Special to the Financial Independence Hub

In Stocks for the Long Run, Wharton Professor Jeremy Siegel states “over long periods of time, the returns on equities not only surpassed those of all other financial assets but were far safer and more predictable than bond returns when inflation was taken into account.”

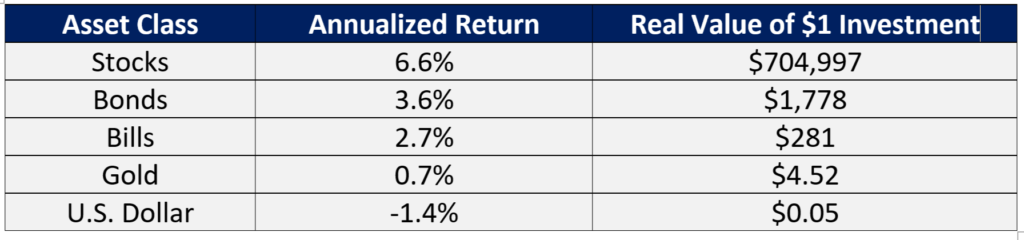

As the following table demonstrates, not only have stocks outperformed bonds, but have also trounced other major asset classes. The effect of this outperformance cannot be understated in terms of its contribution to cumulative returns over the long-term. Over extended holding periods, any diversification away from stocks has resulted in vastly inferior performance.

Real Returns: Stocks, Bonds, Bills, Gold, and the U.S. Dollar: 1802-2012

The All-Stock Portfolio: Better in Theory than in Practice

Notwithstanding that past performance is not a guarantee of future returns, the preceding table begs the question why investors don’t simply just close their eyes and hold all-stock portfolios. In reality, however, there are valid reasons, both psychological and financial, that render such a strategy less than ideal for many people.

The buy and hold, 100% stock portfolio is a double-edged sword. If you can (1) stick with it through stomach-churning bear market losses, (2) have a (very) long-term horizon, and (3) don’t need to sell assets for any reason, then strapping yourself into the roller-coaster of a 100% stock portfolio may indeed be the optimal solution. Conversely, it would be difficult to identify a worse alternative for those who do not meet these criteria.

With respect to the emotional fortitude required to stand pat through bear markets, there is considerable evidence that many investors are simply incapable of doing this. Perhaps one of the best illustrations of this fact is Fidelity Investments’ flagship Magellan Fund under the stewardship of legendary investor Peter Lynch. From May 1977 to May 1990, Lynch managed to achieve an annualized return of 29.06% as compared to 15.52% for the S&P 500 Index. However, the average investor in the fund actually lost money during this period.

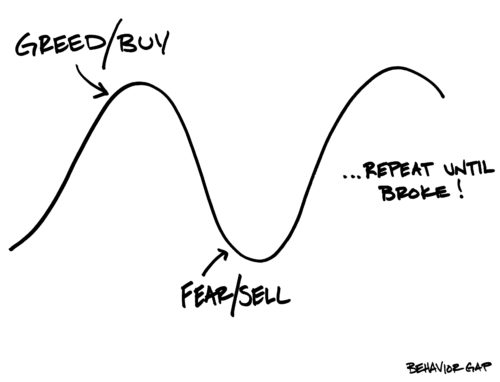

Many Magellan investors hopped on board when the fund was soaring and then jumped ship during difficult periods. This all-too-common misfortune is well-depicted by the following graph, which demonstrates how emotionally charged decisions can have a devastating effect on long-term performance.

Even if you have the emotional fortitude to stay the course through bear markets, there may be other reasons that compel investors to liquidate stocks, whether it be to fund living expenses, help their children buy homes, or invest in other opportunities. Unfortunately, the markets pay no heed to the convenience of mortals. If you are lucky, the need for cash will materialize at market peaks. Conversely, if you need liquidity near market troughs, then the effect is similar to that detailed in the graph above.

Bonds: the Good News & the Bad News

Historically, investors have used bonds to diversify their stock portfolios and reduce volatility. Investors typically set aside enough in bonds to weather periodic stock market downturns. Over the past several decades, the diversification value from holding bonds has been neutral to overall portfolio returns. During the bull market in bonds of the past 30 years, bond returns have just about kept pace with those of stocks. However, as indicated by the table at the beginning of this missive, this has not typically been the case. Continue Reading…