All posts by Financial Independence Hub

Giving with a Warm Hand: through the new FHSA

By Michael J. Wiener

Special to Financial Independence Hub

I expect to be leaving an inheritance to my sons, and I’d rather give them some of it while I’m alive instead of waiting until after both my wife and I have passed away. As the expression goes, I’d like to give some of the money with a warm hand instead of a cold one.

I have no intention of sacrificing my own retirement happiness by giving away too much, but the roaring bull market since I retired in mid-2017 has made some giving possible. Back then I thought stock prices were somewhat elevated, and I included a market decline in my investment projections to protect against adverse sequence-of-returns risk.

Happily for me, a large market decline never happened. In fact, the markets kept roaring for the most part. As it turned out, I could have retired a few years earlier. A large market decline in the near future is still one of several possibilities, but the gap between our spending and the money available is now large enough that we are quite safe.

Our lifestyle has ramped up a little over time, but not nearly as much as the stock market has risen. We just aren’t interested in expensive toys. Owning a second house or a third car just seems like extra work. Our idea of fun travel is to go somewhere with nice hiking trails.

So, we have the capacity to help our sons with money, but there is another consideration: what is best for them? I’m no expert in the negative effects of giving large sums of money to young people, but I’m thinking it makes sense to ease into giving.

Ease into giving with the FHSA

This is where the new First Home Savings Account (FHSA) is convenient for us. Our plan is to have our sons open FHSAs, and we’ll contribute the maximum over the next 5 years. This will give them an extra tax refund each year, and if they choose to buy a house at some point, they can use the FHSA assets tax-free as part of their down payment. If they don’t buy a house, they can just shift the FHSA contents into their RRSPs without using up any RRSP room. Continue Reading…

Fraud was bad during pandemic, but poll finds it could get worse if recession hits

Kevin Purkiss, vice president, Fraud Management, RBC

Special to Financial Independence Hub

While we don’t always want to think about the risk of fraud, it’s never been more important to stay vigilant. During the pandemic we saw a sharp rise in fraud attempts, but it may be about to get worse if we end up in a recession later this year.

Not only have we seen a strong correlation between increased fraud and economic slowdowns in the past, but many Canadians believe a recession will make fraud even more risky, according to new RBC research.

The poll found that 78% of Canadians believe a recession will increase everyone’s fraud risk and 42% think it will be harder to spot scams during a recession than in the pandemic. Three quarters (75%) also believe that it’s easier to fall victim to a scam when you’re struggling financially and 36% are simply too worried about other issues to be concerned about fraud.

While it’s understandable that Canadians have a lot on their minds and don’t want to think about fraud, scams are getting harder to spot and fraudsters are becoming more sophisticated. This is why we all need to continue to stay aware and take steps to protect ourselves.

Missing the signs of fraud is costing us money

Our research also found that 32% of respondents are concerned they are already starting to miss the signs of potential fraud and 71% are worried it will be harder to spot the signs of fraud as they get older.

Almost a quarter (23%) have been a victim of fraud or fallen for a scam, with 14% saying they lost money because of a scam. While the average lost was $400, 6% of respondents say they lost more than $10,000.

Apathy about fraud risk among Canadians 18-34

More than half (53%) of adult Canadians under the age of 35 say they share more information online than they should and 44% say they are quick to share personal data to get access to an offer, website, app or service. Thirty-five per cent of this age group also perceive fraud as something that happens to others, but not to them, and 33% have never been worried about falling victim to a scam. Continue Reading…

More on the FHSA [Tax-free First Home Savings Account]

The FHSA and reasons why younger Canadians should really opt in to opening this account with any intention to buy their first home over time …

The New Tax-Free First Home Savings Account (FHSA) Facts:

- Think of the FHSA as a hybrid of the Registered Retirement Savings Plan (RRSP) / Home Buyers’ Plan and Tax-Free Savings Account (TFSA): FHSA contributions are tax-deductible like the RRSP and qualifying withdrawals out of the account are not taxed just like the TFSA.

- To be eligible to open and contribute to your FHSA you must be:

- A Canadian resident + 18 years or older + *a first-time home buyer. (Meaning, existing homeowners AND folks that owned a home in the *last four preceding years of trying to open the FHSA won’t qualify to open this account).

*An individual is considered to be a first-time home buyer if at any time in the part of the calendar year before the account is opened or at any time in the preceding four years they did not live in a qualifying home (or what would be a qualifying home if located in Canada) that either (i) they owned or (ii) their spouse or common-law partner owned (if they have a spouse or common-law partner at the time the account is opened).

- The FHSA can hold stocks and bonds and ETFs just like the TFSA and RRSP.

FHSA Contributions and Tax Deductions:

- Individuals would be able to claim an income tax deduction for FHSA contributions made in a particular taxation year; contributions currently capped at $8,000 per year up to a $40,000 lifetime contribution limit. So, a solid 5-years of striving to max-out the account for tax-free withdrawals.

- Like the TFSA, your unused FHSA contribution room can be carried forward to the following year but only up to a maximum of $8,000.

FHSA Holding Period and Withdrawals:

The account can stay open for 15 years OR until the end of the year you turn 71 (not very likely???) OR until the end of the year following the year in which you make a qualifying withdrawal from an FHSA for the first home purchase, whichever comes first.

FHSA worst-case? What if you open an account and you don’t purchase a home??

Any savings not used to purchase a qualifying home could be transferred to an RRSP or RRIF (Registered Retirement Income Fund) on a non-taxable transfer basis, subject to applicable rules. Of course, funds transferred to an RRSP or RRIF will be taxed upon withdrawal.

All that and more, is highlighted in this comparison graphic below via @AaronHectorCFP and more details from Cut The Crap Investing with even more Q&A.

Reference/Source: https://cutthecrapinvesting.com/2023/03/01/the-tax-free-first-home-savings-account-in-canada-fhsa/

My FHSA Thesis

Overall, pretty great stuff with the FHSA and a major opportunity for younger investors who are really trying to find ways to sock away more money for their very first home.

Fixed Income: The Outlook & Opportunities

By Winnie Jiang, Vice President, Portfolio Manager, BMO ETFs

(Sponsor Content)

Little about the current economic cycle has conformed to historical norms. With divergence in employment data and leading economic indicators, recent data released sent mixed signals that left investors perplexed about the near-term economic outlook.

On one hand, the job market remains overwhelmingly strong, with ISM (Institute for Supply Management) Services bouncing back from extreme lows in December and retail sales also rebounding. The re-opening of the Chinese economy will likely provide a breather on global supply chain issues while boosting demand. Consumer credit remains well retained as default rates stay low with no warning signs of near-term upticks.

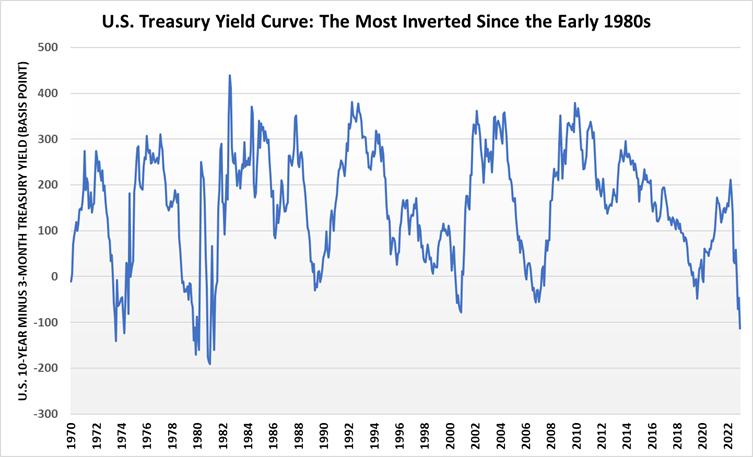

On the other hand, yield curve inversions, a precedent of most recessions, continue to worsen. 3-month U.S. Treasury yields are pushed above 10-year yields by the widest margin since the early 1980s. ISM Manufacturing PMI (purchasing managers’ index) and housing data also point to a gloomy outlook. Corporate sentiment and capital expenditure showed little signs of recovery, and housing permits have rolled back to pre-pandemic levels after surging strongly during Covid.

Source: Bloomberg, January 31st, 2023

The Outlook

While robust job markets and consumer data keep inflation well above the Fed’s long-term target, recent CPI (Consumer Price Index) announcements indicate things are steadily, albeit slowly, moving towards the right direction. The inversion of the yield curve caps the magnitude of further rate increases that could be absorbed by the economy before it slips into a recession.