It’s been awhile since I reviewed any political books here on the Hub. The last time was this time a year ago when I surveyed what were then the latest books on the Trump presidency (at one point in 2021, 3 of the top 6 New York Times bestselling books were on Trump: see here).

I occasionally wade in on this topic on the grounds that investors need to be on top of this seemingly unique political situation. That’s despite the fact that when Trump first won his shock victory in 2016, markets briefly cratered, only to quickly recover.

The particular pair of mini-reviews below has no real financial angle but you can see I explicitly covered that a few years ago in a MoneySense column that evaluated the implications of the Trump presidency for the Boomers’ collective retirements: see here.

Over the long weekend, I finished reading two recently published books that some may find of interest, whose covers are illustrated on this blog. One is Thank You for Your Servitude, Mark Leibovich’s entertaining summary of all the Republican enablers who made the Trump presidency possible in the first place, and may yet facilitate a dreaded second term. The other is This Will Not Pass [Simon & Schuster) by Jonathan Martin and Alexander Burns, subtitled Trump, Biden, and the Battle for America’s Future. The co-authors are both New York Times writers and CNN political analysts, neither known as MAGA-friendly outlets.

Save your money and borrow these from the library

I might add that, despite being an author myself, I generally refuse to buy any of these US political books: I either read ebooks from the Toronto Library’s excellent Libby app, or download ebooks or audio books from the paid SCRIBD service. Libby often involves waiting a few weeks or months for popular bestsellers; however, if you can read quickly, you may be able to luck into the occasional Skip the Line service, which lasts only a single week. SCRIBD sometimes has books not yet on Libby, often in audio format, and unlike the library, you can keep them beyond the normal three-week limit.

There’s been a fair bit of press and YouTube clips on both these books. Formerly with the New York Times, Leibovich is perhaps best known for his bestselling This Town, about 21st century Washington. Thank You for Your Servitude [Penguin Press, New York, 2022] is subtitled Donald Trump’s Washington and the Price of Submission. While the author admits that many of the anecdotes will be all too familiar to anyone following the daily press, he manages to provide a fresh perspective on them while simultaneously apologizing for making readers relive the worst of these moments. Many of them center around Trump’s Washington-based Trump Hotel, which is where the book begins and ends. There you meet such familiar characters as Rudy Giuliani, Reince Priebus, Kevin McCarthy, Mitch O’Connell, William Barr, Jeff Sessions, Lindsay Graham, Marjorie Taylor Greene, Kellyanne Conway and the whole sordid collection of Trump toadies and sycophants, or the so-called MAGAts.

One early chapter is entitled “The Joke,” which apparently is how even how Trump’s closest enablers seem to view his rise to the top of the political pyramid:

It would be risky, obviously, for a Republican member of Congress to declare, explicitly, that “Donald Trump is a complete ignoramus,” even though that’s what they really believed. But none of this had to be spoken because the truth of this scam, or “joke,” was fully evident inside the club …. Everyone … got the joke.

Covers Ukraine invasion but not January 6th hearings

The book is recent enough that it includes an epilogue about the Russian invasion of Ukraine in February. The book ends on a despairing note of pessimism about the prospects of anyone stopping Trump in 2024. Of course, it was published months before this summer’s high-profile January 6th hearings, nor does he spend much time addressing any of the other multiple investigations into Trump’s businesses and political shenanigans.

The following telling snippet is one of many that may not be widely known. I was struck by the revelation in the epilogue that within a day of Trump’s “Be there, will be wild” tweet promoting the January 6 rally, the cheapest room in the Trump Hotel immediately jumped from US$476 to US$1,999.

Donald Trump didn’t just inspire the Jan. 6 riot … He seems to have made money off it.

That pretty much says it all. Leibovich ends with an ominous foreshadowing of Trump’s possible triumphant return in 2024. His final sentence is “And who’s going to stop him?” A few sentences earlier, he quotes a former Republican congressman who confessed that the party’s only real plan for dealing with Trump in 2024 involved a darkly divine intervention: “We’re just waiting for him to die .. That was it, that was the plan. He was 100 percent serious.”

Can Joe Biden extract the US from its “political emergency?”

Those who are thoroughly sick of Trump — as I am — may find This Will Not Pass more to their liking, as roughly half the content is devoted to Trump’s successor, Joe Biden. The focus is what it describes as the “political emergency in the United States: the story of how the country reached and survived a moment when carrying out the basic process of certifying an election became a mortally dangerous task.”

It recounts how the country “sort of” survived but like Leibovich, leaves readers pretty nervous about what may yet occur in the 2022 mid terms this fall and ultimately in 2024. As Martin and Burns remind us (as if we needed it!):

Donald Trump has not been banished from national life, but instead remains the dominant force in his party and is bent on purging those few Republicans who won’t bow to him … The former president’s delusions about a stolen election … have lingered with corrosive force, warping his own party and catalyzing a wave of red-state voting restrictions aimed at cracking down on election fraud that did not happen. The fantasies of a Trump restoration have only deepened since his departure from the White House.

The book is arranged in three parts: the year before the 2020 election and Trump’s mismanagement of Covid; the tumultuous months between the contested 2020 election and Inauguration Day, and everything that has transpired since:

… As President Biden attempted an acrobatic feat of leadership: pushing a liberal policy agenda of titanic ambition with the thinnest of majorities … Far from quickly erasing the Trump era, leaders in both parties have found the shadow of the last presidency has been longer and darker than they anticipated, colouring every major political decision and legislative negotiation of the Biden administration and shaping even the perceptions of American democracy overseas.

Ambitious, yes: One chapter nicely summarizes the dominant question before Biden as “How Big Can We Go?”

Unlike Servitude, This Will Not Pass was published too soon to cover much of the events of 2022. Oddly, for an American book, it closes with an observation by a Canadian, Bob Rae (at one point Canada’s ambassador to the United Nations.) He calls Trump an “authoritarian … I don’t believe the Republican Party believes in democracy.” And he warned that the threat to American democracy was far from defeated: “America,” he said, “is a very important battleground.”

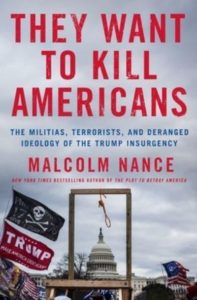

They Want to Kill Americans

(Added subsequently). There’s a third and even scarier book that I only began to read the day this blog initially was published. They Want to Kill Americans by Malcolm Nance, describes Trump’s brownshirts and the ongoing assault on American democracies by Americans. Here’s a link to Goodreads’ entry on it. And here’s a Kirkus review.

(Added subsequently). There’s a third and even scarier book that I only began to read the day this blog initially was published. They Want to Kill Americans by Malcolm Nance, describes Trump’s brownshirts and the ongoing assault on American democracies by Americans. Here’s a link to Goodreads’ entry on it. And here’s a Kirkus review.

Jonathan Chevreau is Chief Financial Officer of the Financial Independence Hub, author of the financial novel, Findependence Day, co-author of the non-fiction Victory Lap Retirement, and columnist and Investing Editor at Large for MoneySense.ca.

Jonathan Chevreau is Chief Financial Officer of the Financial Independence Hub, author of the financial novel, Findependence Day, co-author of the non-fiction Victory Lap Retirement, and columnist and Investing Editor at Large for MoneySense.ca.