabinet covers – Ka-Ching! You are hearing the cash register tallying up the cost.

If you have a hot tub, an extensive garden, or if you want to build a deck to connect the house to the garden, or put in a Koi pond … Well, you get the idea.

I understand that for some people, their home is their castle, and those homes are gorgeous and a comfortable place to stay. All we are suggesting is that homes will never say no to having money poured into them.

If you want to travel or to snow bird part time, then you will find yourself paying twice for housing – the one you have left in your first location, and the hotel or the vacation home in which you will spend part of the year.

If you are not vigilant, this one category will suck the life out of your retirement. We just want you to know that you have a choice.

Downsizing in retirement is not a bad thing. Relocating to a state or country with less taxation is a smart move. You could move to an Active Adult Community where you could choose to own the land or lease it. Here a variety of social activities are offered and the maintenance of your front yard is taken care of in your lifestyle fees.

When you travel, you could choose to house sit. Or take advantage of better pricing for apartments or hotels that rent for the month and include utilities, WiFi, and a maid. You could try AirBnB for less than a hotel room, and live like a local instead of a tourist.

Do you know how much your home (including the taxes, insurance and utilities) costs you per day? It is a figure that might startle you.

Transportation is the second highest category of expense. Now we realize that especially in the States, it is a bit more challenging to wrap your mind around the idea of not owning a car, or just having one for your household instead of three.

According to the latest AAA’s report on car ownership in 2023, it costs an average of $12,182 every year — $1,015.17 every month — to drive for five years at 15,000 miles per year.

So then, in the category of transportation, if you decide you want to fly to an island for a vacation, you must add in the cost of the flight… and any boat trips you might take, and any taxis from the airport to your hotel, and the price of a car rental for the week or two that you will be vacationing.

It all adds up and it’s all a part of this category. Continue Reading…