My latest MoneySense Retired Money column looks at the revolutionary “Tontine” type Retire Solution announced by Guardian Capital and finance professor Moshe Milevsky earlier this month. My initial take was here on the Hub and the more in-depth MoneySense feature story can be viewed by clicking on this highlighted headline: Tontines in Canada — Moving from Theory to Practice as a solution to our Retirement Crisis.

We’ve illustrated this blog with financial projections of one of the three new Guardian Capital Retirement solutions developed in partnership with Milevsky. Some of the ideas were adapted from Milevsky’s latest book: How to Build a Modern Tontine. The theory behind this book is a driving force for Guardian Capital’s efforts to commercize these concepts and put them in the hands of retirees and would-be retirees worried about outliving their money. Nobel Laureate Economist William Sharpe has described this as “the nastiest, hardest problem in finance.”

Milvesky’s book is certainly aimed at industry practitioners and sophisticated financial advisors and investors, and contains a lot of mathematics that may beyond the reach of average investors or retirees. So rather than attempt to review it, we’ll move on to the efforts to bring these ideas to the market. What Milevsky calls “tontine thinking” is belatedly showing up in the marketplace in Canada, starting last year with Purpose Investments’ and now with three different solutions from Guardian Capital. Hub readers also can read an excerpt of the book which ran earlier Wednesday: Longevity Insurance vs Credits — a Primer.

All this has been a long time coming. MoneySense readers may recall two of my Retired Money columns about Milevsky and the future of tontines published in 2015: Part one is here and part two here. Also see my 2018 column that explains tontines in detail: Why Ottawa needs to push for tontine-like annuities.

Last June (2021), Purpose got the tontine ball rolling in Canada with its Purpose Longevity Fund. Here’s my MoneySense take on that one: Is the Longevity Pension Fund a cure for Retirement Income Worries?

As the MoneySense feature explains, Milevsky is Guardian Capital’s Chief Retirement Architect. It sums up the original 2021 launch of Purpose Longevity Fund, and how it compares to Guardian’s three solutions.

Think of Purpose’s product as a lower-case tontine, and Guardian Capital’s as a Tontine with a capital T.

Guardian Capital’s Modern Tontine

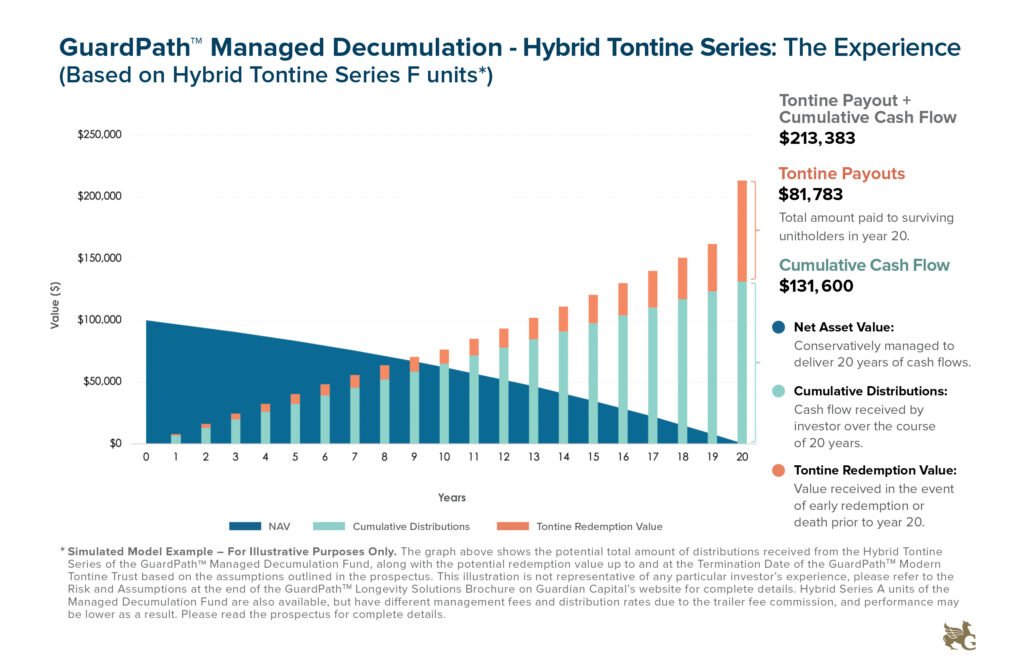

Guardian Capital’s September 7th press release uses the term “Modern Tontine.” There, Guardian Capital Managing Director and Head of Canadian Retail Asset Management Barry Gordon said “With our modern tontine, investors concerned about outliving their nest egg pool their assets and are entitled to their share of the pool as it winds up 20 years from now … Over that 20-year period, we seek to grow the invested capital as much as possible to maximize the longevity payout.”

Along the way, investors who redeem early or pass away leave a portion of their assets in the pool to the benefit of surviving unitholders, boosting the rate of return. “All surviving unitholders in 20 years will participate in any growth in the tontine’s assets, generated from compound growth and the pooling of survivorship credits. This payout can be used to fund their later years of life as they see fit, and aims to ensure that investors don’t outlive their investment portfolio.” Continue Reading…